/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

Mizuho Securities is betting big on Micron Technology (MU) ahead of the memory chipmaker's Sept. 23 earnings report. The investment firm raised its price target on MU stock from $155 to $182 while maintaining an "Outperform" rating.

The bullish thesis centers on accelerating demand for High Bandwidth Memory (HBM), which includes the advanced HBM3e technology that powers artificial intelligence (AI) applications.

Mizuho expects stronger-than-anticipated orders for Nvidia's new GB300 chips, which require sophisticated memory solutions compared to previous generations. It also estimates that 25% of Nvidia's (NVDA) July quarter shipments were GB300 chips versus the older GB200 models, with the GB300 mix potentially exceeding 50% in the October quarter. This shift toward more memory-intensive chips could provide upside to Micron's guidance for the November quarter.

The firm highlighted the improvement in supply-demand dynamics across both DRAM and NAND memory markets as recent capacity cuts by major suppliers have tightened availability, driving memory prices 20-30% higher from current levels.

Micron remains one of only two qualified suppliers for next-generation HBM4 technology, with initial samples already being shipped to customers for a potential launch in late 2026. The analyst upgrade reflects growing confidence in the company's positioning within the AI-driven memory boom.

The Bull Case for Investing in Micron Stock

Micron Technology's impressive third-quarter performance and upward guidance revision demonstrate the memory chipmaker's position in the artificial intelligence revolution. In fiscal Q3, it reported revenue of $11.2 billion, higher than its prior guidance of $10.7 billion. Its gross margins expanded to 44.5%, beating estimates of 42%, showcasing strong execution across its product portfolio.

The standout performance stems from pricing strength rather than volume increases, as Micron benefits from price improvements across all end markets. This pricing power reflects favorable supply-demand dynamics in memory markets, as AI applications drive strong demand for high-performance memory solutions.

Micron's High Bandwidth Memory business is a key driver of future growth, ending fiscal Q3 with an annual run rate of $6 billion. Its HBM3E 12-high products are ramping up faster than previous generations, with 12-high volumes now exceeding those of 8-high shipments. Notably, Micron has already sampled HBM4 to customers and expects to sell out its entire 2026 HBM capacity, including both HBM3E and HBM4 products.

Micron's HBM products deliver 30% lower power consumption than competitors, a key advantage in power-constrained data centers. As the only U.S.-based memory manufacturer, Micron benefits from geopolitical preferences among American customers, supported by its $200 billion domestic investment commitment over the next two decades.

Micron anticipates a fundamental transformation in the memory industry's business model. The upcoming HBM4E generation will feature customized logic dies designed in partnership with specific customers, creating deeper, longer-term relationships similar to ASIC partnerships. This evolution promises higher returns and reduced commodity-like pricing pressures.

Beyond data centers, artificial intelligence is beginning to proliferate to edge devices, with smartphones requiring increased memory capacity for on-device AI processing. Micron expects this trend to drive substantial demand growth over the next 24 months as smartphone manufacturers upgrade average DRAM capacity from 8 GB to 12 GB.

The company's strong balance sheet, with record liquidity of $15.7 billion and minimal net leverage, provides flexibility for continued technology leadership investments while returning capital to shareholders through dividends and opportunistic share repurchases.

