During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

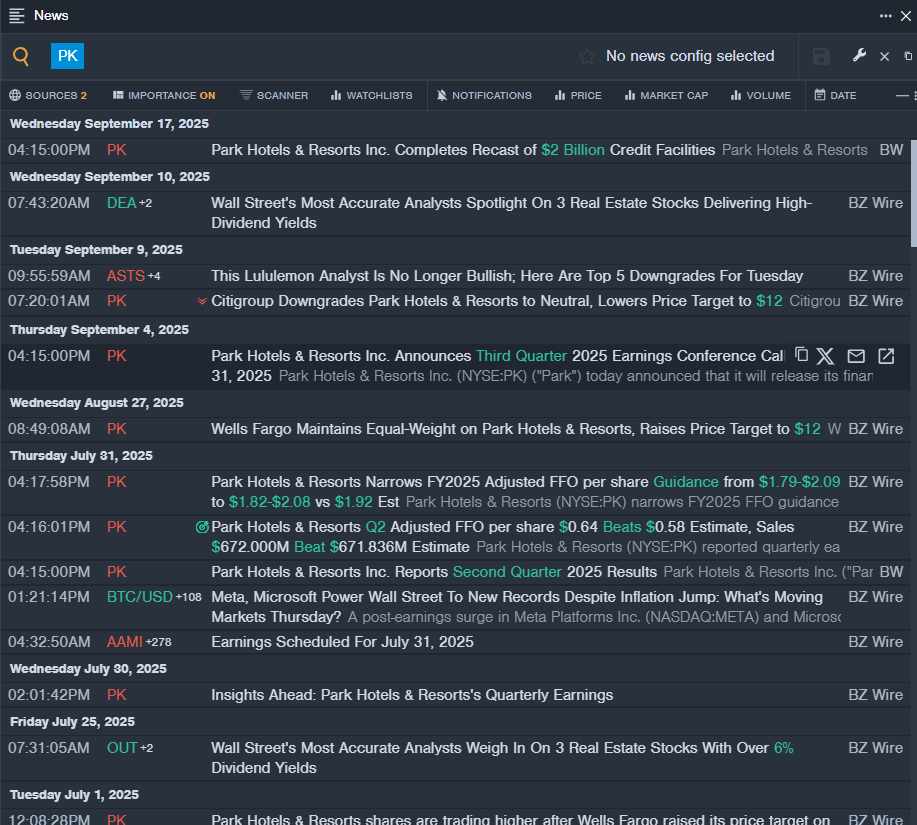

Park Hotels & Resorts Inc. (NYSE:PK)

- Dividend Yield: 8.60%

- JP Morgan analyst Daniel Politzer initiated coverage on the stock with an Underweight rating and a price target of $10 on June 23, 2025. This analyst has an accuracy rate of 63%.

- Truist Securities analyst Patrick Scholes downgraded the stock from Buy to Hold and slashed the price target from $16 to $11 on May 30, 2025. This analyst has an accuracy rate of 69%

- Recent News: Park Hotels & Resorts will release its financial results for the third quarter after the stock market closes on Thursday, Oct. 30.

- Benzinga Pro’s real-time newsfeed alerted to latest PK news.

