The central role of rare earth minerals in the U.S.-China trade war has prompted investors to look for ways to capitalize on the ongoing conflict. These materials are primarily used in magnets vital for electric vehicles (EVs), wind turbines, fighter jets, and numerous other advanced technologies. As China—the dominant global producer of rare earth elements—tightens control over its exports, the U.S. government has begun prioritizing the development of secure, domestic supply chains.

Against this backdrop, one little-known U.S. coal producer, Ramaco Resources (METC), is emerging as an unexpected contender in the critical minerals space. That’s because the company is also developing its Brook Mine in Wyoming, which contains substantial deposits of heavy rare earth elements and other critical minerals. Ramaco’s expansion into this high-value sector could unlock a new phase of growth—and Wall Street is beginning to take notice.

Baird recently initiated coverage of the stock with a bullish view and a Street-high price target. Analyst Ben Kallo described Ramaco’s Brook Mine project as “the next frontier for METC and potentially for the U.S. rare earth economy.” With that, let’s take a closer look at Baird’s bullish thesis, the company’s fundamentals, and whether it truly deserves its newfound spotlight.

About Ramaco Resources Stock

With a market cap of $2.48 billion, Ramaco Resources primarily engages in the development, operation, and sale of metallurgical coal, with an emphasis on high-quality, low-cost production. The company operates multiple mining complexes, including Elk Creek, Berwind, Knox Creek, and Maben, located across southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. Beyond its coal operations, Ramaco is developing the Brook Mine in northeastern Wyoming, covering roughly 16,000 acres. The site is important for its potential deposits of rare earth elements (REEs) and other critical minerals. The Brook Mine is expected to produce REEs such as neodymium and praseodymium without generating radioactive waste, supporting U.S. efforts to strengthen critical mineral supply chains.

Shares of the coal and rare earth minerals producer have spiked 283% on a year-to-date (YTD) basis. The rally was primarily driven by the company’s strategic expansion into REE and critical minerals after discovering that its Brook Mine asset in Wyoming contains a significant deposit of these materials. This shift has garnered investor attention, especially as China, a dominant player in the REE market, continues to tighten export restrictions.

Baird Views Ramaco as Potential Winner in Rare Earth Economy

Last Wednesday, Baird analyst Ben Kallo initiated coverage of METC stock with a “Buy” rating and price target of $63. Kallo’s price target is the highest on Wall Street, underscoring his view that the company is well-positioned to capitalize on the U.S. expansion of domestic rare earths production capacity.

Kallo wrote in a note, “Every indication we have received from third-party media outlets and company checks leads us to believe that more critical mineral deals between the U.S. and developers are near.” He believes Ramaco will likely receive some form of government support, given its substantial heavy REE deposits and China’s tight control over this part of the supply chain. The analyst noted that government support could range from assistance with expedited permitting to more direct involvement, such as taking a stake in the company—something we’ve already seen multiple times.

The analyst described Ramaco’s Brook Mine as “the next frontier for METC and potentially for the U.S. rare earth economy.” He also pointed out that the mine is fully permitted at both the state and federal levels for an initial production capacity of 1,200 tons of REEs and 2 million tons of coal, while management plans to pursue a permit amendment to increase output to 3,400 tons of REEs and 5 million tons of coal.

Kallo values Ramaco at 13 times the $444 million in earnings before interest, taxes, depreciation, and amortization he anticipates the company will generate in 2030. “It will take several years for Ramaco Resources to ramp operations at the Brook Mine, and 2030 will likely be the first year of smooth, full run-rate production,” the analyst wrote.

Meanwhile, Baird’s optimism was shared by several other Wall Street firms, including Texas Capital, Lucid Capital, and Northland, all of which recently initiated coverage on METC stock with bullish ratings.

METC’s Financials

On July 31, Ramaco Resources reported its financial results for the second quarter of fiscal 2025. The company’s revenue fell 1.5% year-over-year (YoY) to $153 million but still exceeded Wall Street estimates by $21.45 million. The decline was primarily due to the negative impact of pricing, partially offset by an 18% YoY increase in tons sold, which stood at over 1 million. Notably, the increase in tons sold was driven by gains in both the North American and export markets, which grew by 29% and 13% YoY, respectively. And the company reached a record level of quarterly production for the second straight quarter. This demonstrates the company’s ability to maintain record extraction levels and cost discipline, even amid pricing pressures.

With that, let’s turn to the company’s cost base, which remains highly competitive. In Q2, non-GAAP cash cost per ton sold was $103, down from a year earlier, keeping Ramaco within the first quartile of the U.S. cash cost curve. Notably, excluding the now-idled Eagle mine, cash cost per ton sold would have been $101. So, this figure indicates that the company can continue its operations in conditions where many competitors would be forced to halt.

Still, things didn’t look as good on the profitability front. GAAP EPS came in at a loss of $0.29 in Q2, compared to a loss of $0.19 in Q1. The bottom line figure also missed expectations by $0.09. Its second-quarter adjusted EBITDA was $9 million compared to $10 million in Q1.

Meanwhile, METC maintains a clean balance sheet, with over $87 million in liquidity and minimal debt. In August, Ramaco strengthened its balance sheet with a $150 million public stock offering, with proceeds intended for the Brook project, strategic growth, and other corporate objectives.

