/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Taiwan Semiconductor Manufacturing Company (TSM), referred to commonly as TSMC, is the world’s largest contract chipmaker, creating advanced chips that power everything from Apple (AAPL) iPhones and Nvidia’s (NVDA) AI accelerators to automotive electronics and data center infrastructure.

Due to this unique position, Wall Street has become increasingly bullish on the company’s growth prospects, particularly as advanced manufacturing, high-performance computing (HPC), and artificial intelligence (AI) continue to evolve. TSMC just posted another standout quarter, and Wall Street is buzzing. Let’s see if now is the right time to buy TSMC stock?

What Are Analysts Saying About TSMC Stock?

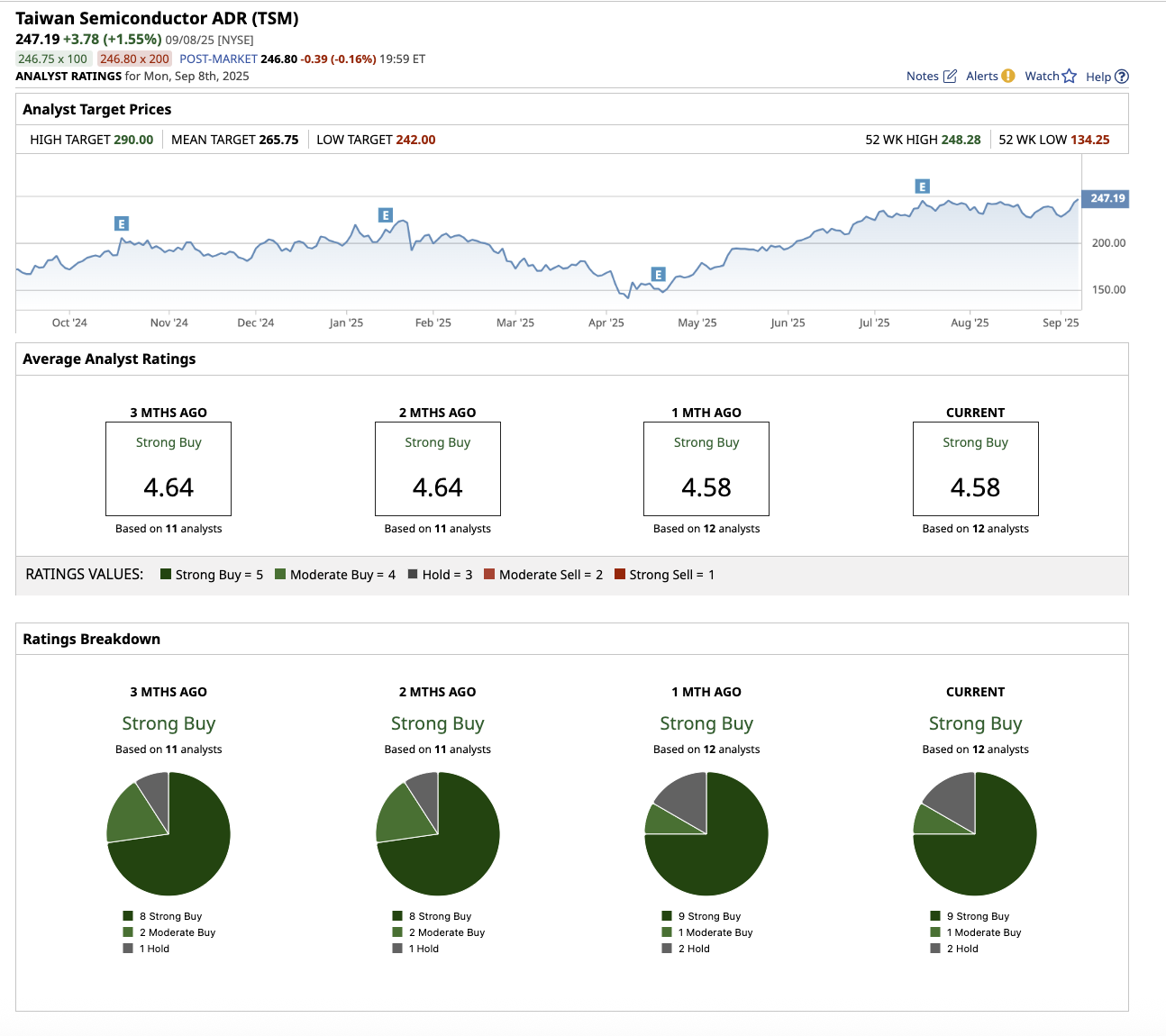

Following the second quarter earnings release, Needham analyst Charles Shi maintained a “Buy” rating on TSMC with a price target of $270. He emphasized the company’s resiliency in Q2 despite macroeconomic concerns, citing access to China and expanding AI demand as further growth drivers. Shi believes that controlled capital spending aimed at long-term expansion will accelerate TSMC’s growth trajectory.

Similarly, Barclays, Susquehanna, Goldman Sachs, and Bernstein also maintained their “Buy” ratings for the stock.

More recently, Bank of America Securities analyst Brad Lin reaffirmed a “Buy” rating on TSMC with the highest price target of $290. Lin explains the rationale as TSMC’s expected exemption from proposed U.S. Section 232 semiconductor tariffs, owing to large U.S. investments, particularly in its Arizona fabs. Lin believes that even if tariffs were imposed, the predicted profit impact would be low (0.8% to 4.0%), as strong demand for AI and HPC is expected to overcome possible headwinds. With a predicted 18x price-earnings multiple by 2026 and strong growth drivers, Lin believes TSMC’s valuation is attractive and its strategic outlook is intriguing.

Overall, Wall Street is highly optimistic and rates TSM stock a “Strong Buy.” Out of the 12 analysts that cover the stock, nine rate it a “Strong Buy,” one says it is a “Moderate Buy,” and two rate it a “Hold.”

