/Semiconductor%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Chip stocks have been getting all the love on Wall Street over the recent years, thanks to artificial intelligence (AI) becoming the center of attention in the investment world. While we have all heard plenty about chip giants such as Nvidia (NVDA) and Advanced Micro Devices (AMD) riding the AI wave, it’s easy to miss some of the newer players making big strides. One such name is Astera Labs (ALAB).

Astera, which designs and manufactures semiconductor-based connectivity solutions for cloud and AI infrastructure, is still a relative newcomer on Wall Street, having made its public debut just last year, in March. Yet in that short span, ALAB stock has surged triple digits over the past year, fueled by strong fundamentals and a growing base of partnerships. Investors aren’t the only ones noticing. Wall Street analysts are also paying closer attention.

On Aug. 29, leading investment bank Morgan Stanley took a more bullish view on Astera, boosting its price target from $155 to $200 and reiterating an “Overweight” rating. Analyst Joseph Moore highlighted that the rise of rack-scale AI business has created a massive $17 billion greenfield opportunity “virtually overnight,” opening the door for multiple chipmakers, including Astera Labs. So, with that vote of confidence in mind, here’s a closer look at ALAB stock.

About ALAB Stock

California-based Astera Labs is a fast-growing semiconductor company focused on addressing the data, memory, and networking bottlenecks that arise when building AI and cloud infrastructure. Its platform combines hardware and software solutions, integrating technologies such as CXL, Ethernet, PCIe, and UALink with its COSMOS software to connect various parts of a data center into a single, scalable system.

By teaming up with major hyperscalers and ecosystem partners, the company is carving out a central role in powering the next wave of AI-driven data centers. With a market capitalization hovering around $29 billion, this newcomer chip stock has quickly become a favorite among investors since its public debut last year, and its price performance speaks volumes.

Over the past year, ALAB stock has skyrocketed a stunning 357%, dwarfing the broader S&P 500 Index’s ($SPX) modest 18% return during the same stretch. The momentum hasn’t slowed either. The stock has surged another 110% in just the last three months, underscoring the market’s growing confidence in its growth story.

High-growth stories often come with a steep price tag, and Astera is no exception. The stock currently trades at an eye-watering 214 times forward earnings and 74 times sales, levels that dwarf the sector medians of 23.3 times and 3.4 times, respectively. Such lofty valuations reflect investors’ firm conviction in its long-term potential, but they also leave little room for error, making execution critical to justify the premium.

Astera Labs Takes Off After Q2 Earnings

Astera delivered a blockbuster fiscal 2025 second-quarter earnings report on Aug. 5, igniting a sharp rally in ALAB stock. Shares popped nearly 28.7% in the very next trading session as investors digested results that smashed Wall Street's expectations and underscored the company’s rapidly strengthening position in the AI infrastructure space. The quarter showcased robust growth in both revenue and earnings, fueled by accelerating adoption of its PCIe 6 portfolio and stronger momentum from Scorpio Fabric Switches.

Revenue hit a record $191.9 million in the second quarter, soaring a remarkable 150% year-over-year (YoY) and handily surpassing analyst estimates of $171.5 million. Profitability gains were equally eye-catching. On an adjusted basis, EPS of $0.44 jumped a whopping 238.5% YoY and crushed estimates by a notable 35.7% margin. The company also posted its strongest cash generation to date, producing $135.4 million in operating cash flow.

Beyond the numbers, Astera continued to deepen its strategic partnerships. It expanded collaboration with Nvidia to advance the NVLink Fusion ecosystem, giving hyperscalers new options for deploying high-performance, scale-up networks. In addition, the company announced a tie-up with Alchip Technologies, a leader in high-performance ASICs, aimed at integrating compute and connectivity solutions for next-generation AI rack-scale infrastructure.

Management struck an optimistic tone about the road ahead. While reflecting on the Q2 performance, CEO Jitendra Mohan pointed to accelerating demand for Astera’s signal conditioning products across PCIe and Ethernet-based custom ASIC platforms, noting that the company is “at the forefront of an AI infrastructure transformation.”

Moreover, the CEO reiterated Astera’s strategy of increasing investments to solidify its leadership in rack-scale connectivity for next-generation AI systems. Looking ahead, management has also set an upbeat tone for the third quarter. The company expects revenue in the range of $203 million to $210 million, alongside adjusted EPS of $0.38 to $0.39. It also anticipates maintaining a robust non-GAAP gross margin of around 75% for the quarter.

What Do Analysts Think About ALAB Stock?