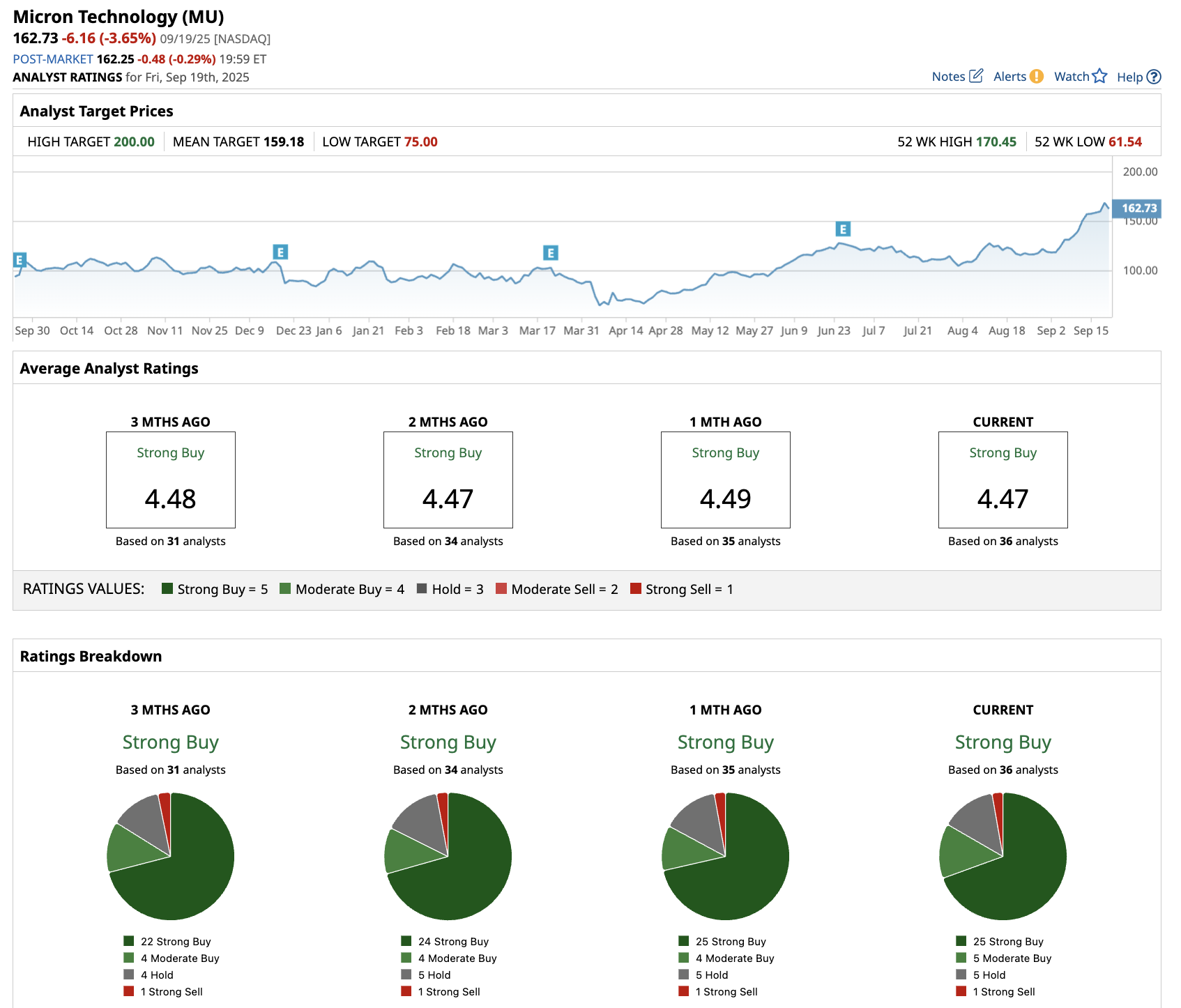

What Is the Price Target for MU Stock?

Analysts tracking Micron forecast revenue to rise from $25 billion in fiscal 2024 (ended in August) to $54 billion in fiscal 2027. In this period, adjusted earnings per share are expected to expand from $1.30 to $15.56.

MU stock is priced at 13.2 times forward earnings, above its 12-month average of 11.3 times. If MU stock is priced at 15 times earnings, it should trade around $233 in early 2027, indicating an upside potential of 43% from current levels.

Out of the 36 analysts covering MU stock, 25 recommend “Strong Buy,” five recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average MU stock price target is $159, below the current price of about $163.