During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

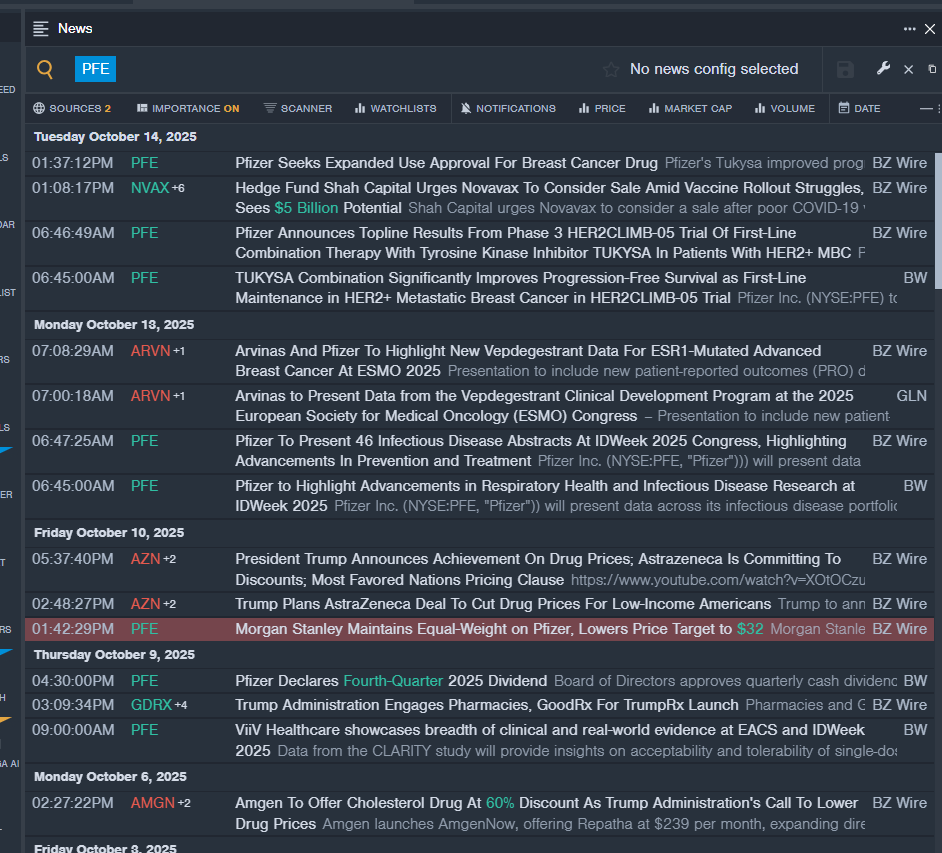

Pfizer Inc (NYSE:PFE)

- Dividend Yield: 7.01%

- B of A Securities analyst Tim Anderson maintained a Neutral rating and raised the price target from $28 to $30 on Oct. 3, 2025. This analyst has an accuracy rate of 75%.

- Citigroup analyst Andrew Baum maintained a Neutral rating and raised the price target from $25 to $26 on Aug. 6, 2025. This analyst has an accuracy rate of 70%

- Recent News: Pfizer on Tuesday announced the initial results from a clinical trial called HER2CLIMB-05.

- Benzinga Pro’s real-time newsfeed alerted to latest PFE news.

