New York-based Warner Bros. Discovery, Inc. (WBD) operates as a media and entertainment company worldwide. With a market cap of $31.6 billion, the company offers a complete portfolio of content, brands, and franchises across television, film, streaming, and gaming.

Shares of this leading global media and entertainment company have outperformed the broader market over the past year. WBD has gained 53.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.5%. In 2025, WBD’s stock rose 21.8%, surpassing the SPX’s 6.1% rise on a YTD basis.

Zooming in further, WBD’s outperformance looks less pronounced compared to Invesco Leisure and Entertainment ETF (PEJ). The exchange-traded fund has gained about 27.5% over the past year. Moreover, WBD’s double-digit gains on a YTD basis outshine the ETF’s 8.8% returns over the same time frame.

WBD’s outperformance is driven by the success of popular series and substantial international expansion of Max to 77 markets, leveraging HBO's premium content reputation and its extensive film library to offer a unique value proposition in the streaming space.

On May 8, WBD shares closed up more than 5% after reporting its Q1 results. Its loss of $0.18 per share fell short of Wall Street's expectations of a loss of $0.12 per share. The company’s revenue was $9 billion, falling short of Wall Street forecasts of $9.7 billion.

For the current fiscal year, ending in December, analysts expect WBD’s loss per share to grow 99.1% to $0.04 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

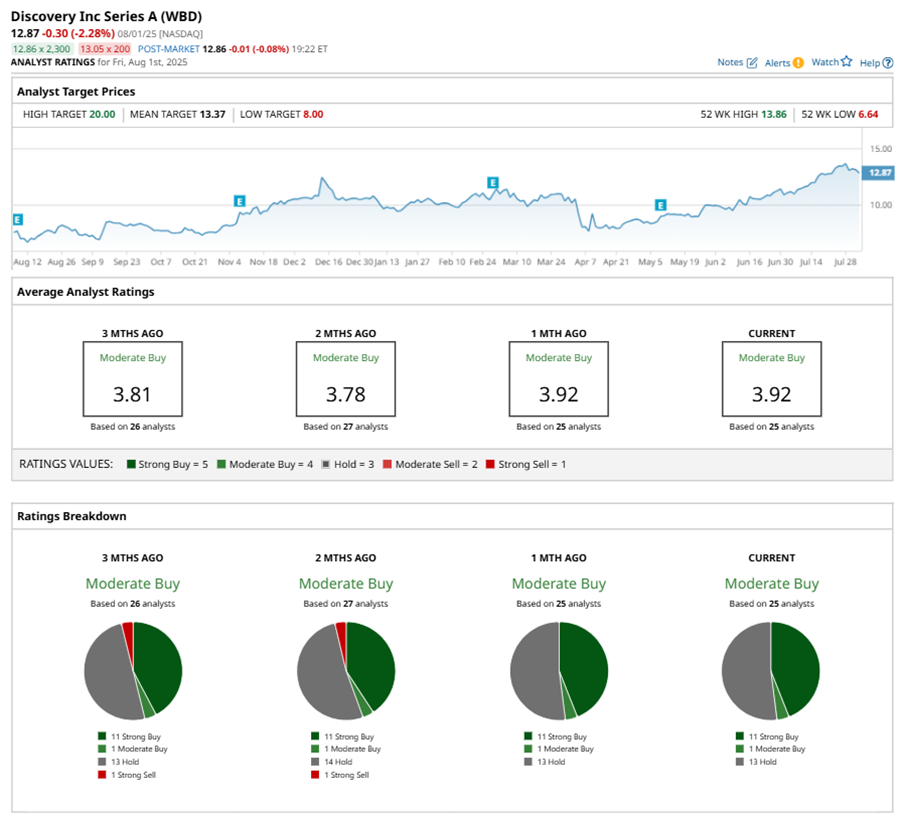

Among the 25 analysts covering WBD stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and 13 “Holds.”

This configuration is less bearish than two months ago, with one analyst suggesting a “Strong Sell.”

On Jul. 30, Patrick Sholl from Barrington reiterated a “Buy” rating on WBD with a price target of $16, implying a potential upside of 24.3% from current levels.

The mean price target of $13.37 represents a 3.9% premium to WBD’s current price levels. The Street-high price target of $20 suggests an ambitious upside potential of 55.4%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.