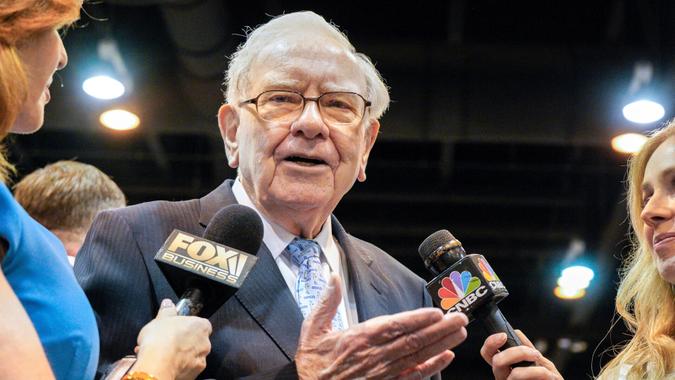

Warren Buffett’s holding company, Berkshire Hathaway, recently filed its quarterly Form 13F equity investment portfolio, providing investors with an update regarding the company’s holdings. The filing indicated five newer holdings that Buffett and Berkshire have acquired, including one rather surprising investment in a very controversial and embattled company.

Also Learn: 10 Genius Things Warren Buffett Says To Do With Your Money

Buffett has long been known as the “Oracle of Omaha” thanks to incredible investment acumen, financial success and longevity in the market — all of which makes these most recent investments worth considering. The Oracle has bet on these companies — should you?

Also see why Buffett is so good at weathering market unrest.

UnitedHealth Group

Certainly the most surprising investment reveal in Berkshire’s filing is that the holding company now has 5 million shares (valued at around $1.55 million) of the embattled UnitedHealth Group (UNH). Berkshire has been amassing shares of UNH in secret since the final quarter of 2024 so as to avoid a spike in share prices. UNH is currently under a criminal investigation by the Department of Justice due to a potential Medicare fraud, which caused its income to plummet throughout 2025.

So why did Buffett’s company invest, and should you?

“UnitedHealth Group is strongly recommended as a company selling at a 50% discount to its peak price of $615 just nine months ago,” said David Kass, clinical professor of finance at the University of Maryland’s Robert H. Smith School of Business.

Kass commended Berkshire’s investment, adding that UNH’s controversies will likely lead to some “major fines and some executives may be forced to leave the company. But [UNH] will survive and likely regain its prominence in the industry. Its finances are solid. It has above-average profitability and a below-average price-to-earnings ratio.”

Vince Stanzione, CEO and founder of First Information, said, “What we see with Berkshire’s latest buys is that they have gone for out-of-favor stocks such as UnitedHealth, where they see value after the near 50% drop. As the old Buffett saying goes, ‘Be greedy when others are fearful.'”

Warren Buffett: 10 Things Poor People Waste Money On

Allegion

Allegion, a security products firm, is “attractive as a result of its high profitability, with a gross margin of 45% and a return on equity of 39%, along with a solid growth outlook,” Kass said. Berkshire scooped 780,000 shares of the security company for an estimated $107 million.

Discover More: Warren Buffett’s Top 4 Tips for Getting Richer

D.R. Horton

D.R. Horton is the largest homebuilder in the United States by volume. As reported by Morning Star, Berkshire had previously acquired 6 million shares of the company in 2023 for approximately $660 million and then sold them off by 2024. In 2025, Berkshire spent an estimated $203 million on 1.5 million shares of Horton, of which 27,000 shares were later sold.

While Kass found Berkshire’s move to be a smart one, noting that Horton is an attractive acquisition due to “high profitability (gross margin of 25%, return on equity of 16%) and a relatively low valuation,” others are less sure.

David Materazzi, CEO of Galileo FX, warned that housing demand “is chained to mortgage rates. When money tightens, buyers vanish. Inventory sits and bleeds capital. The ride up is sweet; the fall is brutal.”

Lamar Advertising

Berkshire snapped up 1.2 million shares of the global advertising firm Lamar Advertising for approximately $138 million. Kass called the company “highly attractive for investors,” thanks to a return on equity of 42% and a gross margin of 82%.

Nucor

The largest steel manufacturer and recycler in the United States, Nucor is viewed by Kass as “very attractive as a large steel producer with much of its production in the U.S. and therefore may benefit from tariffs being charged to foreign steel producers.”

Materazzi partially agreed, noting that Nucor “crushes weaker rivals when prices collapse.” He added, though, that “steel is a commodity. Global forces set the price, not Nucor, and the stock bends with every swing.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Warren Buffett’s New Stock Bets Revealed — Should You Buy In, Too?