Employer-sponsored health insurance costs rose for a third straight year in 2025, with average family premiums approaching $27,000, according to KFF's annual Employer Health Benefits Survey released on Wednesday.

Premiums Outpace Inflation As Workers Shoulder More

The average family premium reached $26,993, up 6% by $1,408 from 2024, outpacing overall inflation and matching the brisk increases of the prior two years. On average, workers contributed $6,850 toward those family premiums, with employers covering the remainder, according to KFF.

The survey, based on responses from more than 1,800 employers of varying sizes, offers a snapshot of job-based coverage that insures roughly 154 million Americans under age 65.

Drug Costs, GLP-1s Drive Higher Employer Spending

KFF attributed premium growth primarily to higher health spending and noted that employers increasingly cite prescription drug costs as a major driver of this growth. Among large firms with at least 200 workers, more than a third said prescription drug prices contributed "a great deal" to recent premium increases. Many also pointed to new high-cost drugs, chronic disease prevalence, higher utilization and hospital prices.

The report highlights the growing footprint and cost of GLP-1 medications for weight loss. Among the largest employers (5,000 or more workers), 43% said their biggest plan now covers GLP-1s such as Novo Nordisk A/S’s (NYSE:NVO) Wegovy and Eli Lilly and Co.’s (NYSE:LLY) Zepbound, up from 28% last year. Most of those large employers said the drugs' costs have exceeded expectations.

"There is a quiet alarm bell going off. With GLP-1s, increases in hospital prices, tariffs and other factors, we expect employer premiums to rise more sharply next year," KFF President and CEO Drew Altman said in a statement shared with The Hill.

Deductibles Rising And More Cost Sharing Likely

Premiums are only part of what workers pay. For employees who face a deductible for single coverage, the average deductible climbed to $1,886, up from $1,773 a year earlier. More than half of covered workers at small firms now face deductibles of at least $2,000, KFF found. The organization cautioned that deductibles and other forms of cost sharing could rise further as employers attempt to limit premium growth.

Over the past five years, cumulative increases in family premiums and worker contributions are roughly in line with inflation and wage growth, but KFF warned employers "may be bracing for higher costs next year," given insurer filings and underlying medical trends.

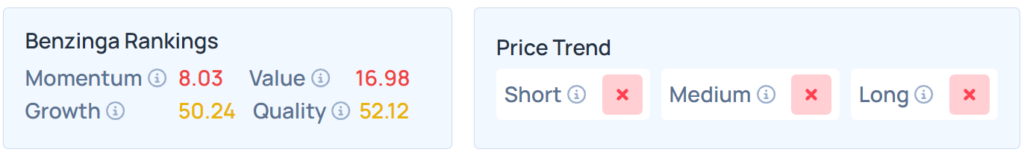

Benzinga Edge Stock Rankings for NVO show very weak momentum with a score of just 8.03, followed by a poor showing on the Price Trend metric in the short, medium and long term. Check here to see how LLY fares in comparison.

Read Next:

Photo Courtesy: Shutterstock/ zimmytws