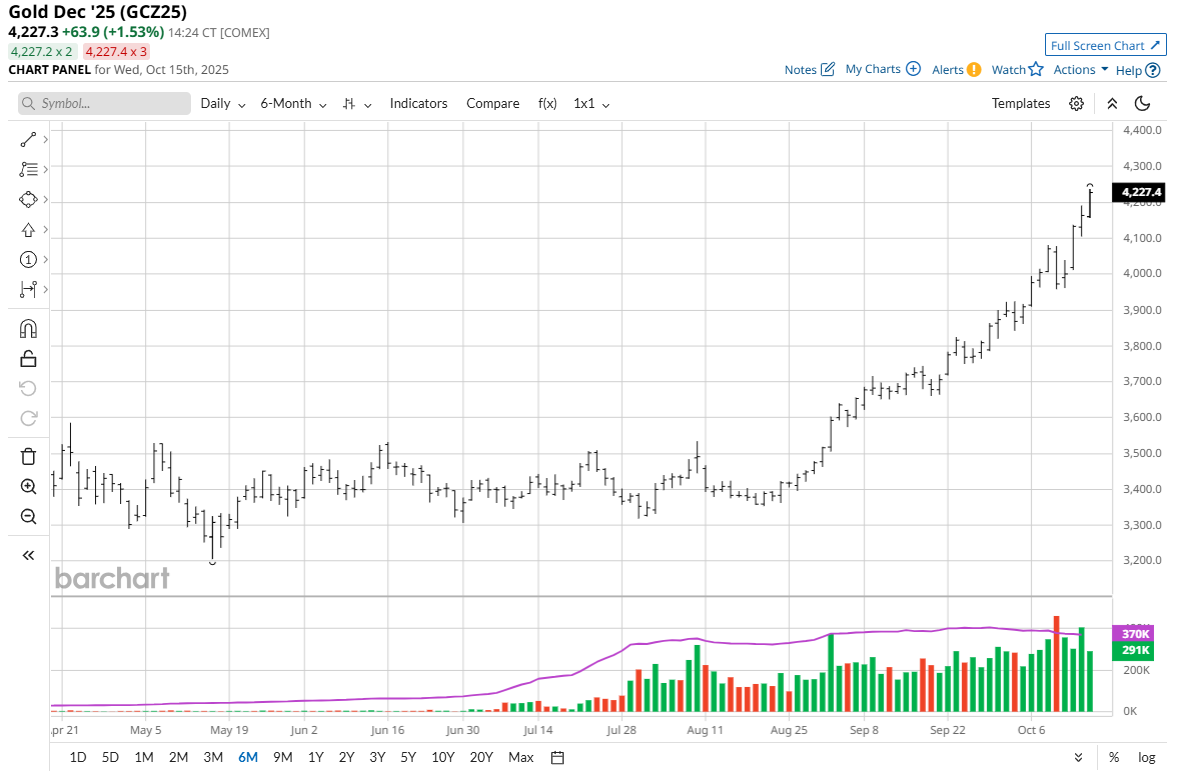

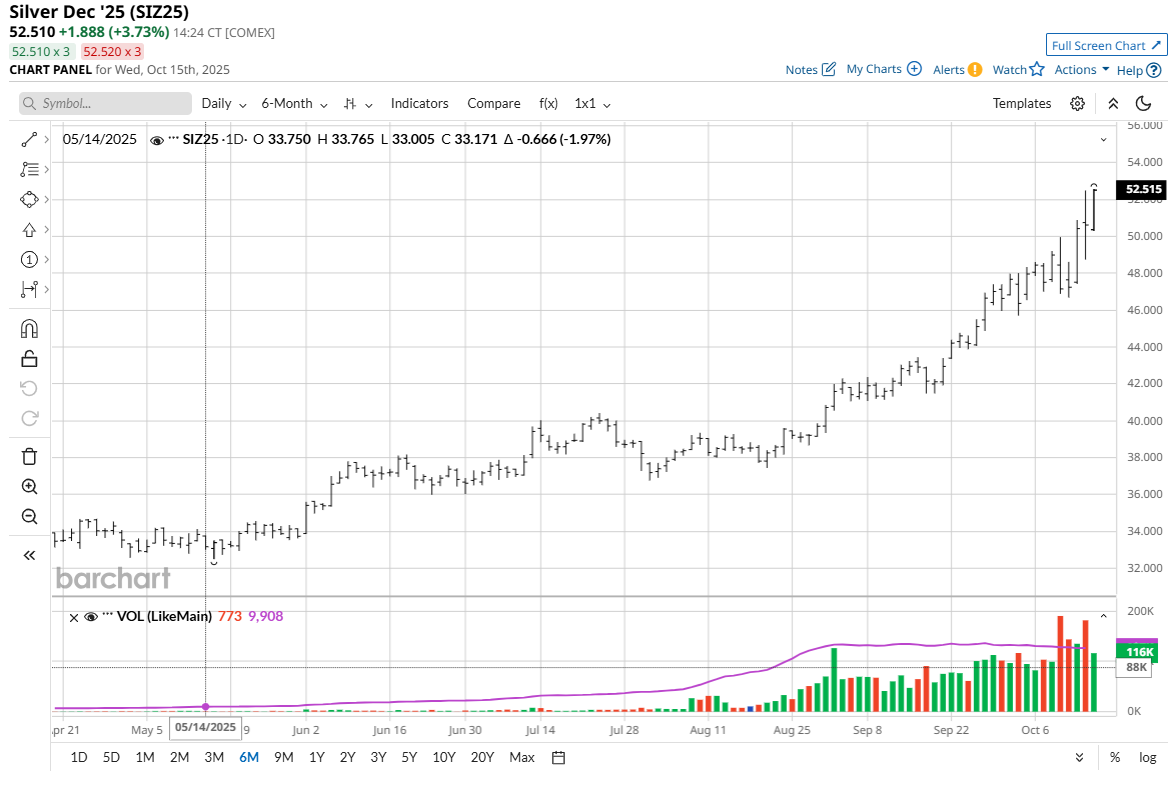

Gold (GCZ25) today hit a record high of $4,235.80 an ounce, basis December Comex futures. December silver (SIZ25) futures hit a record peak of $42.495 an ounce on Tuesday, Oct. 14.

Is there still more upside for the two precious metals, or are they at or near their peaks for their major bull runs? Let’s tackle this question with a bull versus bear debate.

The Bull Case: There’s Still Room for the Gold, Silver Markets to Run

Here and the bullish elements for gold and silver that may extend their record-setting rallies.

-

Safe-haven demand. The U.S. government shutdown has created a dearth of U.S. economic data, which has created marketplace uncertainty. And there are no early signs the stalemate between Democrat and Republican lawmakers will come to an end any time soon. There are other geopolitical matters supporting gold and silver, such as elevated U.S.-China trade tensions.

www.barchart.com

- Lower global interest rates are likely in the coming months. Federal Reserve Chair Jerome Powell on Tuesday reiterated the U.S. central bank is set to cut its main interest rate in late October. The marketplace thinks the Fed will make at least two more quarter-point rate cuts in this rate-cutting cycle. Recent weaker economic data out of China has the Chinese government saying it will ease its monetary policy in the coming weeks and months. Other countries, including Canada, the U.K., and Australia have also lowered interest rates, with the European Central Bank recently holding its rates steady. Lower interest rates mean lower borrowing costs for consumers and businesses, meaning better demand for metals.

- Central banks stocking up on more gold. The de-dollarization moves by many countries — namely Brazil, Russia, India, China, and South Africa — are moving away from holding the U.S. dollar in their reserves and opting to hold more gold.

- Major industrialized countries are stocking up on rare-earth minerals as well as metals. Recent years have seen a move away from “globalism” amid supply chain disruptions, trade wars and increasing nationalism, led by the U.S. and China. This de-coupling has prompted nations to stockpile their own supplies of raw commodities, to the point of hoarding. Gold and silver markets are benefiting from this situation.

- More investors are adding gold and silver to their portfolios. JPMorgan chief Jamie Dimon was asked about owning gold. “I’m not a gold buyer — it costs 4% to own it,” Dimon said Tuesday at Fortune’s Most Powerful Women conference in Washington. “It could easily go to $5,000, $10,000 in environments like this. This is one of the few times in my life it’s semi-rational to have some in your portfolio,” he said.

- Technical charts remain overall bullish for gold and silver, both near term and longer term. Prices remain in uptrends on the daily charts and on the weekly and monthly charts. For the gold and silver bulls, “the trend is their friend.”

