With a market cap of $829.7 billion, Walmart Inc. (WMT) is a global retailer that operates through three main segments: Walmart U.S., Walmart International, and Sam’s Club. The company runs retail and wholesale stores, eCommerce platforms, and digital payment services, offering a broad assortment of merchandise, groceries, health and wellness products, and financial solutions.

Companies valued at more than $200 billion are generally considered “mega-cap” stocks, and Walmart fits this criterion perfectly. Guided by its everyday low price (EDLP) philosophy and omni-channel strategy, Walmart helps customers save money and live better by seamlessly integrating in-store and online shopping experiences.

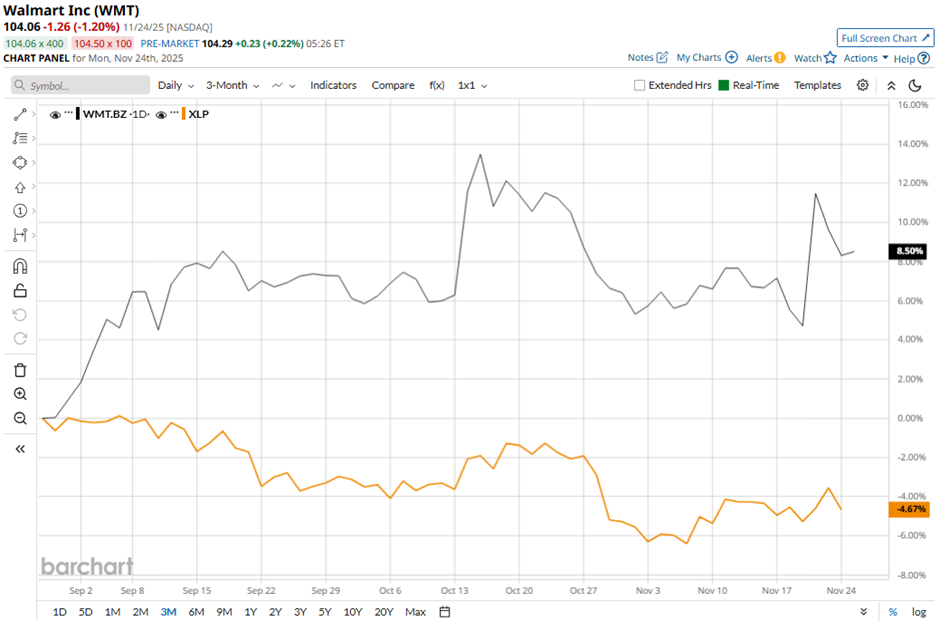

Shares of the Bentonville, Arkansas-based company have decreased over 5% from its 52-week high of $109.57. Over the past three months, its shares have risen 7.5%, surpassing the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.6% decline during the same period.

Longer term, WMT stock is up 15.2% on a YTD basis, outpacing XLP's 2.1% dip. Moreover, shares of the retail giant have returned 15.1% over the past 52 weeks, compared to XLP’s 5.9% drop over the same time frame.

Despite a few fluctuations, the stock has been in a bullish trend, consistently trading above its 200-day moving averages since last year.

Shares of WMT climbed 6.5% on Nov. 20 after Walmart delivered a strong Q3 2026 performance, with revenue rising 5.8% to $179.5 billion and adjusted EPS increasing 6.9% to $0.62. Investors reacted positively to exceptional e-commerce strength, with global online sales up 27%, advertising revenue up 53%, and improved margins, alongside solid growth across all segments, including U.S. comp sales up 4.5% and International sales up 10.8%.

Sentiment was further boosted by Walmart raising fiscal 2026 guidance, expecting 4.8% - 5.1% net sales growth and adjusted EPS of $2.58 - $2.63.

Additionally, WMT stock has outpaced its rival, Costco Wholesale Corporation (COST). COST stock has fallen 3.3% YTD and 8.1% over the past 52 weeks.

Due to WMT's outperformance over the past year, analysts remain bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 37 analysts in coverage, and the mean price target of $118.46 is a premium of 13.8% to current levels.