During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

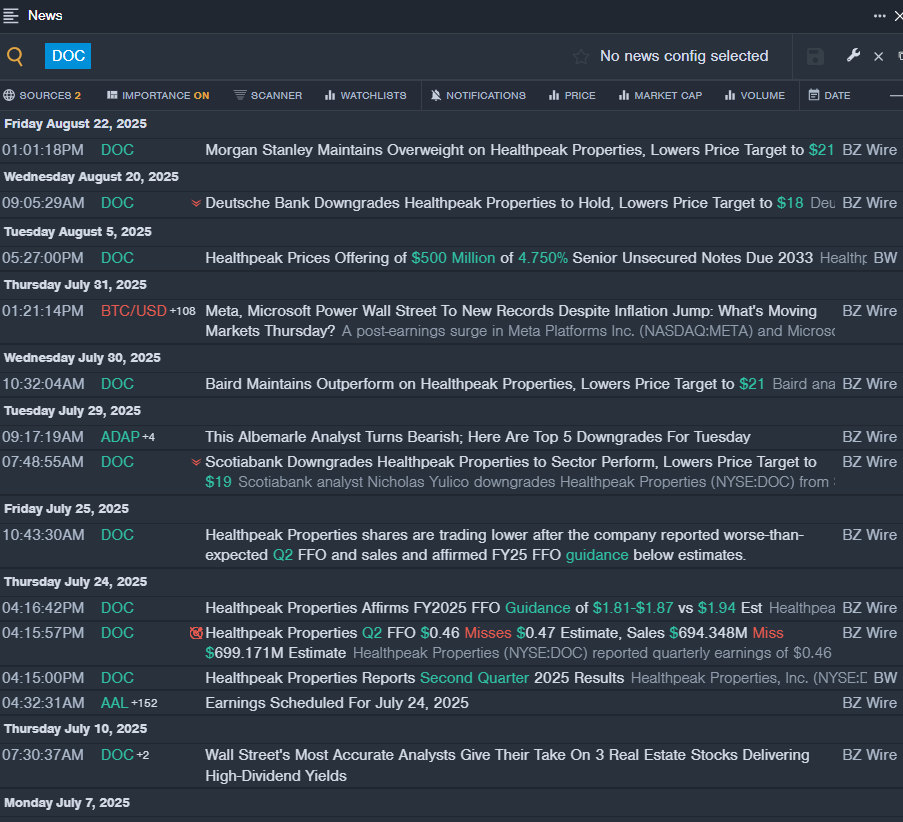

Healthpeak Properties, Inc. (NYSE:DOC)

- Dividend Yield: 6.87%

- Deutsche Bank analyst Omotayo Okusanya downgraded the stock from Buy to Hold and cut the price target from $28 to $18 on Aug. 20, 2025. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Connor Siversky maintained an Equal-Weight rating and cut the price target from $22 to $20 on June 2, 2025. This analyst has an accuracy rate of 68%.

- Recent News: On Aug. 5, Healthpeak priced offering of $500 million of 4.750% senior unsecured notes due 2033.

- Benzinga Pro’s real-time newsfeed alerted to latest DOC news.

