Shares of Marvell Technology (MRVL) have been on a wild ride this year. For most of 2025, the chipmaker struggled to find its footing as a broader tech selloff, fueled by trade tensions and slowing global growth, dragged the stock lower. Uncertainty around the continuity of top customer Amazon’s (AMZN) AWS didn’t help either, adding another layer of hesitation among investors despite Marvell’s crucial role in the artificial intelligence (AI) supply chain.

Fast forward to now, and the narrative has flipped. Marvell’s stock has suddenly caught fire, climbing sharply over the recent months as investors rediscover its growth story. A strong earnings report, a $5 billion share buyback, and strategic partnerships with major tech players have all reignited confidence in the company’s outlook. And Wall Street seems to agree.

Recently, investment firms like Oppenheimer and UBS have lifted their price targets on the stock, citing growing confidence in Marvell’s long-term potential, especially as AI-driven data center demand continues to soar. So, with fresh momentum and bullish analysts piling in, let’s take a closer look at this “Strong Buy”-rated chip stock.

About Marvell Stock

Marvell powers the future of data infrastructure, delivering the essential silicon that fuels today’s AI, cloud, enterprise, and carrier networks. With decades of innovation behind it, the company designs cutting-edge semiconductor solutions that move, store, process, and secure the world’s data faster and more efficiently. By partnering closely with global technology leaders, Marvell is redefining what’s possible in a connected, intelligent world.

Currently valued at around $74.3 billion by market capitalization, this chip designer faced a rocky start to 2025, dropping nearly 19.6% and lagging the broader S&P 500 index's ($SPX) 13% year-to-date (YTD) gain. But the tide has turned spectacularly. Over the past six months, shares have soared 67%, including a stunning 32% surge in the past month alone. From its 52-week low of $47.08 in April, the stock has now rebounded nearly 90%.

Marvell Reports Strong Q2 Earnings

The chip maker dropped its fiscal 2026 second-quarter earnings report on Aug. 28, with its top- and bottom-line numbers closely aligning with Wall Street's forecast. For the quarter, the company achieved record revenue of $2.01 billion, a notable 58% year-over-year (YoY) surge, thanks to AI-driven data center growth, complemented by an ongoing recovery in enterprise networking and carrier infrastructure end markets.

Data center revenue alone skyrocketed 69% annually to $1.5 billion, while revenue from enterprise networking and carrier infrastructure end markets climbed 28% and 71%, respectively. Profitability remained strong in the second quarter, with gross margin expanding 420 basis points to 50.4%, while net income swung from a $193.3 million loss to a $194.8 million profit. On an adjusted basis, EPS jumped an eye-catching 123% YoY to $0.67.

CEO Matt Murphy emphasized that Marvell’s growth is being driven by strong AI demand for custom silicon and electro-optics products, as well as a significant recovery in enterprise networking and carrier infrastructure markets. The CEO highlighted that Marvell’s “AI design activity is at an all-time high,” with the company currently working on over 50 new design opportunities across more than 10 customers.

Cash and cash equivalents ended the quarter at $1.2 billion, up from $886 million in the prior quarter. Last month, the company also announced a new $5 billion share repurchase program, on top of the remaining $1.7 billion from its previous plan. Looking ahead to Q3 of fiscal 2026, Marvell expects revenue of approximately $2.06 billion, with a potential variance of plus or minus 5%.

The company anticipates non-GAAP gross margins of 59.5% to 60% for the upcoming quarter. Plus, on the earnings front, Marvell projects non-GAAP EPS to land between $0.69 and $0.79. Over the longer term, analysts tracking Marvell project its profit to rise 132.5% YoY to $2.14 per share in fiscal 2026, followed by another 23% jump to $2.63 per share in fiscal 2027.

What Do Analysts Expect for Marvell Stock?

Investors took notice after Oppenheimer analysts raised Marvell’s price target to $115 from $95 and reiterated an “Outperform” rating following meetings with CFO Willem Meintjes and SVP of Investor Relations Ashish Saran. Analysts highlighted the company’s confident outlook, driven by continuity in custom AI ASIC projects and sustained networking outperformance.

