/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

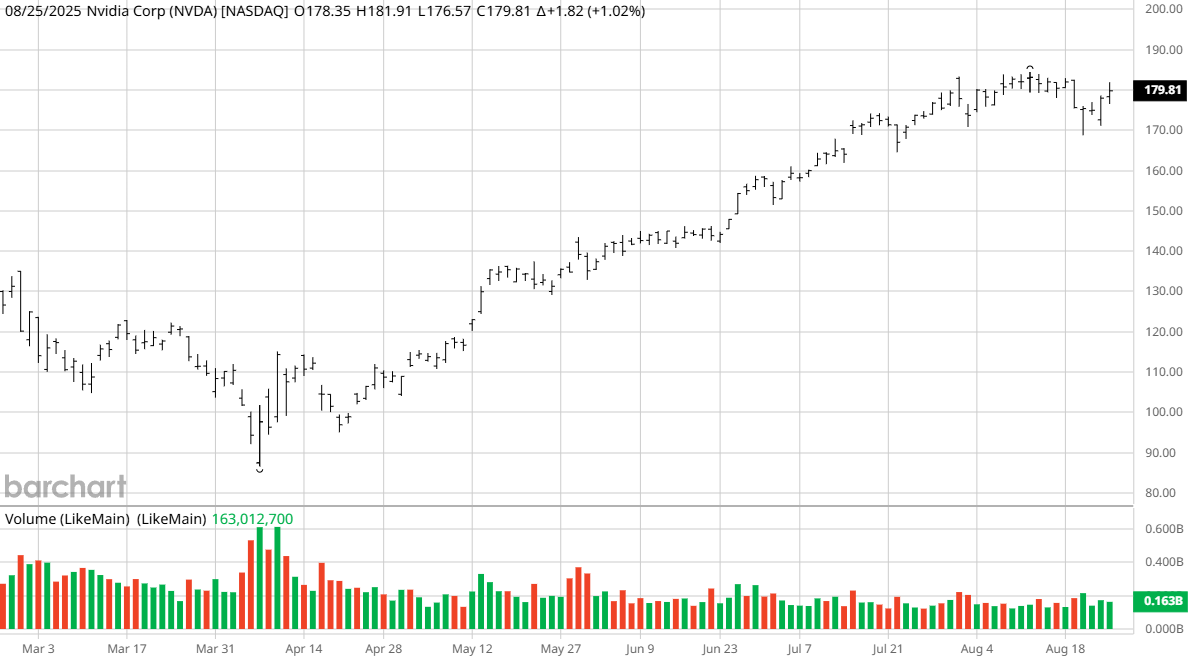

Chipmaker Nvidia (NVDA) is scheduled to release its earnings for the second quarter of fiscal 2026 (ending July 27, 2025), after the closing bell Aug. 27. All eyes will be on the company’s revenue and earnings per share, as well as guidance for the third quarter and the rest of the year.

Nvidia is the unquestioned leader in producing graphics processing units (GPUs) used in data centers to power the most sophisticated computing processes, including artificial intelligence (AI), machine learning (ML), and large language models (LLMs). And now Nvidia received yet another glowing review as the company prepares its earnings report.

The Latest From Wedbush

Wedbush Securities is arguably one of the best-known and respected research firms on Wall Street, particularly when it comes to tech stocks. The company is known for its bullish calls and has at times compared the AI-driven tech cycle to the Internet boom of 1996. Dan Ives, the company’s managing director and global head of technology research, is one of the most influential analysts covering tech stocks today.

Now Wedbush is suggesting that Nvidia, which has grown to be the biggest publicly traded company in the world with a market capitalization of almost $4.4 trillion, could still have a massive growth opportunity with its GPUs.

“When Nvidia reports earnings this week on Wednesday after the bell the tech world and Wall Street will be listening closely to every word from (CEO) Jensen (Huang) as we continue to believe from our Asia field checks that demand to supply is 10:1 for Nvidia's golden chips,” Wedbush analysts wrote in a note to clients on Monday.

That’s massive, particularly when you consider Nvidia’s massive revenue numbers today. In the first quarter of fiscal 2026, Nvidia recorded $44.1 billion, up 69% from the previous year. And it would have been even more had U.S. export restrictions not prevented Nvidia from selling its H20 chip in China. The company took a $4.5 billion charge in the first quarter for excess inventory, and also was prevented from delivering $2.5 billion in chips that were already purchased.

Nvidia still isn’t selling those chips, although they’ve been the subject of a lot of discussion. This summer, Nvidia struck a deal with the Trump administration that would allow it to sell the H20 in exchange for 15% of the revenue from those sales. The H20 was created for the Chinese market specifically in response to U.S. restrictions. While it’s not as powerful as the Hopper H100, it still has high bandwidth memory and has been optimized to deliver 20% faster inference speeds on some large language model workloads.

