While the ‘Oracle of Omaha,' Warren Buffett, has offloaded more than two-thirds of Berkshire Hathaway Inc.'s (NYSE:BRK) (NYSE:BRK) stake in the iPhone maker, he has built a stake in this consumer-facing company over the last three quarters.

Check out the current price of AAPL stock and DPZ stock here.

What Happened: According to its 13F filings, Berkshire holds 300 million shares of a total of 26% stake in Tim Cook's Apple Inc. (NASDAQ:AAPL) as of the end of the first quarter of 2025.

This is down by two-thirds or 67.25% of Berkshire's Apple stake, which stood at 916 million shares during the third quarter of 2023. Over approximately two years, the company has significantly offloaded about 616 million shares of its largest holding.

This contrasts with its stake in pizza maker Domino's Pizza Inc. (NASDAQ:DPZ). Berkshire first acquired 1.3 million shares in the firm during the third quarter of 2024 and has increased its holdings by 100% to 2.6 million shares as of the first quarter of 2025.

The table below showcases Berkshire's historical trades in Apple and Domino's over the last few quarters.

| Company | Holdings As Of Q3 2023 | Holdings As Of Q4 2023 | Holdings As Of Q1 2024 | Holdings As Of Q2 2024 | Holdings As Of Q3 2024 | Holdings As Of Q4 2024 | Holdings As Of Q1 2025 | Value As Of Q1 2025 |

| Apple Inc. (NASDAQ:AAPL) | 916 million | 906 million | 789 million | 400 million | 300 million | 300 million | 300 million | $66.639 billion |

| Domino's Pizza Inc. (NASDAQ:DPZ) | — | — | — | — | 1.3 million | 2.4 million | 2.6 million | $1.204 billion |

Meanwhile, looking at it on a quarter-on-quarter basis, Berkshire made no adjustments in its Apple holdings from the first quarter of 2024 to the first quarter of 2025. However, it bumped its stake in Domino's by 10%.

As of the end of the first quarter, Berkshire holds $66.639 billion worth of Apple shares and $1.204 billion worth of Domino's shares.

| Company | Holdings (as of Dec. 31, 2024) | Holdings (as of March 31, 2025) | Change (in %) | Value (as of March 31, 2025) |

| Apple Inc. (NASDAQ:AAPL) | 300,000,000 | 300,000,000 | 0% | $66.639 billion |

| Domino's Pizza Inc. (NASDAQ:DPZ) | 2,382,000 | 2,620,613 | 10% | $1.204 billion |

See Also: Figma’s Market Debut Could Value Design Giant At $16 Billion, Down From Adobe’s $20 Billion Deal

Why It Matters: Apple has been facing regulatory hurdles concerning its iPhone manufacturing in China and India amid tariff turmoil. Whereas President Donald Trump's One Big, Beautiful Bill makes the 21% peak marginal corporate income tax rate permanent.

Meanwhile, Wall Street has been urging the company to make huge investments in artificial intelligence (AI) instead of using its cash pile to engage in its share repurchase program.

Domino's, on the other hand, stated during its second quarter earnings call that it believes its cost structure and scale uniquely position it to thrive as consumers increasingly prioritize value, according to CEO Russell Weiner.

Weiner stated that while value-seeking trends act as “headwinds” for competitors, they’re “tailwinds” for Domino’s, largely due to its integrated supply chains and strong franchise profitability.

Price Action: Shares of Apple were up 0.13% in premarket on Tuesday. It has fallen by 12.86% on a year-to-date basis and 5.13% over the past year.

DPZ was 0.49% higher in premarket on Tuesday. It has gained 6.28% YTD and 11.24% over the past here.

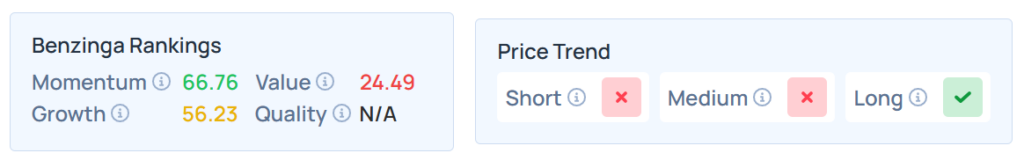

Benzinga Edge Stock Rankings shows that Domino’s had a weaker price trend over the medium and short term but a strong price trend over the long term. Its momentum ranking was good, but its value ranking was subpar at the 24.49th percentile.

The details for Apple's Edge Stock Rankings other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.10% at $628.14, while the QQQ declined 0.18% to $563.13, according to Benzinga Pro data.

Read Next:

Photo Courtesy: Photo Agency on Shutterstock.com