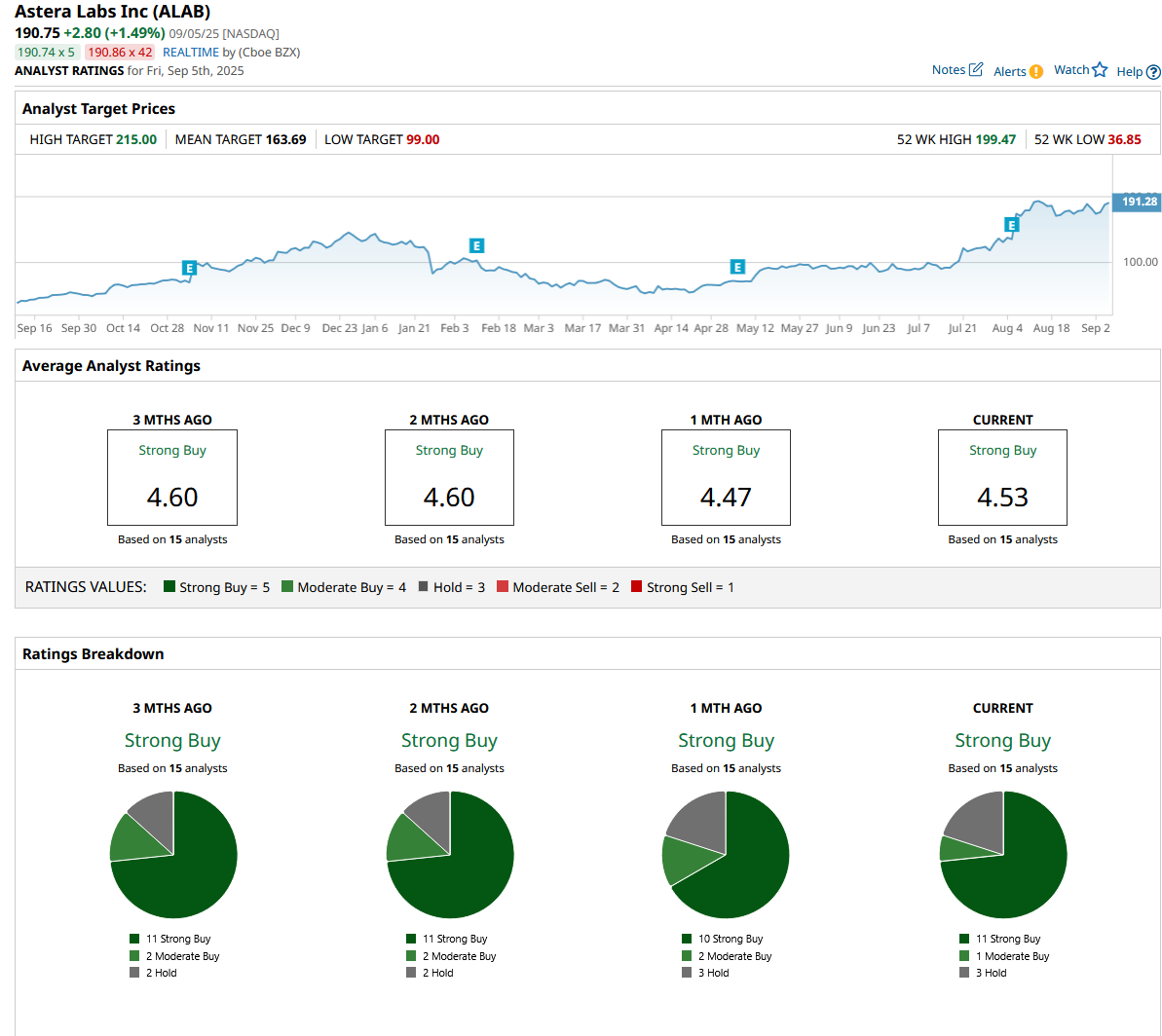

Echoing Morgan Stanley’s optimism, the broader analyst community has also lined up behind the stock, reinforcing its status with a consensus “Strong Buy” rating overall. Of the 15 analysts offering recommendations, 11 advocate a “Strong Buy,” one leans toward a “Moderate Buy,” and the remaining three urge investors to “Hold.”

While the stock is already trading at a premium to its average analyst price target of $160.62, the Street-high target of $215 suggests that ALAB can still rally as much as 13% from current levels.

Bottom Line

Astera Labs may still be a relative newcomer, but its meteoric growth and expanding role in AI infrastructure have already made it a standout chip stock on Wall Street’s radar. With analysts backing its potential and investors rewarding its execution, the company is shaping up to be one of the most exciting and closely watched growth stories in the semiconductor world.