All segments are expected to grow by more than 10% in 2026 as cloud service providers and hyperscalers expand AI infrastructure and cyclical verticals recover. Oppenheimer also sees Marvell leveraging Teralynx’s low-latency technology to capture opportunities in the emerging scale-up switching market, potentially rivaling the scale-out switch total addressable market.

Shortly after, UBS also raised Marvell’s price target to $105 from $95, maintaining a “Buy” rating. The upgrade came as analysts focused on the company’s strong revenue growth driven by surging demand for AI-focused data centers. At the same time, optimism across the semiconductor sector, fueled by encouraging developments in China trade and a high-profile OpenAI–Broadcom AI chip partnership, further lifted investor confidence.

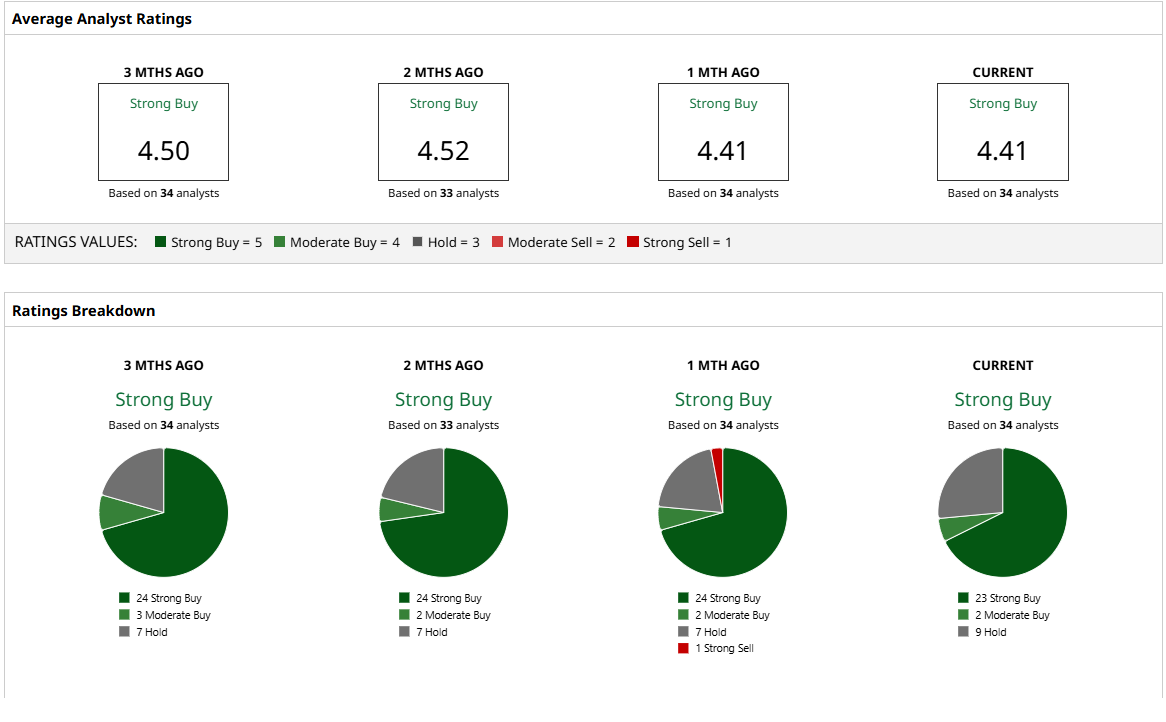

Overall, Wall Street appears highly bullish on MRVL, with the stock carrying a consensus “Strong Buy” rating. Of the 34 analysts offering recommendations, a majority of 23 analysts are giving it a solid “Strong Buy,” two suggest a “Moderate Buy,” and the remaining nine give a “Hold.” The stock trades slightly below its average price target of $89.49, the Street-high target of $122 implies potential upside of 37% from current levels.