XRP (CRYPTO: XRP) is down 2% on Tuesday as filings for spot XRP exchange-traded funds gained traction, while technical charts pointed to a decisive breakout setup.

Wall Street ETF Filings Put XRP Back In The Spotlight

Seven XRP ETF filings are currently under SEC review, placing it just behind Solana's (CRYPTO: SOL) eight.

Applicants include established names such as WisdomTree, Grayscale, Franklin, and Canary Capital, along with newer issuers experimenting with derivative-based and yield-focused strategies according to Cointelegraph.

The range of filings spans from simple spot ETFs to leveraged and short products, with proposed assets under management ranging from millions to over $100 billion.

XRP Consolidates In Symmetrical Triangle

XRP Key Technical Levels (Source: TradingView)

Technical analysis: On the daily chart, XRP is compressing inside a symmetrical triangle with higher lows and lower highs.

Resistance is stacked at $2.91–$2.92 where the 20- and 50-day EMAs converge, while support is anchored near $2.83. The 200-day EMA remains supportive at $2.61, keeping the broader uptrend intact.

A sustained break above $2.92 could target $3.15 and $3.30, while a failure to defend $2.83 risks exposing deeper support at $2.61.

Derivatives Show Defensive Bias

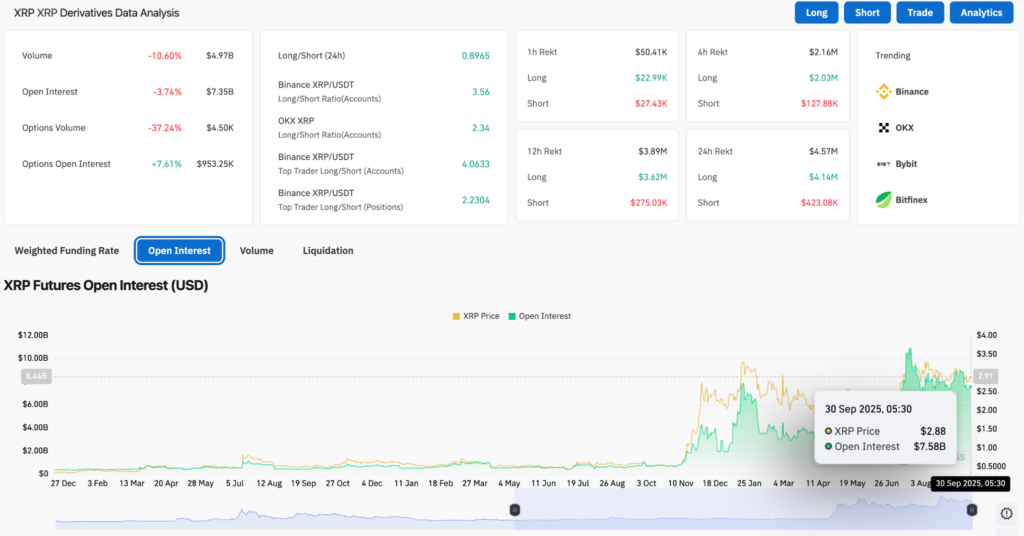

XRP Derivative Analysis (Source: Coinglass)

Futures open interest fell 3.7% to $7.35 billion, and options volume dropped 37%, showing reduced speculative activity.

Options open interest, however, rose 7.6% to nearly $1 billion, highlighting hedging demand.

Binance's top traders held long/short ratios above 4, reflecting a directional lean toward the upside despite lighter leverage.

Whale Outflows Signal Silent Accumulation Of XRP

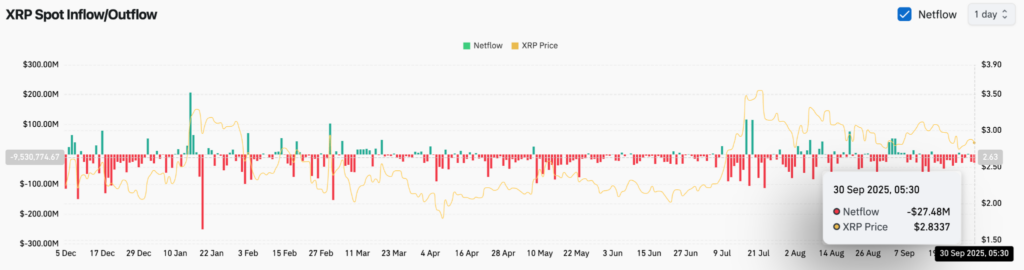

XRP Netflows (Source: Coinglass)

Netflows on Sept. 30 showed $27.5 million in outflows, part of a broader pattern of coins leaving exchanges through September.

Such flows typically reduce near-term liquidity but historically precede medium-term rallies if broader risk appetite stabilizes.

Why It Matters

XRP is caught between Wall Street's ETF race and a chart primed for a decisive move.

With seven filings under SEC review, major institutions are signaling growing interest through products that span from spot funds to leveraged strategies.

At the same time, persistent exchange outflows point to accumulation as coins shift away from speculative trading.

This rare overlap of institutional demand and technical compression could set the stage for a breakout towards $10.

Read Next:

Image: Shutterstock