During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

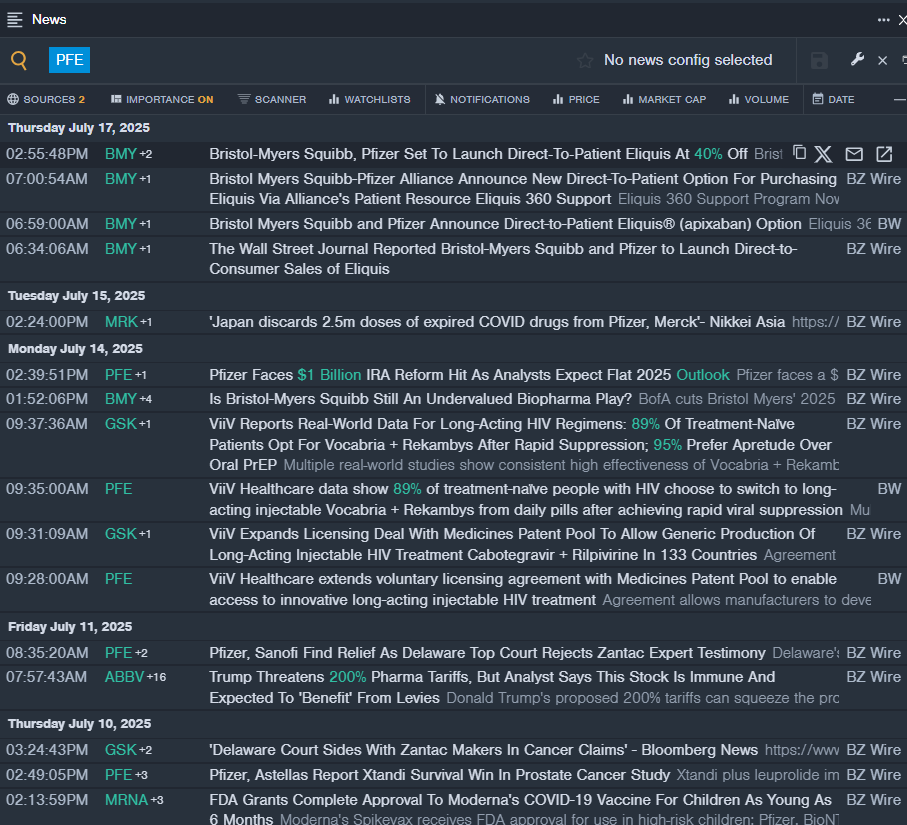

Pfizer Inc. (NYSE:PFE)

- Dividend Yield: 7.03%

- Guggenheim analyst Vamil Divan reiterated a Buy rating on March 18, 2025. This analyst has an accuracy rate of 75%.

- Citigroup analyst Andrew Baum maintained a Neutral rating and slashed the price target from $30 to $29 on Jan. 28, 2025. This analyst has an accuracy rate of 69%.

- Recent News: The Bristol Myers Squibb Co. (NYSE:BMY) and Pfizer alliance announced a new direct-to-patient option for purchasing Eliquis (apixaban) via the alliance's patient resource, Eliquis 360 Support, on July 17.

- Benzinga Pro’s real-time newsfeed alerted to latest PFE news.

