During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

Infosys Ltd (NYSE:INFY)

- Dividend Yield: 3.14%

- BMO Capital analyst Keith Bachman maintained a Market Perform rating and raised the price target from $18 to $20 on July 24, 2025. This analyst has an accuracy rate of 79%.

- Stifel analyst David Grossman maintained a Hold rating and slashed the price target from $18 to $17 on April 21, 2025. This analyst has an accuracy rate of 65%

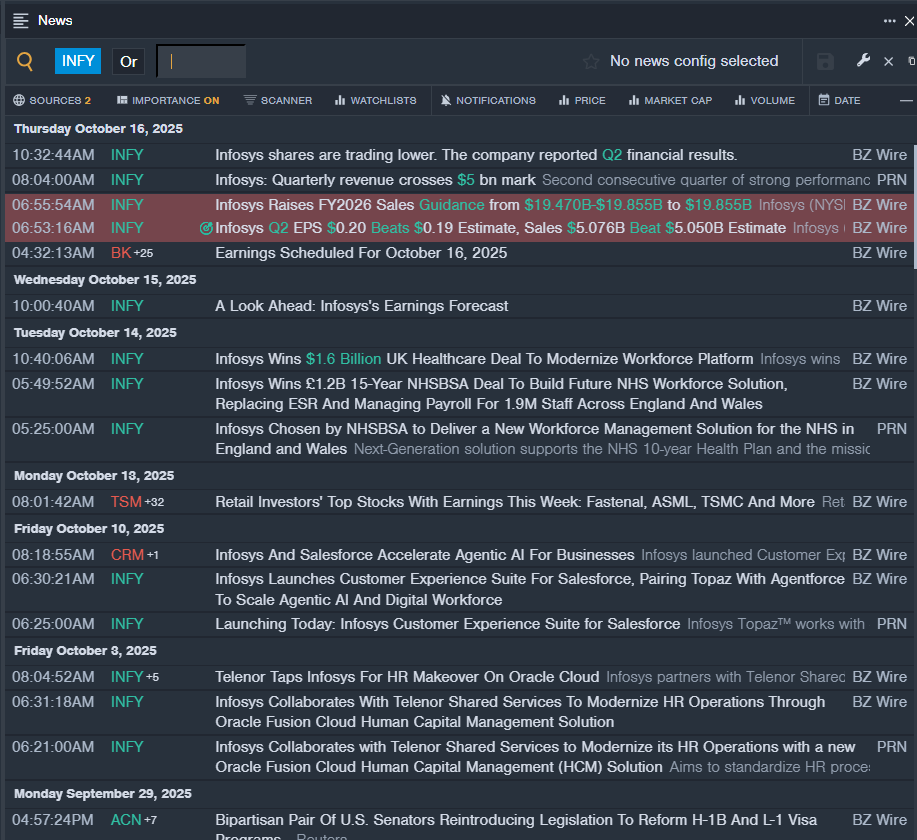

- Recent News: On Oct. 16, Infosys posted better-than-expected quarterly results.

- Benzinga Pro’s real-time newsfeed alerted to latest INFY news.

Texas Instruments Inc (NASDAQ:TXN)