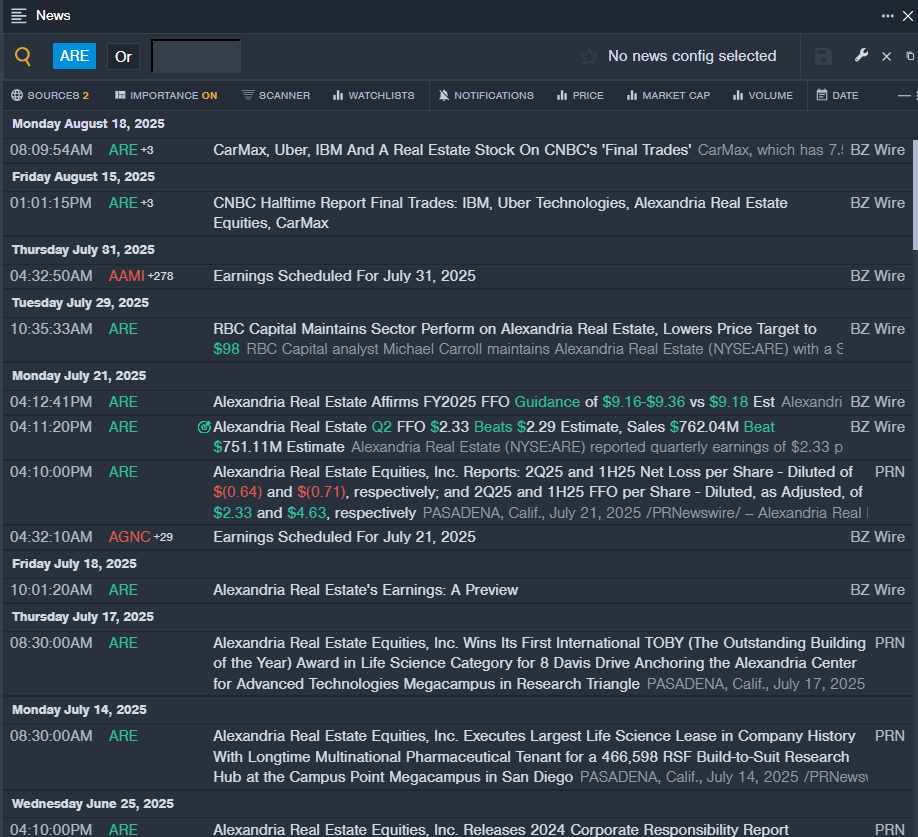

Alexandria Real Estate Equities, Inc. (NYSE:ARE)

- Dividend Yield: 6.52%

- RBC Capital analyst Michael Carroli maintained a Sector Perform rating and lowered the price target from $100 to $98 on July 29, 2025. This analyst has an accuracy rate of 62%.

- JP Morgan analyst Anthony Paolone maintained a Neutral rating and slashed the price target from $117 to $95 on May 20, 2025. This analyst has an accuracy rate of 65%.

- Recent News: On July 21, Alexandria Real Estate posted better-than-expected quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest ARE news

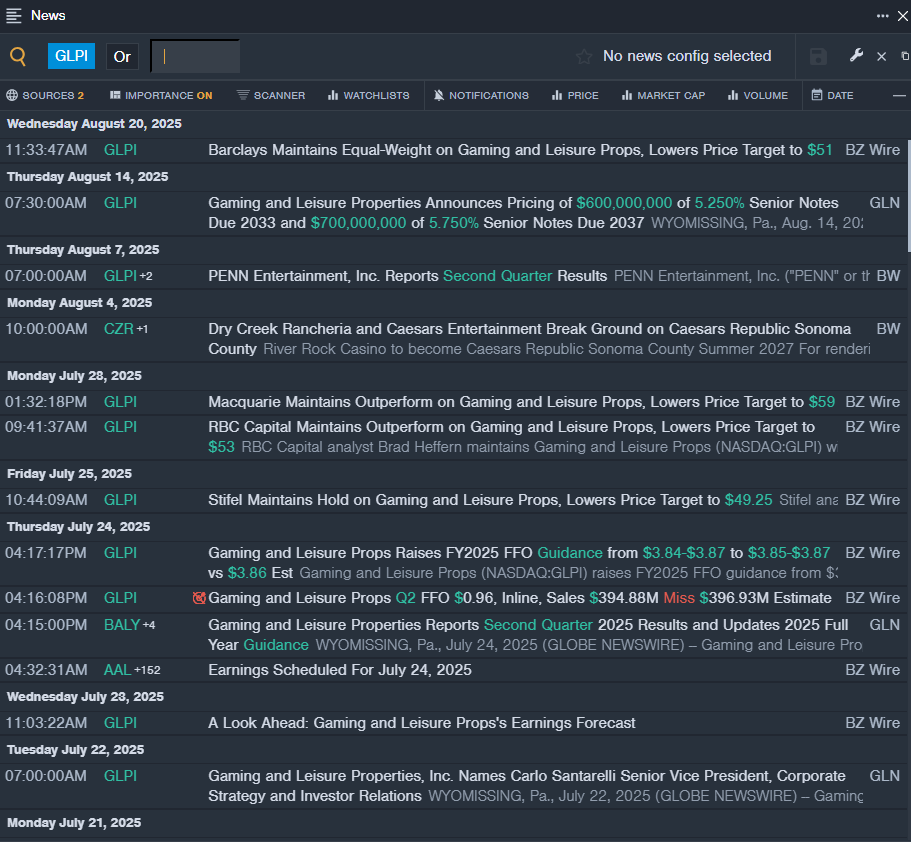

Gaming and Leisure Properties, Inc. (NASDAQ:GLPI)

- Dividend Yield: 6.48%

- Macquarie analyst Chad Beynon maintained an Outperform rating and slashed the price target from $60 to $59 on July 28, 2025. This analyst has an accuracy rate of 62%.

- Stifel analyst Simon Yarmak maintained a Hold rating and cut the price target from $51.25 to $49.25 on July 25, 2025. This analyst has an accuracy rate of 63%.

- Recent News: On Aug. 14, Gaming and Leisure Properties announced the pricing of $600,000,000 of 5.250% senior notes due 2033 and $700,000,000 of 5.750% senior notes due 2037.

- Benzinga Pro’s real-time newsfeed alerted to latest GLPI news

Read More:

Photo via Shutterstock