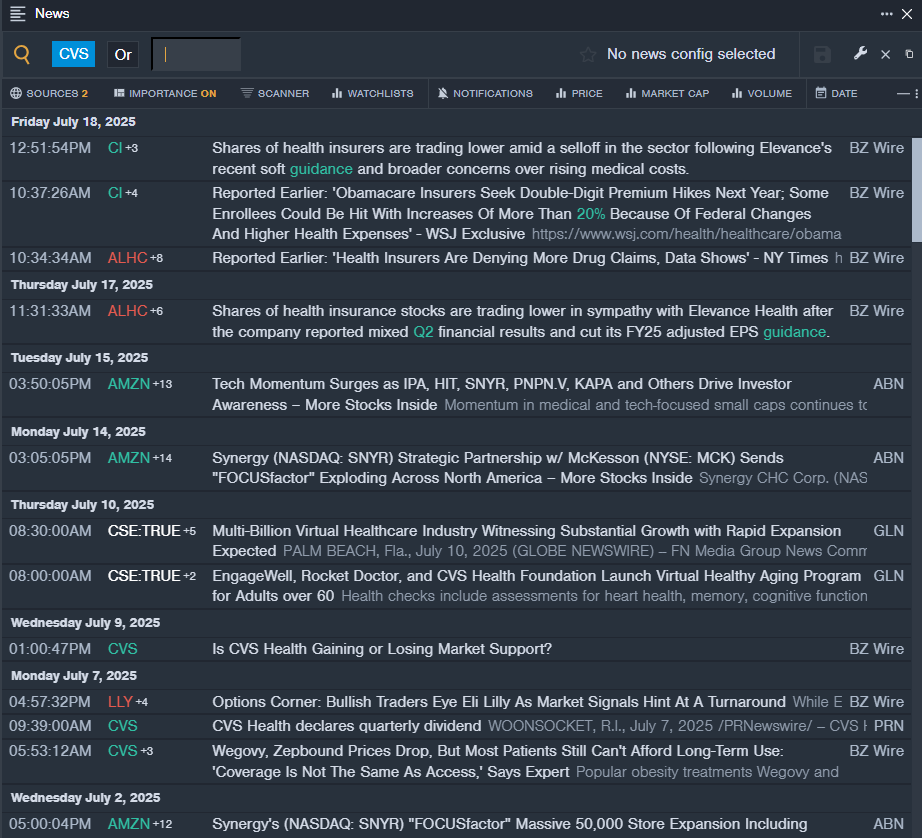

CVS Health Corporation (NYSE:CVS)

- Dividend Yield: 4.29%

- Truist Securities analyst David Macdonald maintained a Buy rating and raised the price target from $82 to $84 on May 12, 2025. This analyst has an accuracy rate of 63%.

- UBS analyst Kevin Caliendo maintained a Neutral rating and raised the price target from $67 to $71 on May 2, 2025. This analyst has an accuracy rate of 71%.

- Recent News: CVS Health will hold a conference call on Thursday, July 31, to discuss second quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest CVS news

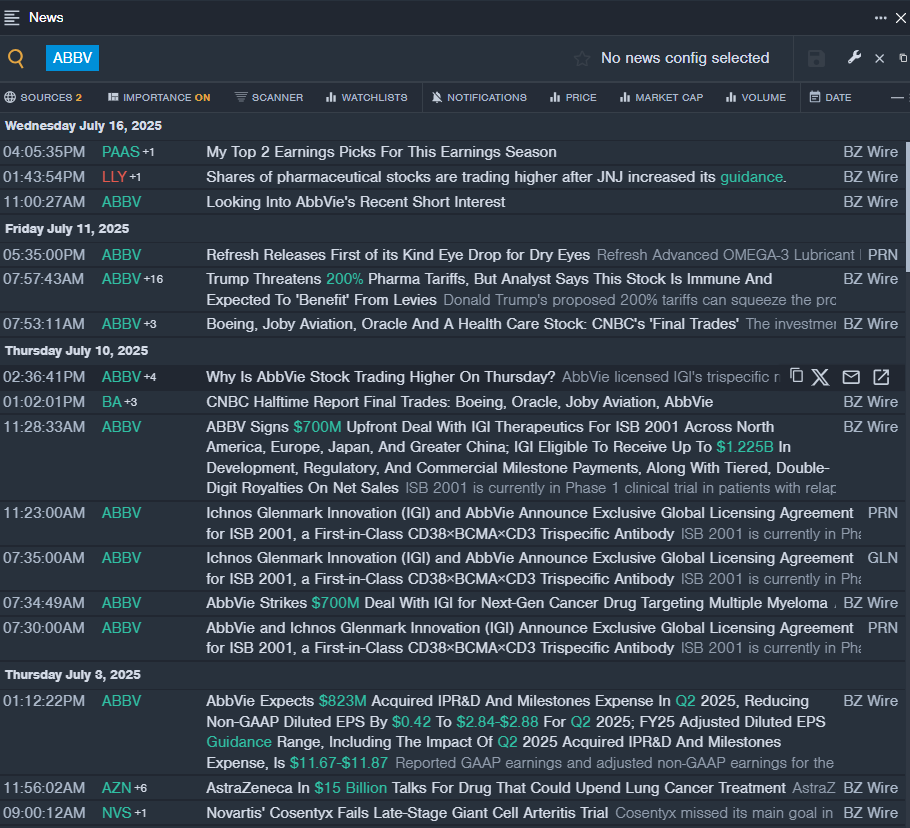

AbbVie Inc. (NYSE:ABBV)

- Dividend Yield: 3.47%

- Citigroup analyst Geoff Meacham downgraded the stock from Buy to Neutral and cut the price target from $210 to $205 on May 14, 2025. This analyst has an accuracy rate of 63%.

- Guggenheim analyst Vamil Divan maintained a Buy rating and increased the price target from $214 to $216 on April 29, 2025. This analyst has an accuracy rate of 75%.

- Recent News: GI Therapeutics SA, a wholly owned subsidiary of New York-based Ichnos Glenmark Innovation Inc., and AbbVie, on July 10, announced an exclusive licensing agreement for IGI's lead investigational asset, ISB 2001, developed using IGI's proprietary BEAT protein platform, for oncology and autoimmune diseases.

- Benzinga Pro’s real-time newsfeed alerted to latest ABBV news

Photo via Shutterstock