The Bear Case: Bulls Are Nearing the Point of Exhaustion

Here are the bearish factors that suggest the gold and silver bulls have run out of gas.

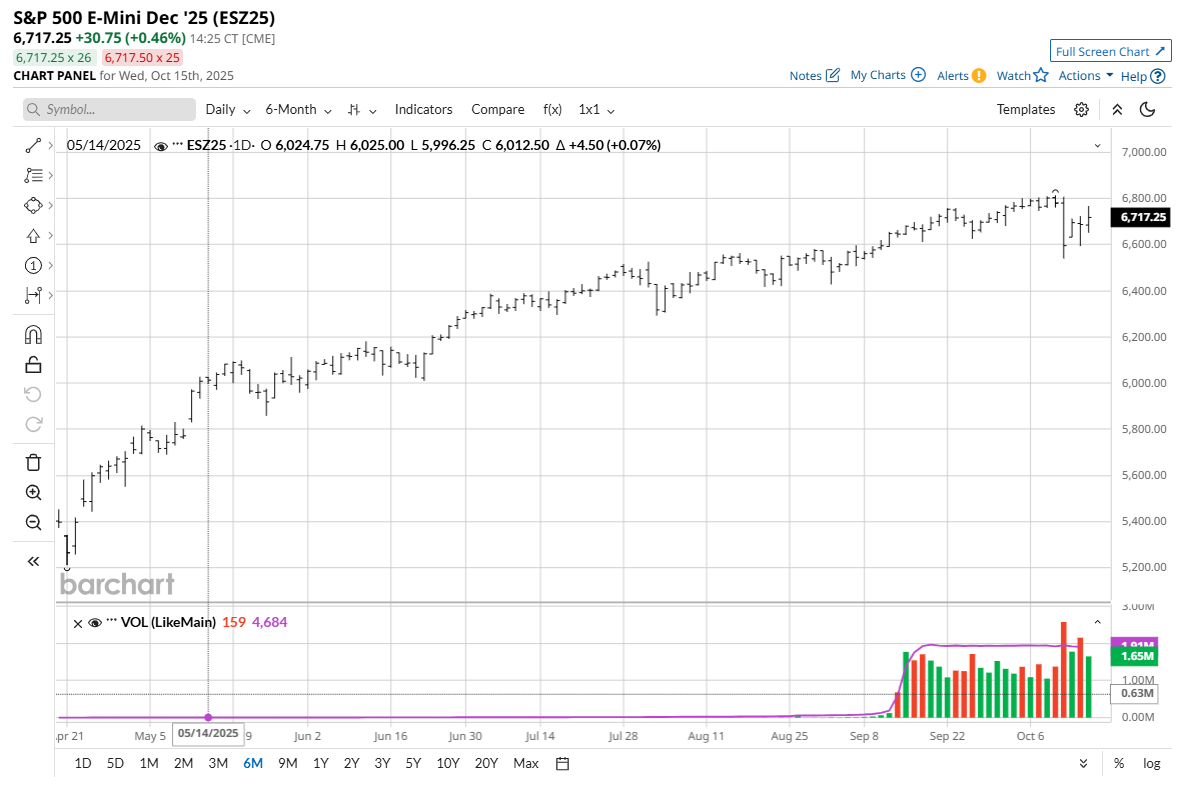

- The U.S. stock indexes ($SPX) ($IUXX) ($NASX) this week have made solid rebounds from last week’s selloff and are now not far below last week’s record highs. The stock market is a competing asset class with safe-haven metals. The stock indexes not far below their record highs suggest better risk appetite in the marketplace, which is bearish for the safe-haven metals.