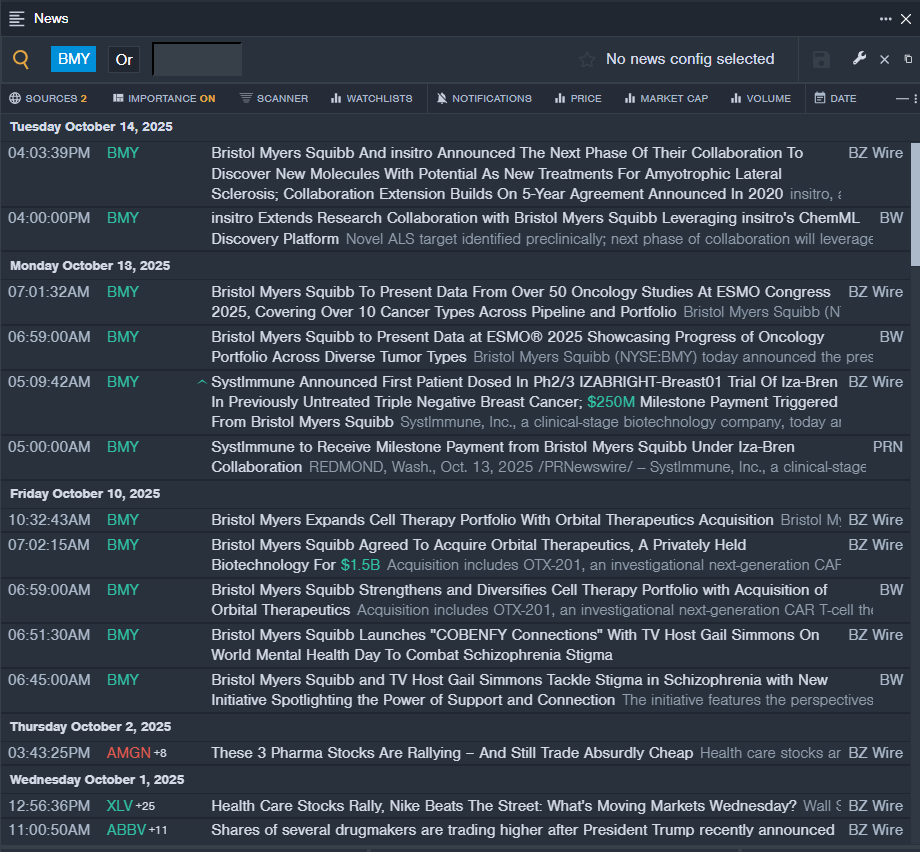

Bristol-Myers Squibb Co (NYSE:BMY)

- Dividend Yield: 5.66%

- Citigroup analyst Andrew Baum maintained a Neutral rating and decreased the price target from $51 to $47 on Aug. 1, 2025. This analyst has an accuracy rate of 70%.

- Morgan Stanley analyst Terence Flynn maintained an Underweight rating and cut the price target from $36 to $34 on July 10, 2025. This analyst has an accuracy rate of 66%

- Recent News: On Oct. 14, Bristol Myers Squibb and insitro announced the next phase of their collaboration to discover new molecules with potential as new treatments for amyotrophic lateral sclerosis.

- Benzinga Pro's real-time newsfeed alerted to latest BMY news

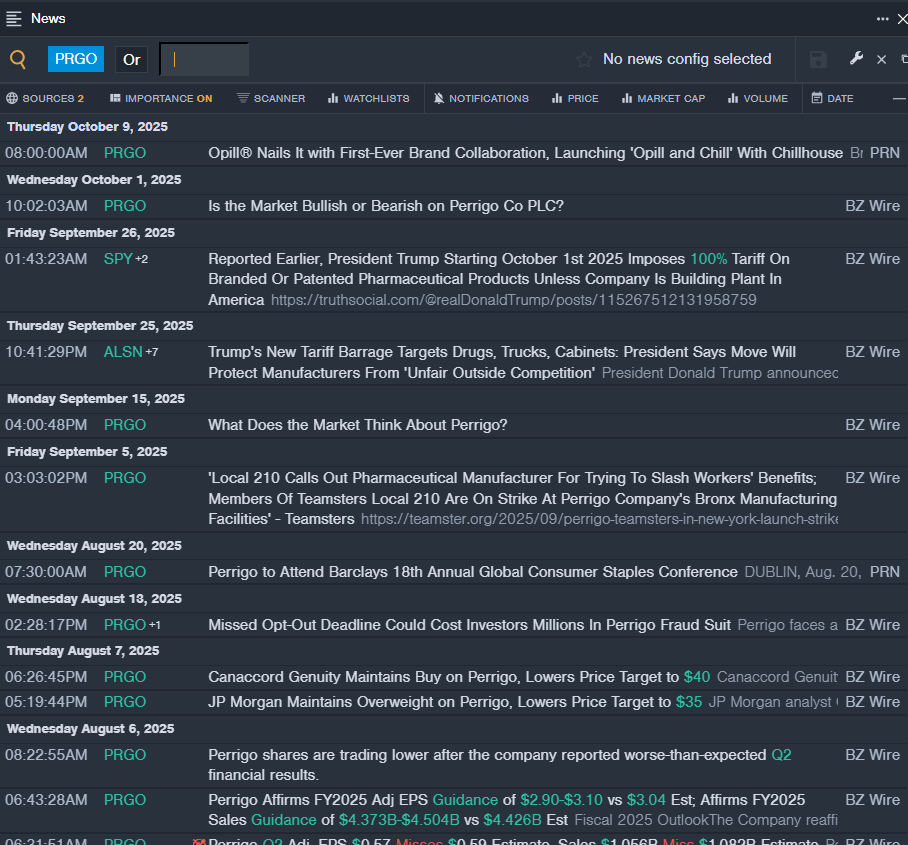

Perrigo Company PLC (NYSE:PRGO)

- Dividend Yield: 5.36%

- Canaccord Genuity analyst Susan Anderson maintained a Buy rating and cut the price target from $42 to $40 on Aug. 7, 2025. This analyst has an accuracy rate of 64%.

- JP Morgan analyst Chris Schott maintained an Overweight rating and slashed the price target from $38 to $35 on Aug. 7, 2025. This analyst has an accuracy rate of 61%.

- Recent News: On Aug. 6, Perrigo reported worse-than-expected second-quarter financial results.

- Benzinga Pro’s real-time newsfeed alerted to latest PRGO news

Photo via Shutterstock