Why Is Wall Street So Bullish?

Wall Street’s love for TSMC can be explained by the company’s continued delivery of growth well above estimates, global expansion to safeguard its customer base, and execution on an aggressive technology agenda. In the second quarter, TSMC reported revenue of $30.1 billion, up 44.4% year on year, while earnings per share increased 60.7%. The revenue mix reflected technology leadership, with 3-nanometer accounting for 24% of wafer revenue, 5-nanometer accounting for 36%, and 7-nanometer accounting for 14%. Overall, advanced nodes (7-nm and below) contributed to 74% of wafer shipments.

On the platform side, HPC demand rose 14% and made up 60% of revenue. Smartphones grew 7%, adding 27% to revenue, while IoT also rose 14%, adding 5% to revenue. Automotive remained steady at 5%, and Digital Consumer Electronics grew 30% but still contributed just 1% to total revenue. TSMC is rapidly expanding its global footprint to fulfil structural semiconductor demand, beginning with a $165 billion investment to create a cluster of six advanced fabs in the U.S. and more in Japan, Europe, and Taiwan. Even with heavy capital investment and exchange rate impacts, TSMC maintains a fortress balance sheet. It ended the quarter with $90 billion in cash and marketable securities.

The Bigger Picture: Demand Is Surging

Management is optimistic about structural semiconductor demand. AI usage continues to grow, with sovereign AI programs and surging token volumes driving ever-increasing computational demands. This translates to more silicon, more sophisticated nodes, and more wafers. Its biggest suppliers like Nvidia, Advanced Micro Devices (AMD), and Apple, are also growing aggressively, meaning more business for TSMC.

Despite the near-term constraints owing to ongoing exchange rate pressures, TSMC maintained its full-year 2025 sales growth guidance of roughly 30%, driven mostly by AI and HPC demand. Analysts covering the stock predict revenue slightly lower than management’s prediction for 2025, but earnings are expected to climb by 39.3%. Furthermore, analysts predict that revenue and earnings will grow by 15.7% and 15.3% in 2026, respectively.

