With a market cap of $932 billion, Walmart Inc. (WMT) is a global retail powerhouse operating retail and wholesale stores, membership clubs, eCommerce websites, and mobile apps through three segments: Walmart U.S., Walmart International, and Sam’s Club. It offers a vast range of products and services spanning groceries, consumables, health and wellness, general merchandise, digital payments, and financial services across physical and digital platforms worldwide.

Shares of the Bentonville, Arkansas-based company have outperformed the broader market over the past 52 weeks. WMT stock has increased 20.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, shares of Walmart are up nearly 5% on a YTD basis, compared to SPX’s 1.9% rise.

Narrowing the focus, the retail giant stock has also outpaced the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 3.9% return over the past 52 weeks.

Shares of WMT climbed 6.5% on Nov. 20 after Walmart delivered a strong Q3 2026 performance, with revenue rising 5.8% to $179.5 billion and adjusted EPS increasing 6.9% to $0.62. Investors reacted positively to exceptional e-commerce strength, with global online sales up 27%, advertising revenue up 53%, and improved margins, alongside solid growth across all segments including U.S. comp sales up 4.5% and International sales up 10.8%.

Sentiment was further boosted by Walmart raising fiscal 2026 guidance, expecting 4.8% - 5.1% net sales growth and adjusted EPS of $2.58 - $2.63.

For the fiscal year ending in January 2026, analysts expect WMT’s adjusted EPS to grow 4.8% year-over-year to $2.63. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

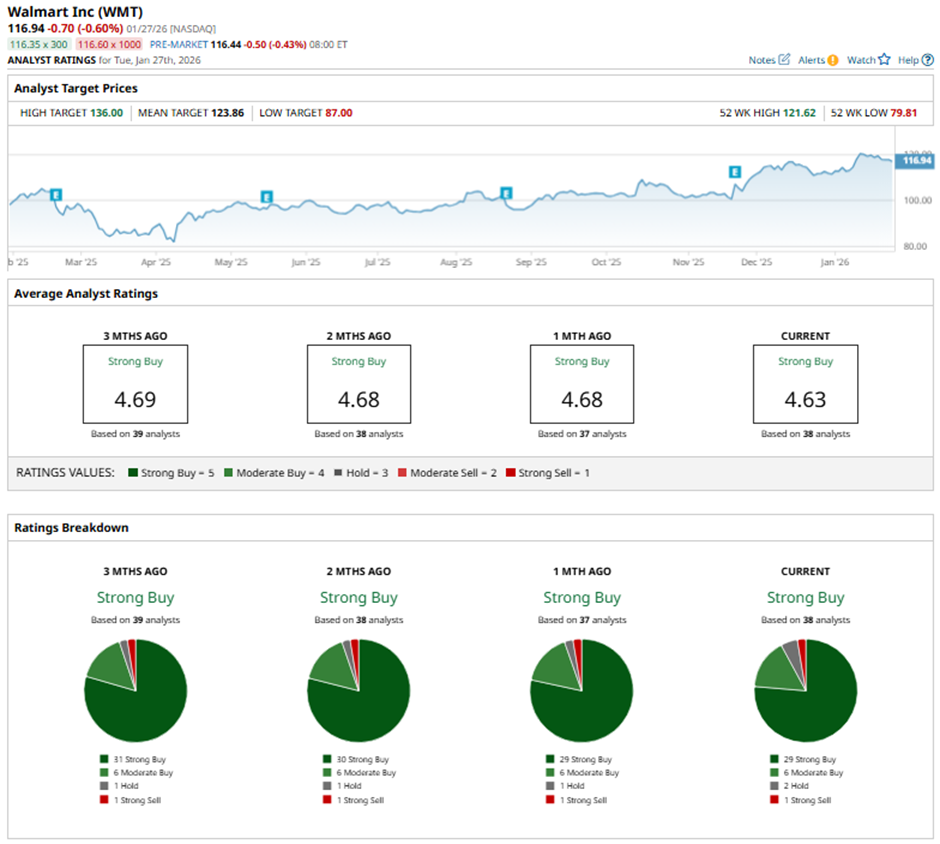

Among the 38 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 29 “Strong Buy” ratings, six “Moderate Buys,” two “Holds,” and one “Strong Sell.”

This configuration is less bullish than it was three months ago, when WMT had 31 “Strong Buys” in total.

On Jan. 23, Tigress Financial raised Walmart’s price target to $135 and maintained a “Buy rating” on the stock.

The mean price target of $123.86 represents a 5.9% premium to WMT’s current price levels. The Street-high price target of $136 suggests a 16.3% potential upside.