/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) is back in the headlines after unveiling lower-cost versions of its best-selling Model Y and Model 3 vehicles. The move arrives at a critical time for the EV leader, as the expiration of federal tax credits and rising competition from legacy automakers and Chinese manufacturers pressure affordability across the industry.

Wall Street analysts had mixed reactions, some applauding the pricing pivot as a bold demand stimulant, others warning it highlights Tesla’s narrowing margin buffer. Still, the consensus is that Tesla’s long-term edge in software and autonomy remains intact, with the price adjustments positioning the company for sustained delivery growth in 2026 and beyond.

About Tesla

Tesla, based in Austin, Texas, designs electric vehicles (EVs), solar power systems, and energy storage solutions. Tesla is still the most valuable automaker globally, worth nearly $1.5 trillion, worth all the combined stock of Toyota (TM), Honda (HMC), GM (GM), Ford (F), Nissan (NSANY), and Stellantis (STLA).

Tesla's shares have fluctuated between $212.11 and $488.54 during the last 52 weeks, currently exchanging hands around $427, up ~5% year-to-date. TSLA stock has pulled back around 5% this week on the news of the updated pricing.

The stock is valued at very high valuation multiples, including a trailing price-earnings ratio of 243 times and a forward multiple around 357—much higher compared to the auto industry average around 8-10x. The price-to-sales (P/S) ratio of 14.9× and price-to-book (P/B) ratio of 18.1x reflect enormous growth and AI optionality premium. TSLA stock, despite single-digit margin figures (7.3%) and return on equity below 8%, still sells an “AI story” multiple with very little room for execution error.

Tesla doesn't distribute any dividend, and management has also made an indication that surpluses will still be invested in Gigafactory expansions and AI-based initiatives like Optimus and Full Self-Driving (FSD).

Tesla Outperforms on Deliveries but Is Haunted by Prices

In Q3 2025, Tesla made 447,450 cars and handed over 497,099—both records. Deliveries increased ~4% sequentially and benefited from enhanced logistics and Model Y production efficiency. Deployments of energy storage reached 12.5 GWh, also a first-time, reflecting Tesla’s expanding role in the grid-scale battery system.

In the future, commentators expect Tesla to get back on track with a ~500K quarterly delivery pace by 2026 despite the end of the U.S. EV tax credits putting a squeeze on affordability. To maintain demand, Tesla reduced the price of the Model Y by 11% to $40K alongside the Model 3 to $37K from $39K.

Deepwater Asset Management’s Gene Munster labeled the cut “bravo,” arguing that the action puts them closer to achieving the 16% delivery growth goal for 2026 among the Street. Wedbush’s Dan Ives took the cut as “the first stride toward the rekindling EV demand,” though he added that the $5K price cut was less aggressive than bulls desired. Wedbush still sets the “Outperform” rating, however, given Tesla’s “incredible AI valuation story.”Futurum Equities' Shay Boloor referred to the pricing move as "a lever pull, not a catalyst" and cautioned it may not release mass-market demand. Camelthorn Investments' Shawn Campbell said the under-$30K Chinese EV threat still had the potential to take market share from Tesla globally.

Consensus estimates for EPS suggest around even profitability in 2025 as declining average selling price headwinds dampen cost benefits from manufacturing efficiency and platform integration.

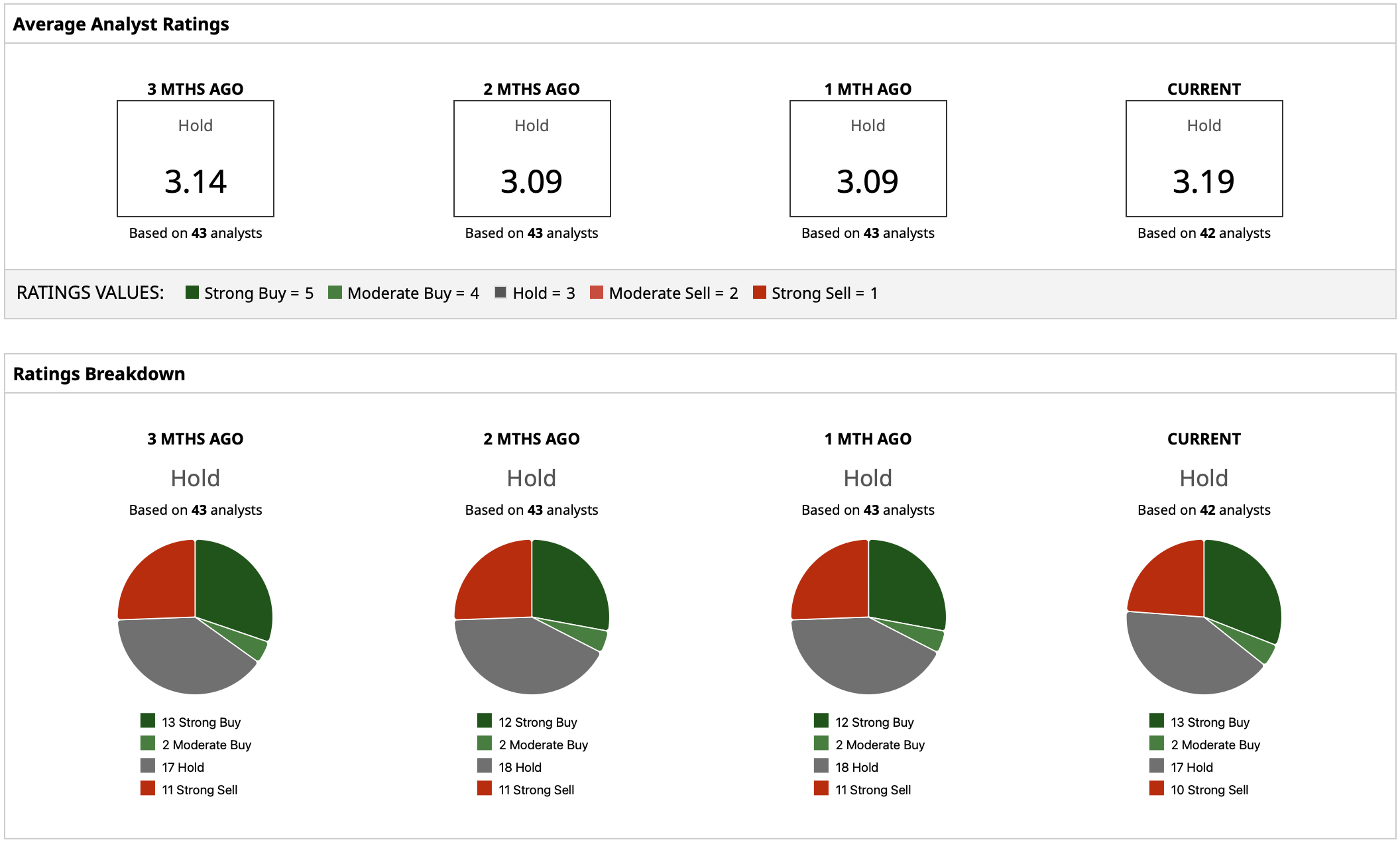

What Analysts Say About TSLA Stock?

TSLA has a “Hold” rating consensus and an average price target of $345, a potential downside of ~19% from current levels, reflecting valuation issues even from bullish analysts. Prices vary considerably—from $120 on the low end to $600 on the high end, reflecting disagreement over how to price Tesla's combination of automotive and AI optionalities.