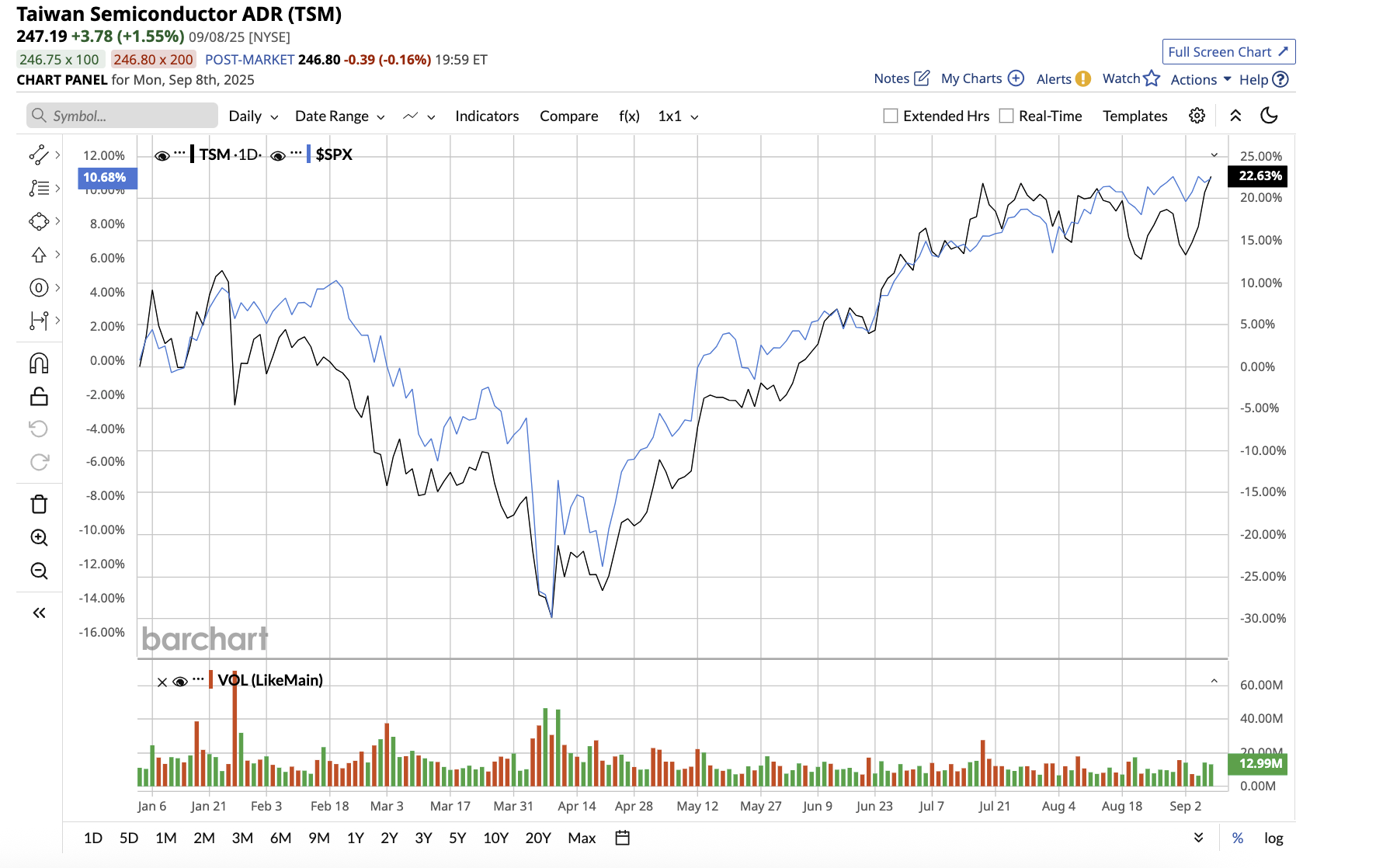

TSMC stock has surged 28.4% year-to-date, and nearly 55.8% over the past 52 weeks. Nonetheless, Wall Street believes there is much more upside to the stock. Based on the average price target of $270.88, TSM stock has upside potential of 6.3% from current levels. Furthermore, its high target price of $290 implies a potential upside of 14.2% in the next 12 months.

TSMC is not without risks, but its combination of profitability, balance sheet strength, and unmatched technology leadership makes it one of the strongest long-term plays in semiconductors. Although the company’s long-term growth drivers, such as AI and HPC, remain solidly intact, currency headwinds and overseas expansion expenditures are likely to put pressure on margins in the near future.

For those who can stomach some near-term volatility, at 21 times forward 2026 earnings, TSM is a reasonable semiconductor stock to buy now.