Bitcoin is “probably rat poison squared.”

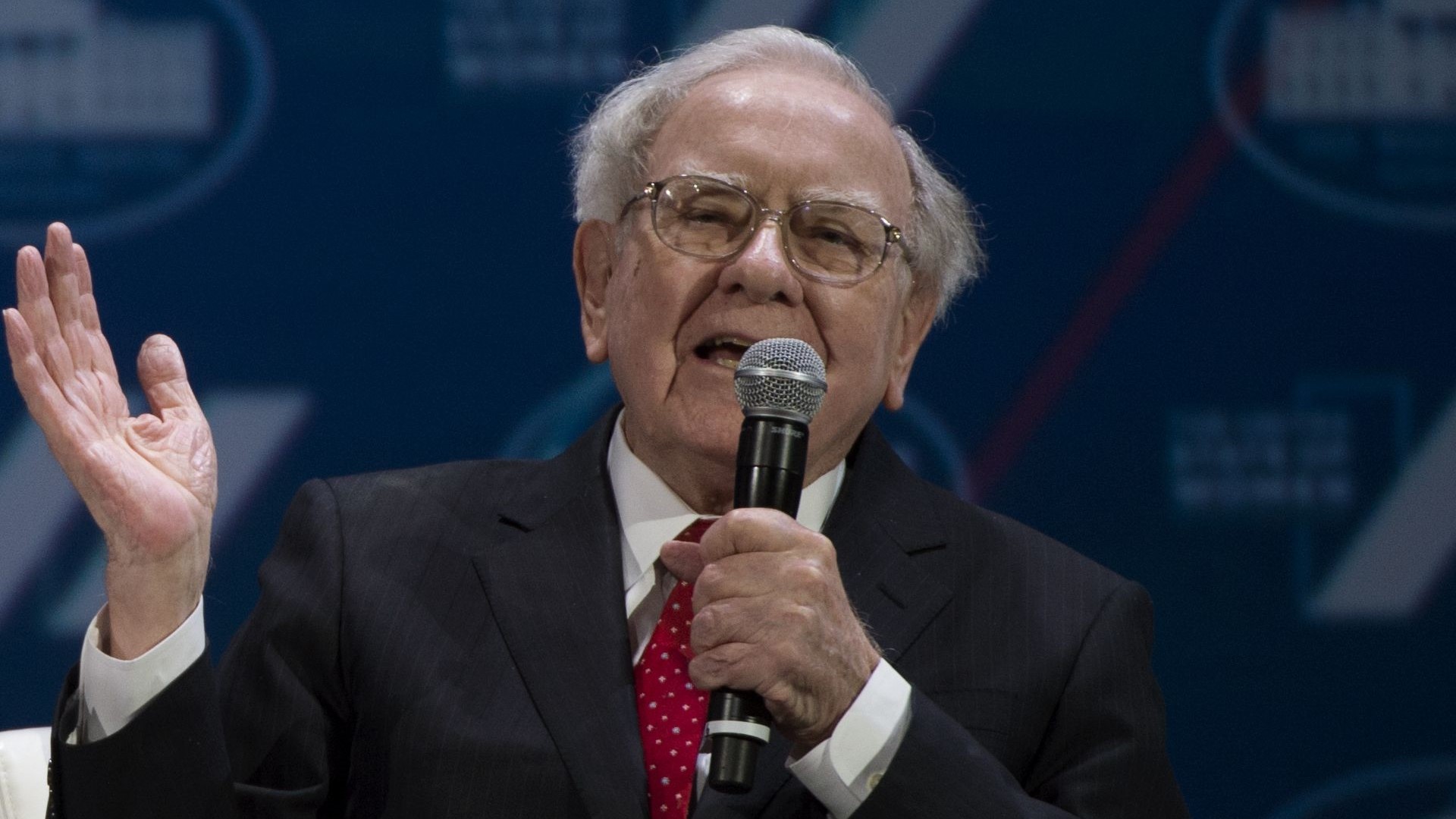

That’s how billionaire investor and “the Oracle of Omaha” Warren Buffett described digital currency during an annual shareholder meeting for his multinational holding company Berkshire Hathaway in 2018, per CNBC.

Explore More: 15 Investments Warren Buffett Regrets

Check Out: 4 Housing Markets That Have Plummeted in Value Over the Past 5 Years

It was an unusually strong denunciation from Buffett, considering that the Berkshire Hathaway CEO is known more for his measured, careful demeanor and investment stratagems than he is fiery rhetoric or strong condemnations. In fact, it’s safe to say that, in a lifetime of cool and calm takes, this may be Buffett’s hottest one.

Also see five ways to adopt Buffett’s long-term approach to investing.

Why Buffett Hates Bitcoin

Buffett’s nickname, the Oracle of Omaha, comes from his uncanny ability to assess the potential value of stocks and companies to invest in, and he has accumulated nearly $150 billion in wealth having done so — making him one of the world’s richest individuals. So it’s worth hearing him out on bitcoin, at the very least.

His primary objection? “Cryptocurrencies basically have no value and they don’t produce anything,” he lamented to CNBC in 2020. “In terms of value: zero.”

A great deal of Buffett’s monumental financial success has come from “value investing,” a strategy in which an investor identifies a stock, company or security with a high intrinsic value that the market has not yet identified as high — that is, a stock trading below its value and thus can be bought low and later sold high.

Much of Buffett’s revulsion at bitcoin likely stems from his professional lifetime of placing a premium on intrinsic value, some which digital currencies do not have. Despite the great deal of money that some have made with crypto, the entire existence of bitcoin is at odds with Buffett’s very successful financial philosophy.

Additionally, bitcoin does not produce services nor does it create products on its own. It doesn’t have a steady, long-term history that can yet be studied (something else that Buffett prefers).

Read More: Warren Buffett’s Top 4 Tips for Getting Richer

Is Buffett Right or Wrong?

As it stands, the longevity of bitcoin as a reliable currency is unknown (which is likely another reason Buffett dislikes it — bitcoin’s future is inherently uncertain). Despite being introduced in 2009, it still has not become the defining way in which most manage their currency. It is popular with some speculators, to be sure, but it remains cloudy as to what will happen with cryptocurrency over the next 10 years.

That very uncertainty — and the high risk that comes with it — makes Buffett all the more justified in his overcaution when it comes to digital currencies. Is he 100% right that bitcoin is “rat poison”? At the moment, no (as plenty of money has been made with it), but he’s not 100% wrong, either.

Bitcoin is a risk, and one that has yet to fully prove itself. Only time will tell if Buffett’s hot take was actually a rather cool and sensible one after all.

More From GOBankingRates

- 9 Costco Items Retirees Need To Buy Ahead of Fall

- Vivian Tu: The Simple Money Rule That Can Keep You Out of Debt

- These Cars May Seem Expensive, but They Rarely Need Repairs

- 3 Reasons Retired Boomers Shouldn't Give Their Kids a Living Inheritance (And 2 Reasons They Should)

This article originally appeared on GOBankingRates.com: Warren Buffett’s Hottest Take on Investing — Is He Right?