On Thursday, Wedbush Securities' Matt Bryson said Taiwan Semiconductor Manufacturing Co.'s (NYSE:TSM) stellar second-quarter earnings leave little doubt that artificial intelligence (AI) demand remains red hot — a promising signal for Nvidia Corporation (NASDAQ:NVDA) and the broader tech sector.

What Happened: In a conversation with Yahoo Finance following TSMC's earnings release, Bryson said that the report reinforces the strength of AI-related demand.

"It tells us again that AI demand is really, really strong, and there's just no change there," said Bryson, managing director of equity research at Wedbush.

He added, "With TSM telling you things are looking good this year, I think things look good for Nvidia."

When asked if he has seen signs of a slowdown in AI demand, Bryson stated that he's been to California and Taiwan — the supply chain is seeing demand lift. Moreover, there's still a shortage of new Blackwell chips, he added, referring to Nvidia's AI GPUs.

Why It's Important: TSMC, the world's largest contract chipmaker and a key supplier to Nvidia and Apple Inc. (NASDAQ:AAPL), reported second-quarter revenue of $30.07 billion, up 38.6% year-over-year, beating expectations.

In U.S. dollar terms, revenue growth hit 44.4% year-over-year, driven largely by advanced chips used in AI applications.

TSMC has projected third-quarter 2025 revenue between $31.8 billion and $33.0 billion, compared to the analyst consensus of $32.7 billion. The company anticipates a gross margin in the range of 55.5% to 57.5% and an operating margin between 45.5% and 47.5%.

Price Action: TSMC shares rose 3.38% on Thursday, closing at $245.60, before dipping slightly by 0.043% in after-hours trading, according to Benzinga Pro.

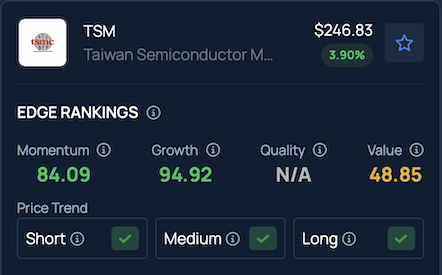

Benzinga's Edge Stock Rankings indicate that TSMC continues to show consistent upward momentum across short, medium and long-term periods. While its growth indicators remain strong, the stock’s value rating is relatively lower. Additional performance insights are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Jack Hong / Shutterstock.com