Management boosted its full-year SG&A guidance from $36-$40 million to $39-$43 million, primarily to support the commercialization of Brook’s REE project. Also, management said that full-year production is likely to land at the lower end of the prior 3.9-4.3 million ton guidance range, as the company opted to reduce selective production amid challenging market conditions.

To sum up, the company’s metallurgical coal operations remain in the first quartile of the U.S. cost curve. Combined with its liquidity and solid balance sheet, Ramaco is well-positioned to weather any near-term weakness in the coal market while advancing the development of its rare earth and critical minerals business.

What Do Analysts Expect for METC Stock?

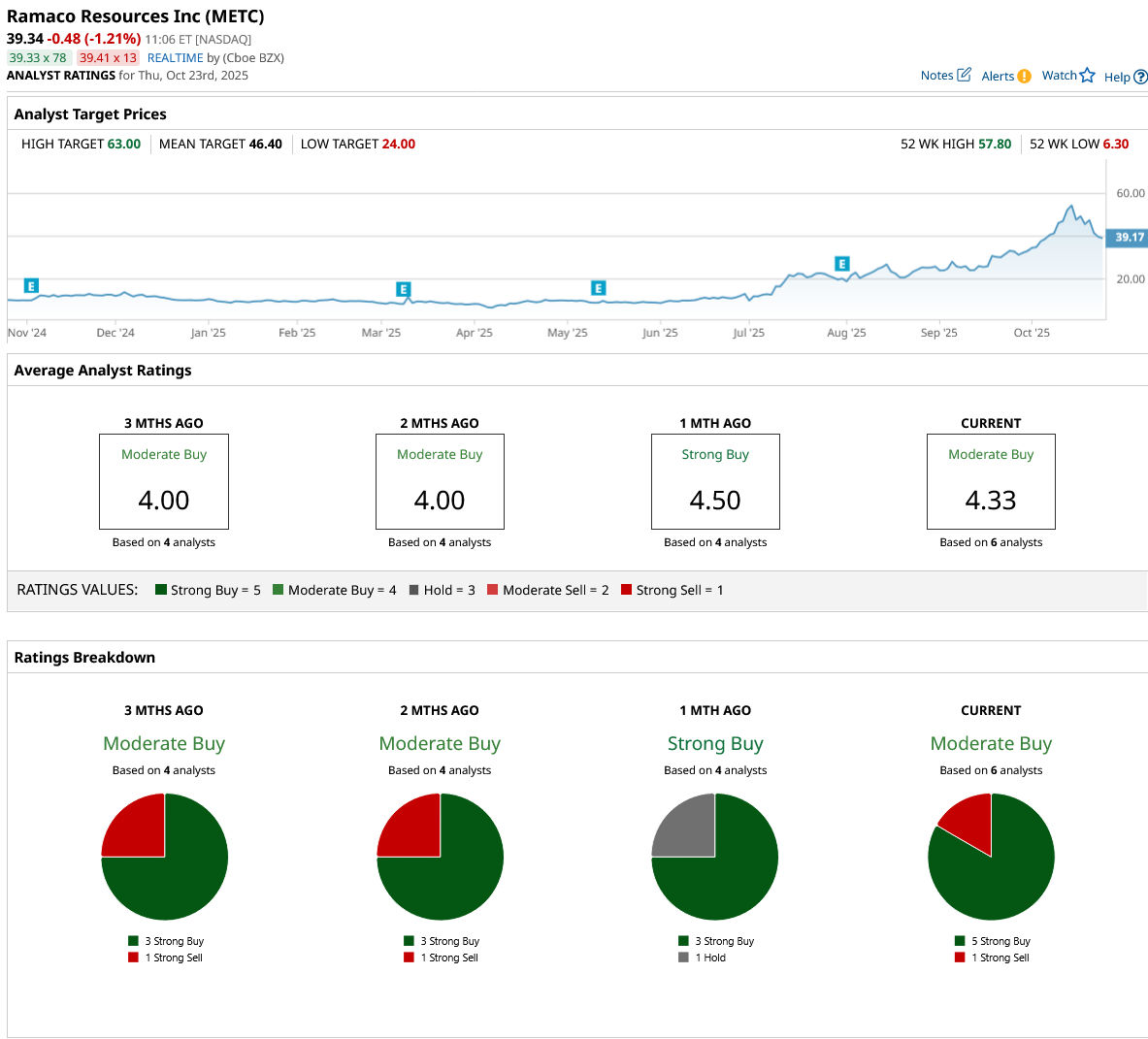

Wall Street analysts have a consensus rating of “Moderate Buy” on METC stock. Of the six analysts covering the stock, five rate it a “Strong Buy,” while one assigns a “Strong Sell” rating. Following a recent pullback from its all-time high, likely driven by profit-taking, METC stock is now trading below its average price target of $46.40. Notably, the stock offers a 60% upside potential to the Street-high price target of $63 (set by Baird analyst Ben Kallo).

Analysts expect the company’s net loss to be $0.97 per share in fiscal 2025. Meanwhile, its full-year revenue is estimated to drop 12.72% YoY to $581.57 million. Since these projections are related to the company’s metallurgical coal operations, investors are paying them little attention, with all eyes on the Brook project.