During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

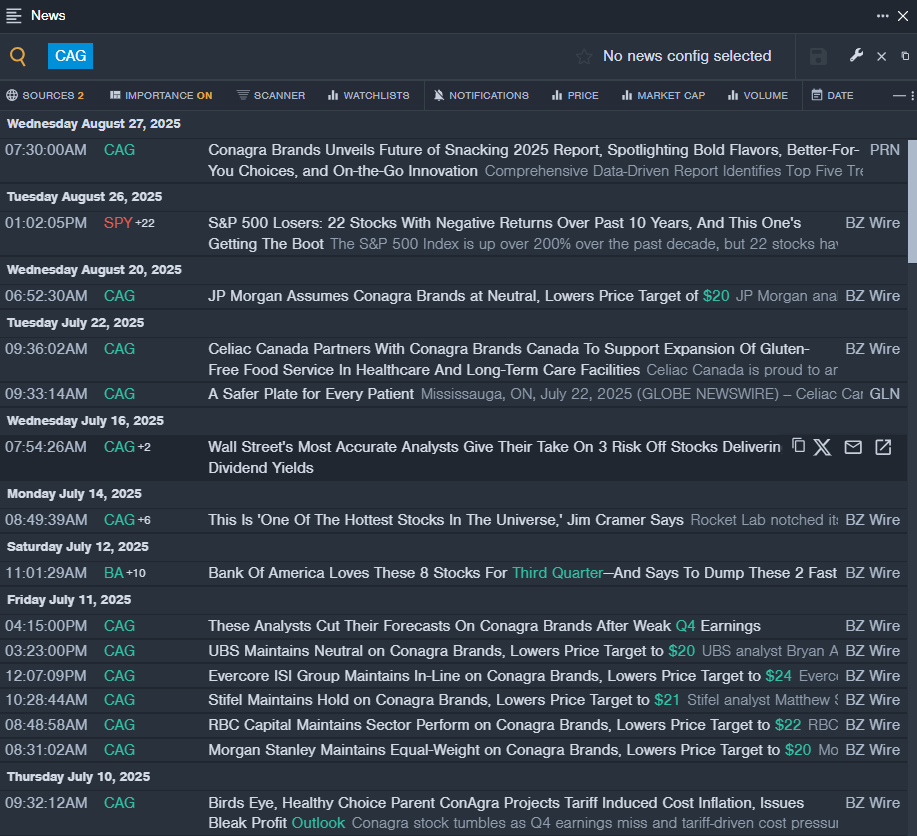

Conagra Brands, Inc. (NYSE:CAG)

- Dividend Yield: 7.45%

- UBS analyst Bryan Adams maintained a Neutral rating and cut the price target from $21 to $20 on July 11, 2025. This analyst has an accuracy rate of 63%.

- Stifel analyst Matthew Smith maintained a Hold rating and lowered the price target from $26 to $21 on July 11, 2025. This analyst has an accuracy rate of 60%.

- Recent News: On July 10, ConAgra Brands reported worse-than-expected quarterly financial results and issued FY26 adjusted EPS guidance below estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest CAG news.

