Wearable Devices Ltd. (NASDAQ:WLDS) shares skyrocketed 125.49% to $2.30 in after-hours trading on Monday following the release of first-half 2025 financial results that marked the company’s commercial debut with its AI-powered Mudra Link wristband.

Check out the current price of WLDS stock here.

Revenue Momentum Despite Year-Over-Year Decline

The Israeli tech company earned $294,000 in revenue for the six months ending on June 30, down from $394,000 during the same time last year. However, the latest figures include early sales of the new Mudra Link gesture control wristband, along with ongoing sales of the Mudra Band for the Apple (NASDAQ:AAPL) Watch.

See Also: Cathie Wood’s Ark Dumps $2.1 Million Of This Hot AI Stock Despite Recent Acquisition Boost

Asher Dahan, the CEO, said the company is “excited to kick off 2025 with strong revenue momentum from the Mudra Link and Mudra Band,” highlighting its entry into the global wearable tech market amid what he called “skyrocketing” demand for touchless interfaces.

Significant Loss Reduction Drives Investor Optimism

Net losses of WLDS narrowed significantly to $3.7 million, or $2.30 per share, from $4.2 million, or $16.52 per share, in the same period last year. The improvement was driven by lower operating expenses across research and development, sales and marketing, and general administrative costs.

The touchless innovator reduced losses appear to be a key factor behind the sharp after-hours surge. According to the Benzinga Pro data, the stock had closed regular trading at $1.02, down slightly by 0.97%.

Strategic Military and Japanese Market Expansion

Wearable Devices announced several new growth plans, including a military project focused on developing touchless neural control systems for tactical use. The company also partnered with Media Exceed Co., a Japanese tech-savvy products distributor, to enter the Japanese market. In addition, it expanded its patent portfolio with key neural interface technology that allows gesture control without the need for physical buttons.

WLDS reached a one-year high of $26.40 on September 11, 2024, with a trading volume of 197,000 shares. Since then, it has declined sharply, hitting a new low of $1.02 just yesterday, with volume rising to 5 million shares. This is significantly higher than the average daily volume of 855,610 shares.

The company currently has a market capitalization of $1.05 million and is trading near its 52-week low. The after-hours price movement follows recent announcements related to commercial developments and financial performance in the wearable technology sector.

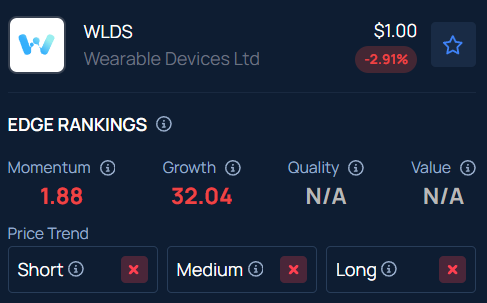

Benzinga Edge Stock Rankings indicate that WLDS has a negative price trend across all time frames. Track the performance of other players in this segment.

Read Next:

Photo Courtesy: Golden Dayz on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.