Nvidia beat Wall Street expectations in its quarterly earnings report on Wednesday, marking another in a string of financial wins for the computer hardware giant. It reported $44.1bn in revenue in the quarter ending in April, up 69% from the previous year.

The company exceeded investors’ predictions of $43.3bn in revenue. Adjusted earnings per share came in at $0.81, under investor expectations of an adjusted earnings per share of 88 cents. The company also reported $39.1bn in data center revenue, up 73% from the year prior.

The company is a bellwether for the business of artificial intelligence (AI), both in its cutting-edge hardware and the new regulatory headwinds it is facing, and investors are watching closely.

“Nvidia beat expectations again but in a market where maintaining this dominance is becoming more challenging,” eMarketer analyst Jacob Bourne said. “The China export restrictions underscore the immediate pressure from geopolitical headwinds, but Nvidia also faces mounting competitive pressure as rivals like AMD gain ground on cost-effectiveness metrics for certain AI workloads.”

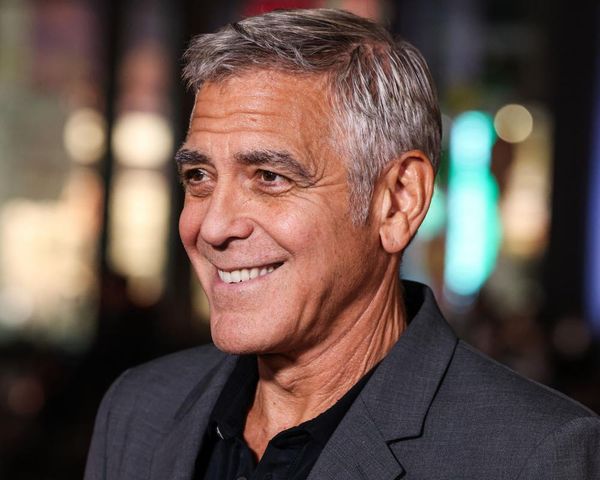

The Nvidia CEO Jensen Huang said in a statement: “Global demand for Nvidia’s AI infrastructure is incredibly strong. Countries around the world are recognizing AI as essential infrastructure – just like electricity and the internet – and Nvidia stands at the center of this profound transformation.”

The chipmaker said it expects to see $45bn in the second quarter of fiscal year 2026.

Nvidia’s quarterly reports for the past year have shown explosive growth. The company faces increasing pressure from the US.

Donald Trump’s April announcement that the administration was tightening export rules on computer chips effectively banned Nvidia from selling its H20 AI chips to China, a major source of revenue.

“H20 products were designed primarily for the China market,” the company’s first quarter earnings report read. As a result, Nvidia said it expects to miss out on $8bn in revenue in the second quarter.

Still, Huang seemed optimistic about Trump’s plans to allow companies to potentially export more limited capacity chips to China.

“The president has a plan, he has a vision and I trust him,” Huang said.

That said, Huang warned that missing out on the potential $50bn AI market in China risks US leadership in the global AI infrastructure race. “China is one of the world’s largest AI markets and a springboard to global success,” Huang said on the earnings call.

“China’s AI moves on with or without US chips,” he said. “It has the compute to train or deploy an advanced model. The question is not whether China will have AI – it already does. The question is whether one of the world’s largest AI markets will run on American chips.”

The company revealed in a recent Securities and Exchange Commission filing that the change would cost the company $5.5bn in charges. The company said it saw just $4.6bn in charges “associated with H20 excess inventory and purchase obligations as the demand for H20 diminished” in the first quarter. The charges came in at just under expectations because they were able to reuse some materials.

In an interview with Ben Thompson, Huang said the move was “deeply painful” and could result in $15bn in revenue loss. In just the first quarter, the company was also “unable to ship an additional $2.5bn of H20 revenue”.

“No company in history has ever written off that much inventory,” Huang said. “[N]ot only am I losing $5.5bn – we wrote off $5.5bn – we walked away from $15bn of sales and probably ... $3bn worth of taxes.”

The tightening rules on chip exports comes as the committee on China within the US Congress announced it was seeking answers from Nvidia about how its chips ended up powering breakthrough AI models in China, particularly DeepSeek, an AI company that matched the products of US AI companies without the same computing power.

The committee has alleged in a new report that DeepSeek “covertly funnels American user data to the Chinese Communist party, manipulates information to align with CCP propaganda, and was trained using material unlawfully obtained from US”.

Analysts said they were encouraged by the company’s ability to deliver a robust quarter despite the issues with the US tightening its China export controls.

“Even during a period of industry consolidation – with growing competition and geopolitical tensions creating a more challenging macro environment – the company demonstrated its ability to focus on the right operational areas,” said Thomas Monteiro, a senior analyst at Investing.com.

“It largely absorbed these headwinds by effectively managing the data-center supply-demand equation. In that sense, the $4.5bn H20 impact during the quarter ultimately highlighted Nvidia’s adaptability to changing market conditions – a trait that will remain critical throughout the rest of the year, at minimum.”

Analysts also say they think negotiations between the US and China “could yield positive results for Nvidia”, according to Wedbush analyst Dan Ives.

“There is one chip in the world fueling the AI Revolution and its Nvidia … that narrative is clear from these results and the positive commentary from Jensen,” said Ives. “This is a very important guide for the broader tech world and it shows the AI revolution is heading into its next gear of growth despite the Trump tariff war playing out.”

While the company’s business in China remains up in the air, analysts seem heartened by recent demand for Nvidia chips in Saudi Arabia and the UAE. Nvidia was among the beneficiaries of the AI windfall that arose from Trump’s visit to the region, which resulted in Saudi Arabia committing to $600bn to US companies.

Nvidia said it will sell hundreds of thousands of AI chips to Saudi Arabia, including 18,000 of its latest chip, Blackwell, to a Saudi sovereign wealth-fund-backed startup called Humain.