However, last month, Beijing raised new questions about whether the H20 chips includes remote tracking capabilities. Nvidia denies the chips have backdoors that would allow them to be operated remotely, but Beijing has now reportedly asked AI developers and tech companies in China not to use the H20 chips for government purposes.

Nvidia’s revenue from China last year came in at $17.1 billion, making it roughly 13% of Nvidia’s total sales. Huang has said the Chinese AI market could be valued at $50 billion in the next two to three years, and Wedbush’s bullish take on Asia demand for Nvidia’s chips fits with that outlook.

A Closer Look at NVDA Stock

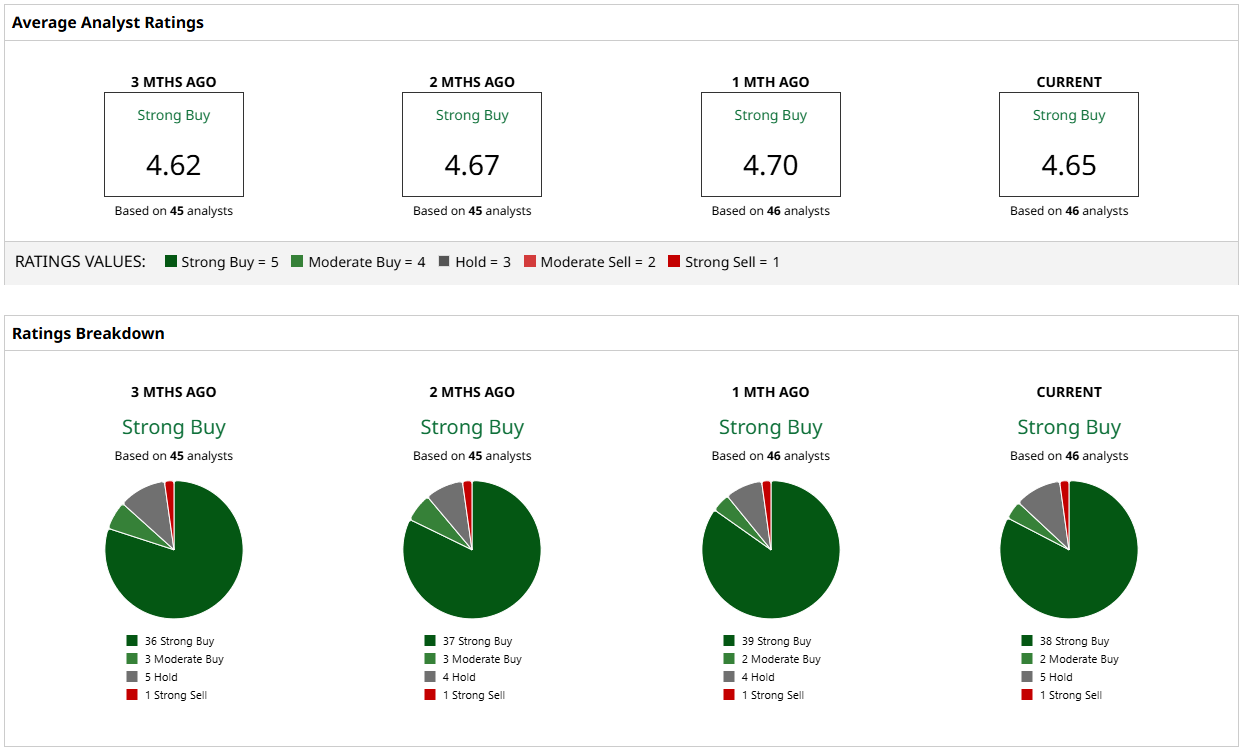

Momentum among analysts is overwhelmingly bullish heading into earnings. Of 46 analysts surveyed, 38 have a “Strong Buy” recommendation, two are at “Moderate Buy” and five say “Hold.” Only one analyst recommends selling.

The consensus estimate is that Nvidia will report earnings per share of $0.94, up 44.6% from a year ago.

In addition to Wedbush’s note, several other analysts are also raising their price targets:

- Baird raised its price target from $195 to $225 on Aug. 25, while maintaining its “Outperform” rating.

- Evercore ISI raised its price target from $190 to $214 on Aug. 22 while maintaining its “Outperform” rating.

- Keybank raised its price target from $190 to $215 on Aug. 20 while maintaining its "Overweight" rating.

- TD Cowen raised its price target from $140 to $235 on Aug. 19 while maintaining its “Buy” rating.

- Morgan Stanley raised its price target from $200 to $206 on Aug. 18 while maintaining its “Overweight” rating.

- Mizuho raised its price target from $192 to $205 on Aug. 14 while maintaining its “Outperform” rating.

Analysts surveyed by Barchart of a mean price target of $198 on NVDA stock, representing a projected 10.6% increase in the next several months, although the most bullish target indicates the possibility of a massive 40% gain in the stock. Should the company be able to sell its advanced AI chips in China and realize the projected gains in Asia as cited by Wedbush, the 40% gain seems attainable.