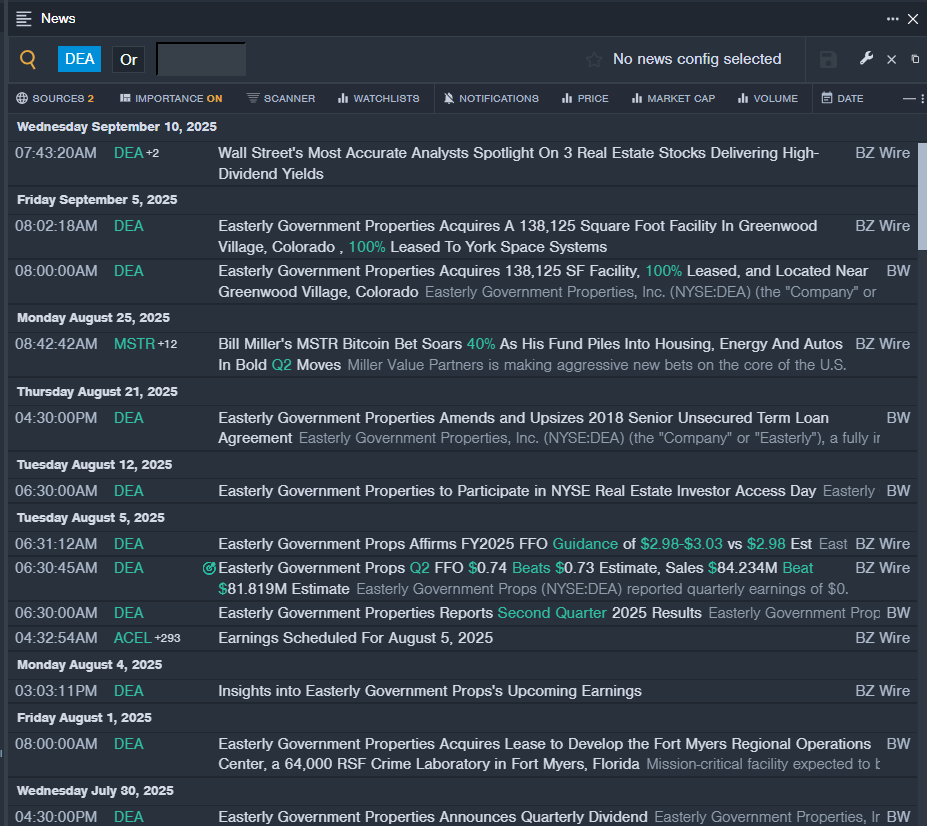

Easterly Government Properties, Inc. (NYSE:DEA)

- Dividend Yield: 7.73%

- RBC Capital analyst Michael Carroll maintained an Underperform rating and slashed the price target from $27.5 to $22 on June 2, 2025. This analyst has an accuracy rate of 61%.

- Truist Securities analyst Michael Lewis maintained a Hold rating and lowered the price target from $14 to $13 on Dec. 6, 2024. This analyst has an accuracy rate of 67%

- Recent News: On Aug. 5, Easterly Government Properties reported upbeat second-quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest DEA news

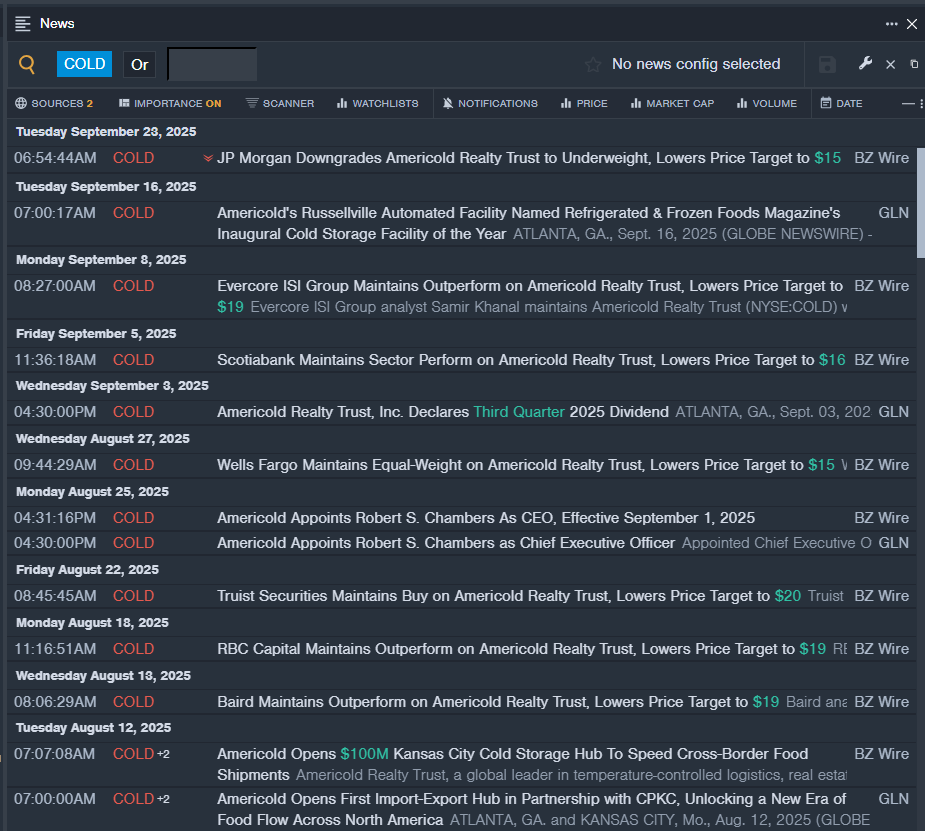

Americold Realty Trust, Inc. (NYSE:COLD)

- Dividend Yield: 7.18%

- Truist Securities analyst Ki Bin Kim maintained a Buy rating and cut the price target from $24 to $20 on Aug. 22, 2025. This analyst has an accuracy rate of 66%.

- RBC Capital analyst Michael Carroll maintained an Outperform rating and lowered the price target from $25 to $19 on Aug. 18, 2025. This analyst has an accuracy rate of 61%.

- Recent News: On Aug. 25, Americold named Robert S. Chambers as CEO.

- Benzinga Pro’s real-time newsfeed alerted to latest COLD news

Read More:

Photo via Shutterstock