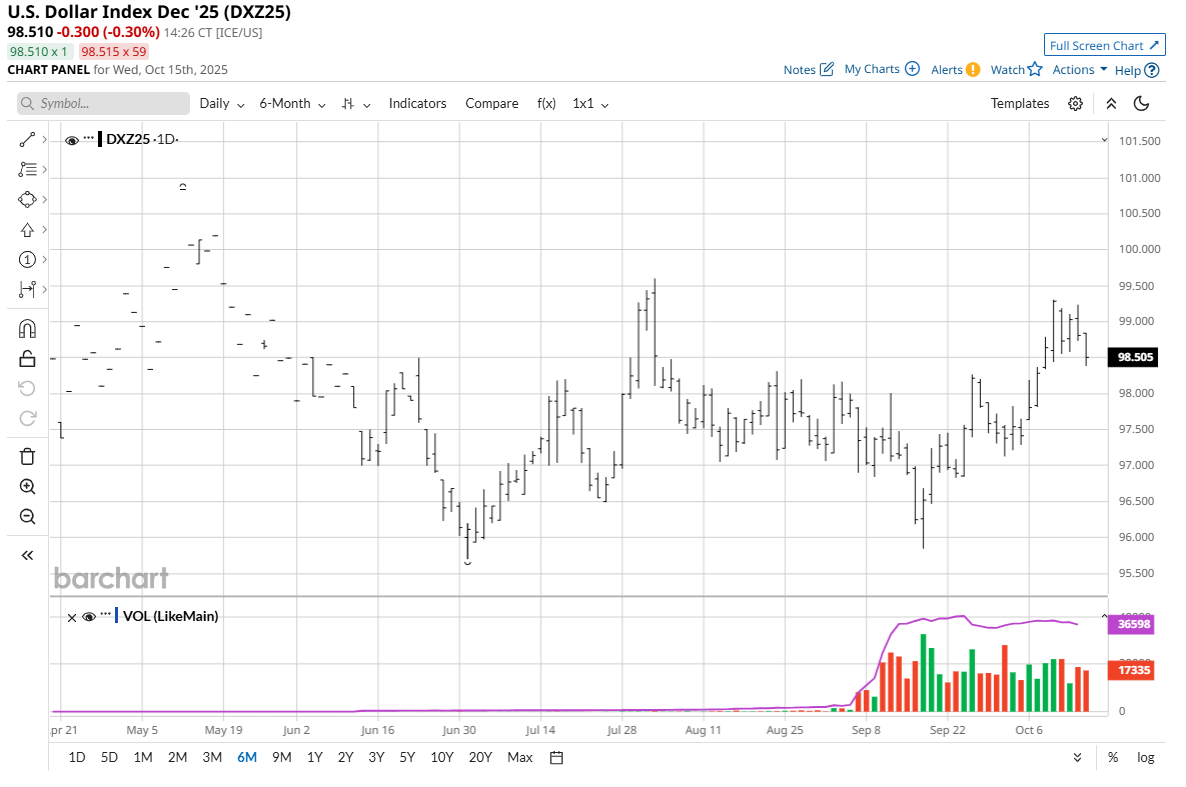

- The U.S. dollar index ($DXY) last week scored a nine-week high, and the index is trending higher. Generally, a rallying U.S. dollar index is a bearish element for the gold and silver markets. The rallying greenback hints at a healthier U.S. economy, which could put the brakes on the Fed cutting interest rates in the coming months.

- A calmer geopolitical front. The Middle East is quieter following this week’s cessation of hostilities between Israel and Hamas.

- The recent higher volatility at higher price levels (bigger daily price bars on the daily bar charts) suggests the already very mature bull market runs for gold and silver are now in their final stages.

- The Relative Strength Index (RSI) is now showing bearish divergence, whereby gold and silver prices reached new record highs this week, while at the same time the RSI numbers have declined from their peaks. That’s a sign of a weakening bull market.

- Strong bull markets need to be fed fresh, bullish fundamental fodder often. It can be argued that gold and silver bulls are now getting hungry for some new developments to keep them in a buying mood.

My Bias on Gold and Silver Prices

Here’s what I see happening to the gold and silver markets. From a time perspective, I believe the major bull runs in gold and silver are in the eighth or ninth inning. However, the last inning or two can still see runs scored.

This is probably the most important factor that I think will determine where gold and silver prices are headed: Silver above $50.00.

Reason: Price history over the past 50 years shows that when silver prices reach $50, or get close to it, which has occurred three times now, the first two times saw silver trade above $50 for only a short period of time. Two weeks from now, if silver prices are above $50 an ounce, then the marketplace can start to believe both gold and silver are entering new, longer-term price ranges that will continue well above what price history of the past 50 years has shown. And if silver drops back below $50 in the next couple weeks, history will again repeat itself — and that would suggest gold and silver are due for extended downside price corrections and even bear markets farther down the road, to continue the historical cycle of boom and bust seen in all raw commodity markets.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.