- Dividend Yield: 3.24%

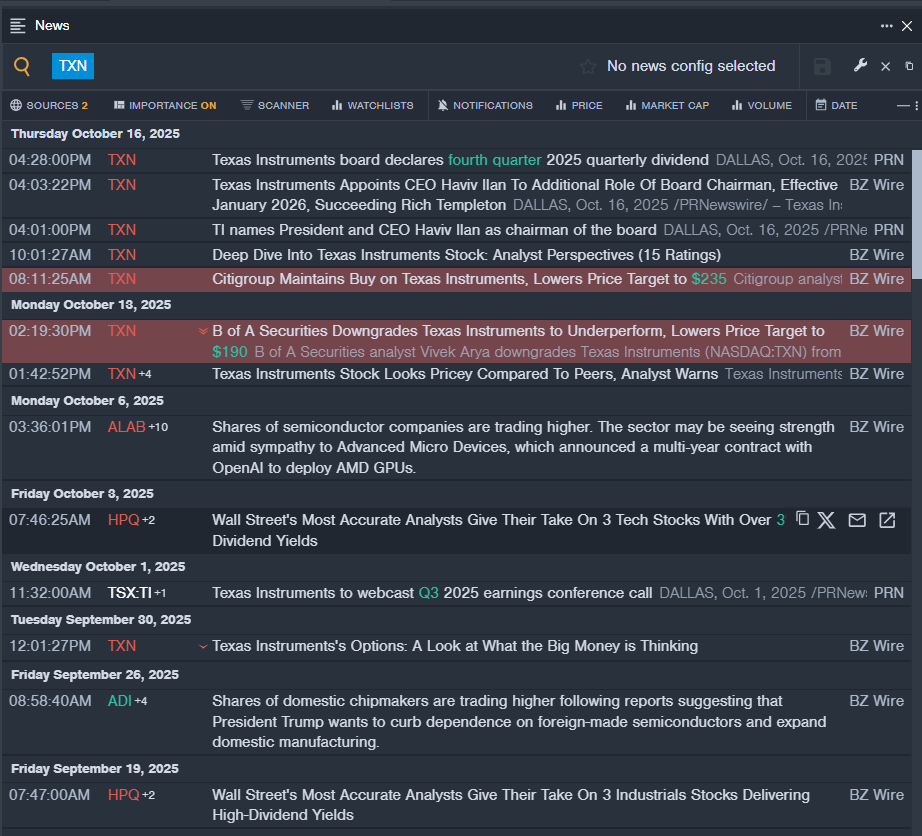

- Citigroup analyst Christopher Danely maintained a Buy rating and cut the price target from $260 to $235 on Oct. 16, 2025. This analyst has an accuracy rate of 80%.

- B of A Securities analyst Vivek Arya downgraded the stock from Neutral to Underperform and cut the price target from $208 to $190 on Oct. 13, 2025. This analyst has an accuracy rate of 82%

- Recent News: On Oct. 16, Texas Instruments named CEO Haviv Ilan to additional role of board chairman, effective Jan. 2026, succeeding Rich Templeton.

- Benzinga Pro's real-time newsfeed alerted to latest TXN news

Skyworks Solutions Inc (NASDAQ:SWKS)

- Dividend Yield: 3.81%

- Citigroup analyst Atif Malik maintained a Sell rating and raised the price target from $63 to $66 on Aug. 6, 2025. This analyst has an accuracy rate of 83%.

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and boosted the price target from $60 to $75 on July 22, 2025. This analyst has an accuracy rate of 77%.

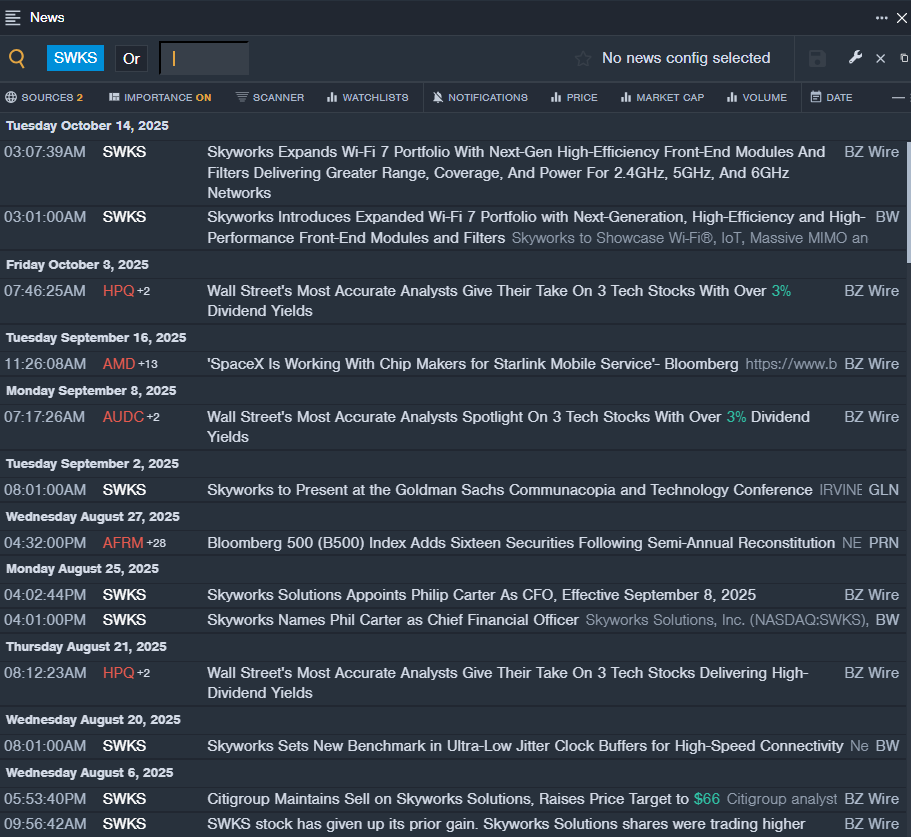

- Recent News: On Aug. 25, Skyworks named Phil Carter as chief financial officer.

- Benzinga Pro’s real-time newsfeed alerted to latest SWKS news

Photo via Shutterstock