For a lot of Millennials, "we can't afford that" was practically a childhood mantra. Vacations? Maybe once a decade. Piano lessons? Too expensive. But one Redditor's post on the r/Millennials forum struck a nerve by questioning whether some parents really were struggling — or just playing frugal while sitting comfortably on six-figure incomes.

The thread opened with the kind of vent that feels both personal and universal. The poster wrote, "I'm not sure what the point of this is. Just venting, I guess." Their mother is a Boomer, their father a late Silent Generation baby, and they grew up what they believed was solidly working class — buying new clothes once a year from Walmart and being told money was always tight.

Don't Miss:

- This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, with minimum investments as low as $100.

- Have $100k+ to invest? Charlie Munger says that's the toughest milestone — don't stall now. Get matched with a fiduciary advisor and keep building

But years later, after gaining access to their parents' finances, that story unraveled fast. "My dad's income was easily in the top 10% in the 80s and 90s," the Redditor wrote. "My mom's career did well with a pension that's no longer offered to younger people. My parents were upper middle class, if not wealthy. They hid all of it."

He recalled that his father even owned extra land "that no one knew about, just to have." Meanwhile, he and his siblings grew up hearing they were "too poor" for anything fun or enriching. "Too poor to send us to college. Too poor to do any after-school sports. Too poor for music lessons. Too poor for anything."

The part that really stung came with the discovery that in 1990 his dad claimed $102,000 in income — roughly $250,000 today. "When you make the equivalent of $250,000 a year on just one parent's income (not to mention my mom's), you are not poor," he wrote. "Through most of their lives, my parents never actually had to worry about money."

Trending: Backed by $300M+ in Assets and Microsoft's Climate Fund, Farmland LP Opens Vital Farmland III to Accredited Investors

It's a post that taps into something many Millennials have wrestled with: that generational money gap between the people who raised them and the economic reality they face now. In the 1980s and 1990s, steady jobs with pensions, lower housing costs, and employer-covered healthcare gave families financial stability that's almost mythical today. The frustration is obvious — not just because some parents hid their comfort, but because those same parents sometimes can't comprehend how different the landscape looks for their adult children.

Commenters on the thread were split between disbelief and empathy. One wrote, "I'm just happy that they'll have money to live off of when they're elderly, because I won't be able to care for them." Another added that the cost of long-term care had already become terrifying: "A patient told me they sold their house to live in a senior community and said, ‘Hopefully I die by next year, otherwise I'll be out of money.' Freaking bleak."

Others noted that some Millennials are watching the opposite story unfold — parents who didn't save enough. "My parents are broke," one user wrote bluntly. "It's been a tough climb my entire life without wealthy parents to say the least."

A few shared stories of parents who got lucky or simply made smart choices. One commenter described a mother who invested her late husband's life insurance in the stock market, eventually ending up with a million dollars and a paid-off home. "I'm happy for her," they said. "She's healthy, and I think she'll be okay for the duration."

See Also: If You're Age 35, 50, or 60: Here’s How Much You Should Have Saved Vs. Invested By Now

Across the board, though, there was a sense of unease about what happens next. Some Millennials may never match their parents' financial standing, but others now shoulder the burden of supporting parents who didn't plan for retirement. As one user warned, "Filial responsibility laws are the scariest financial things Millennials face right now."

The irony is that both sides — the ones resentful of their parents' secret wealth and the ones scrambling to support broke parents — are reacting to the same reality: a generational shift where financial security is no longer a given. For some, the frustration stems from realizing their parents could have made things easier but didn't. For others, it's knowing they'll be the safety net when there isn't one left.

Either way, it's a reminder that the money myths passed down in childhood often look very different under the fluorescent light of adulthood — and that "too poor for music lessons" sometimes meant something else entirely.

But the story doesn't have to end in resentment or panic. Whether someone's realizing their parents' financial story wasn't what it seemed, or bracing to help support aging family members, there are ways to prepare.

Talking with a financial advisor can help clarify options — from planning long-term care strategies to setting realistic savings goals — and create a sense of control in a situation that often feels anything but. Because while Millennials can't rewrite their parents' money choices, they can still make sure the next chapter doesn't look the same.

Read Next: The average American couple has saved this much money for retirement — How do you compare?

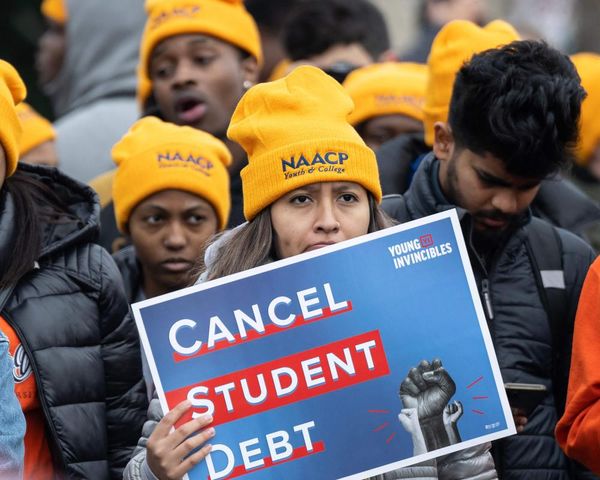

Image: Shutterstock