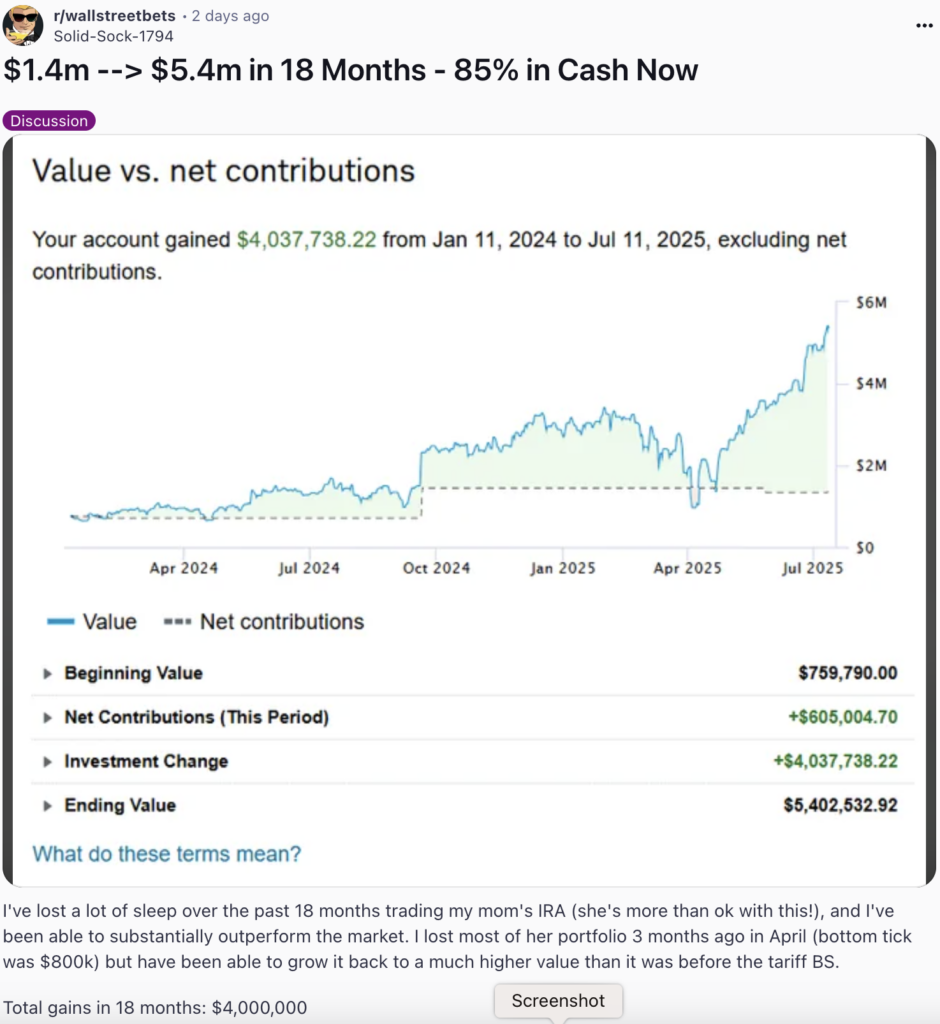

A Reddit user claims to have turned disaster into triumph after nearly blowing his mother’s $800,000 retirement account, before mounting a stellar recovery to a profit of $4 million in just 3 months, via aggressive options trading.

Check out the current price of UNH stock here.

What Happened: On Reddit’s /r/WallStreetBets community on Saturday, a user with the name Solid-Sock-1794 described his 18-month-long trading journey using his mother’s retirement, which he says, “she was more than ok with.”

During this period, he claims to have significantly outperformed the markets by trading options contracts on high-volatility stocks such as Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Nvidia Corp. (NASDAQ:NVDA), and Hims & Hers Health Inc. (NYSE:HIMS). His strategy involved buying near or at-the-money call options with expirations two to five months down the line.

He says the expirations would ideally involve one earnings event in the window, while holding through the actual earnings days.

This strategy, however, failed to stand the test of volatility in April, during what he refers to as “Tariff BS,” following which the account plummeted to $800,000. Since then, the account has made a strong 575% recovery, with an ending balance of $5.4 million.

The user credits this recovery to opportunistic scalps during sharp pullbacks, citing the example of Alphabet’s shares, following Apple Inc.’s (NASDAQ:AAPL) Congressional Testimony that suggested a decline in Google search traffic on Safari for the very first time in history.

As of Friday, the user disclosed he's 85% in cash, with the remaining 15% allocated to QQQ or Nasdaq puts and UnitedHealth Group Inc. (NYSE:UNH) calls.

Citing ongoing trade uncertainty involving the European Union and Canada, he summed up his outlook and strategy going forward with a signature WSB refrain: “TACO's gonna TACO.”

Here, the user is referring to the “Trump Always Chickens Out” trade, where traders make bets as soon as President Donald Trump issues fresh tariff threats, knowing fully well that he won’t follow through with them, something that’s repeated several times in recent months.

Why It Matters: Late last month, as the deadline for the 90-day pause approached, traders did not lose their cool, deciding to lean instead into the “TACO” pattern, betting that Trump would soften his stance before inflicting lasting market damage.

Last week, as Trump began issuing more tariff threats and letters to key trading partners, investors continued to buy, once again putting their faith in the fact that, once all is said and done, the tariffs will not be as harsh as they are set out to be.

This user joins the ranks of another WallStreetBets user who dropped $100,000 into UnitedHealth Group’s shares nearly two months ago.

User Sensitive_Reveal_227 claimed to have acquired 303 shares in the health insurance provider after selling his house, and without informing his wife, in hopes of a recovery in the beaten-down stock, following the assassination of its former CEO, the abrupt exit of its new CEO, and speculations of a DOJ criminal investigation, which the company quickly denied.

The company’s shares have remained largely flat since then, with no recovery in sight, and still trading at over 50% below its all-time high in November 2024.

Price Action: Shares of UnitedHealth were up 1.53% on Friday, trading at $304.10, and are down 0.35% in after-hours trading.

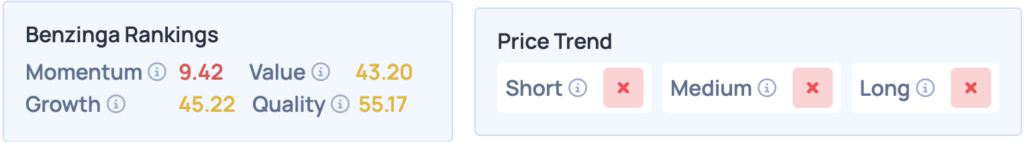

The insurer’s shares have a poor showing across the board in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long term. Click here for deeper insights into the stock.

Read More:

Photo courtesy: khunkornStudio via Shutterstock