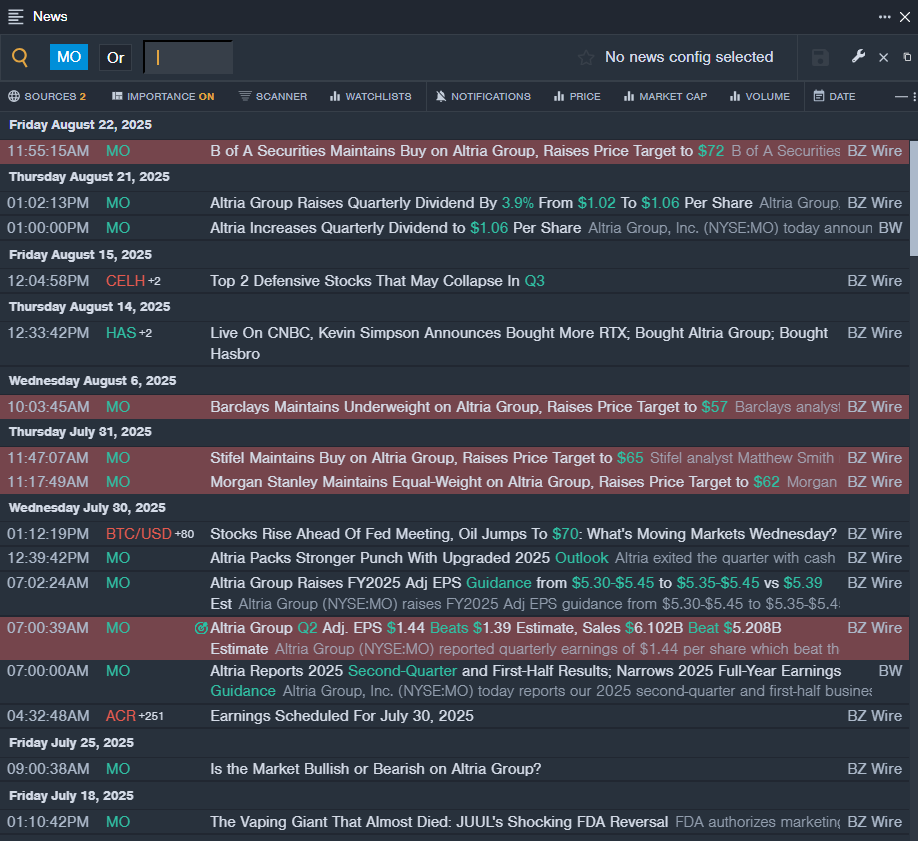

Altria Group, Inc. (NYSE:MO)

- Dividend Yield: 6.38%

- B of A Securities analyst Lisa Lewandowski maintained a Buy rating and raised the price target from $64 to $72 on Aug. 22, 2025. This analyst has an accuracy rate of 64%.

- Stifel analyst Matthew Smithmaintained a Buy rating and increased the price target from $63 to $65 on July 31, 2025. This analyst has an accuracy rate of 60%.

- Recent News: On Aug. 21, Altria Group raised its quarterly dividend by 3.9% from $1.02 to $1.06 per share.

- Benzinga Pro's real-time newsfeed alerted to latest MO news

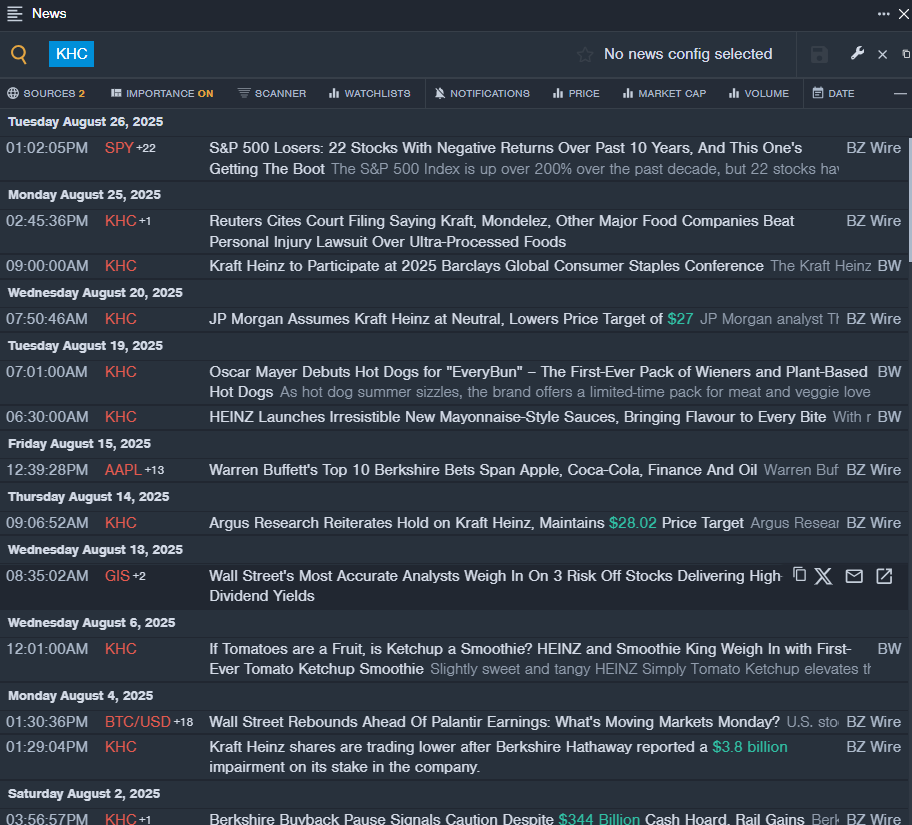

The Kraft Heinz Company (NASDAQ:KHC)

- Dividend Yield: 5.79%

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and raised the price target from $27 to $29 on July 14, 2025. This analyst has an accuracy rate of 60%.

- Mizuho analyst John Baumgartner maintained a Neutral rating and cut the price target from $31 to $29 on May 28, 2025. This analyst has an accuracy rate of 63%.

- Recent News: On Aug. 2, Berkshire Hathaway reported a $3.8 billion impairment on its stake in the company.

- Benzinga Pro’s real-time newsfeed alerted to latest KHC news

Read More:

Photo via Shutterstock