/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

After a strong rally earlier this year, Advanced Micro Devices (AMD) stock pulled back slightly, sliding more than 12% from its recent peak of $186.65. The dip comes as the chipmaker takes a financial hit from U.S. export restrictions to China, which impacted its financials during the second quarter.

In its latest earnings report, AMD disclosed a year-over-year decline in artificial intelligence (AI) revenue within its data center segment. Management stated that the setback originated from the loss of MI308 accelerator sales to China due to export restrictions, as well as the company’s ongoing transition to its next-generation MI350 series accelerators. While the revenue dip grabbed headlines, AMD announced that this was more of a temporary speed bump than a long-term issue.

Looking ahead, the outlook appears far more encouraging. The ramp of the Instinct MI350 series is expected to accelerate AMD’s AI-related sales, giving its data center business a meaningful boost. Meanwhile, the company continues to benefit from robust demand for its EPYC and Ryzen processors.

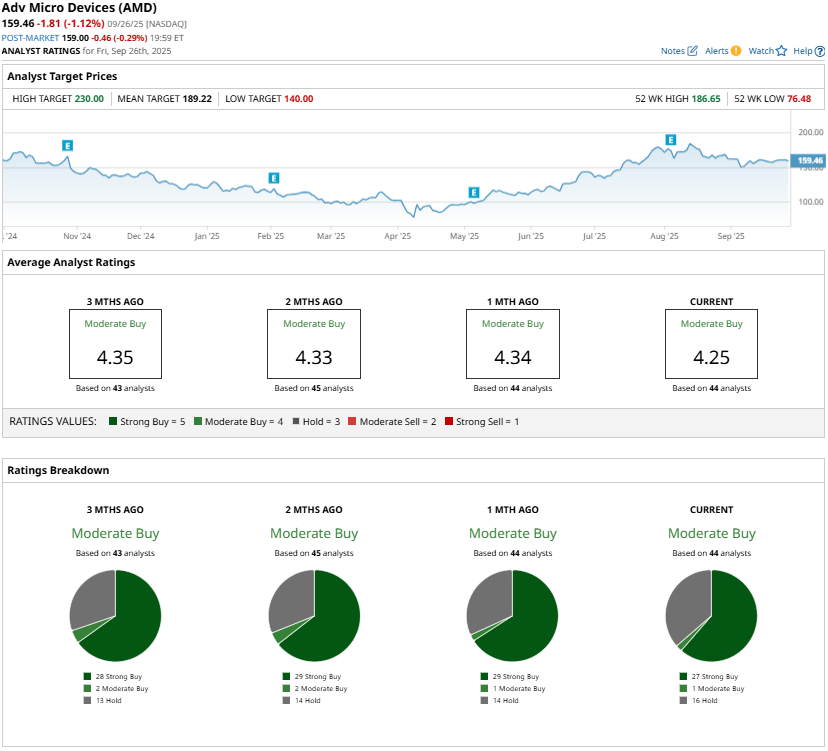

Analysts acknowledge the near-term challenges and maintain a cautiously optimistic outlook. However, they see significant upside in AMD stock as the company executes on its AI roadmap and capitalizes on broader demand in its core businesses. The highest price target for AMD stock is $230, reflecting 40% upside from current price levels.

AMD Stock’s Growth Drivers

AMD has several growth drivers that will accelerate its top-line growth in the coming quarters. It is seeing strong momentum across its server and PC processors, and is poised to capitalize on the AI-driven demand.

AMD’s EPYC server processor portfolio has gained traction among cloud providers, enterprises, and telecom operators. The company has seen adoption expand across the large hyperscalers, who are increasingly deploying EPYC chips to power critical infrastructure, cloud services, and public offerings.

In the enterprise space, AMD has secured sizable deals with companies in aerospace, financial services, streaming, retail, and energy. Telecom operators are also turning to EPYC to modernize their networks, further broadening its reach. Importantly, enterprise deployments have grown significantly from the prior quarter, with wins spanning technology, automotive, manufacturing, and public sector clients.

A key driver of this expansion is the role of CPUs in supporting emerging AI workloads. As enterprises adopt agentic AI applications, demand for compute infrastructure has risen sharply. Management remains bullish that this trend, coupled with sustained share gains and increasing investments in cloud and on-premises computing, will support durable growth for AMD’s server CPU business.

AMD is also gaining ground in the AI accelerator market with its Instinct product line. The company’s MI300 and MI325 chips gained further traction in the most recent quarter, with adoption expanding among Tier 1 customers, next-generation AI cloud providers, and end users. The recent launch of the MI350 series has seen interest from hyperscalers, AI firms, and OEMs. Importantly, AMD began volume production of the MI350 ahead of schedule, setting up for a significant production ramp in the second half of the year to support large-scale deployments.

Beyond commercial clients, AMD is also benefiting from growing government interest in building sovereign AI infrastructure. The company’s sovereign AI initiatives gained momentum in the quarter, with solid demand for its CPUs, GPUs, and software to power national AI strategies.

Overall, AMD’s strong positioning in high-performance CPUs, rapid advances in AI accelerators, and increasing role in both commercial and sovereign AI infrastructure position it well to deliver significant growth in the coming quarters.

The Bottom Line

AMD is witnessing strong demand across its product portfolio. The company expects significant momentum in the second half of the year, driven by the rapid adoption of its MI350 series accelerators alongside continued strength in EPYC and Ryzen processors. Both server and PC CPU businesses are accelerating as enterprises seek high-performance computing solutions. Its embedded-in-gaming divisions are returning to growth, supported by strong design wins. In AI, the adoption of the MI350 series and ROCm 7 platform is expanding across cloud and enterprise customers, offering a solid platform to scale AI revenues into the tens of billions of dollars annually. Looking further ahead, AMD’s next-generation MI400 series promises another leap forward, already drawing strong customer interest for 2026 deployments. With these growth drivers, AMD’s stock could see meaningful upside.