/Tesla%20car%20with%20symbol%20by%20Michael%20Fortsch%20via%20Unsplash.jpg)

The scheduled removal of federal EV tax credits later this month will prove a meaningful headwind for Tesla (TSLA) shares, according to iSeeCars.com’s executive analyst Karl Brauer.

In a recent interview with Yahoo Finance, Brauer warned that the sales of electric vehicles in the United States could be cut in half once the aforementioned incentives expire on Sept. 30.

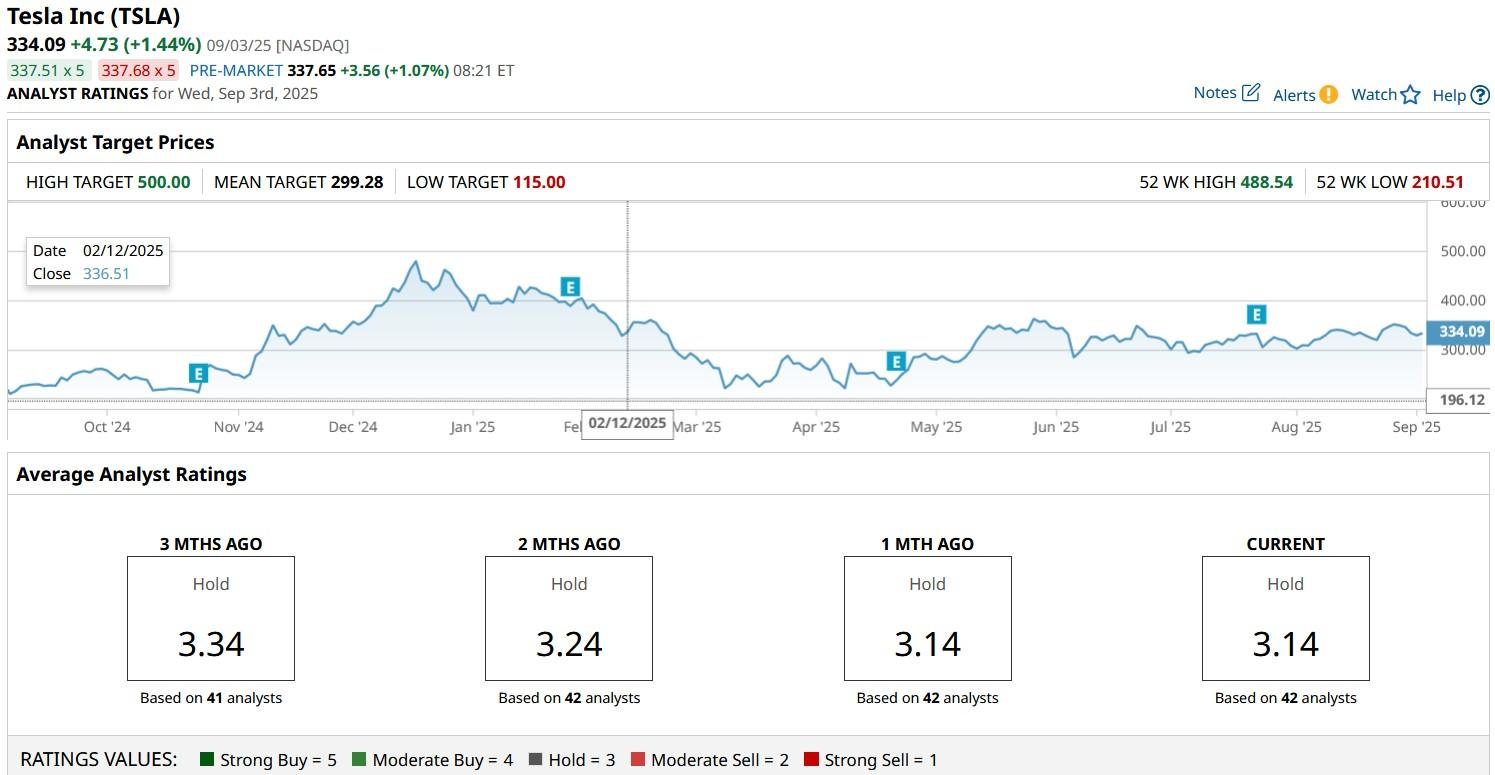

Tesla stock has been a volatile investment in 2025. Versus its April low, the EV stock is up roughly 56% at the time of writing – but it is still down over 20% versus its year-to-date high set in mid-January.

Slowing EV Sales to Hurt Tesla Stock

According to Karl Brauer, the elimination of federal tax credits could see the share of EVs in overall U.S. vehicle sales crash to around 4% only heading into 2026.

This could prove catastrophic for TSLA stock given the company is already grappling with a demand problem in Europe and, more recently, in India.

Recent reports confirm its EU sales were down 40% on a year-over-year basis in July while the company has received orders for just 600 cars in well over a month in India.

Naturally, therefore, if rollback of incentives under President Donald Trump results in a material hit to TSLA sales in the U.S. as well, the EV stock may reverse gains it has accumulated since April.

Could Optimus Initiative Help TSLA Shares?

Billionaire Elon Musk isn’t particularly concerned about Tesla’s sales slump. According to him, as much as 80% of the company’s future value will come from Optimus humanoid robots.

In a recent social media post, TSLA’s chief executive even said the automaker’s Optimus initiative could soar its market cap to about $25 trillion over the long term.

The automotive and clean energy firm is committed to producing some 5,000 Optimus robots this year. If its AI offerings do scale as quickly as Musk hopes, Tesla shares could indeed prove a great investment in the coming years.

Wall Street Recommends Caution on Tesla Shares

Investors should note, however, that Wall Street analysts do not share Musk’s optimism on artificial intelligence initiatives and what they might mean for Tesla stock.

The consensus rating on TSLA shares currently sits at “Hold” only with the mean target of roughly $300 indicating potential downside of more than 10% from here.