/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Wall Street analysts have grown more optimistic on Alibaba Group (BABA), betting on its cloud and AI momentum. This week, Morgan Stanley raised its 12-month price target from $165 to $200, citing strength in its cloud business and AI investments. The broader tech market has also been electrified by speculative bursts; for instance, Wolfspeed (WOLF) shares briefly spiked over 1,000% intraday following a Chapter 11 restructuring and reincorporation, a reminder of how risk-on sentiment can sweep through sectors and amplify interest in high-growth names like Alibaba.

Morgan Stanley also sees Alibaba expanding data centers in Brazil, France, and the Netherlands; collaborating with Nvidia on “physical AI”; and rolling out its Qwen3-Max AI model (over one trillion parameters). In short, analysts cite accelerating cloud sales, higher capital expenditure, and global AI strategy as reasons for the upgrade.

About BABA Stock

Based in Hong Kong, Alibaba is a leading global technology company offering various services to facilitate commerce and digital transactions. Beyond e-commerce, Alibaba's cloud computing division, Alibaba Cloud, offers various technology services, including computing, storage, and data analytics, which contribute significantly to its revenue growth. The company is also expanding its footprint in the AI sector by developing proprietary chips and AI models, positioning itself as a key player in China's tech industry.

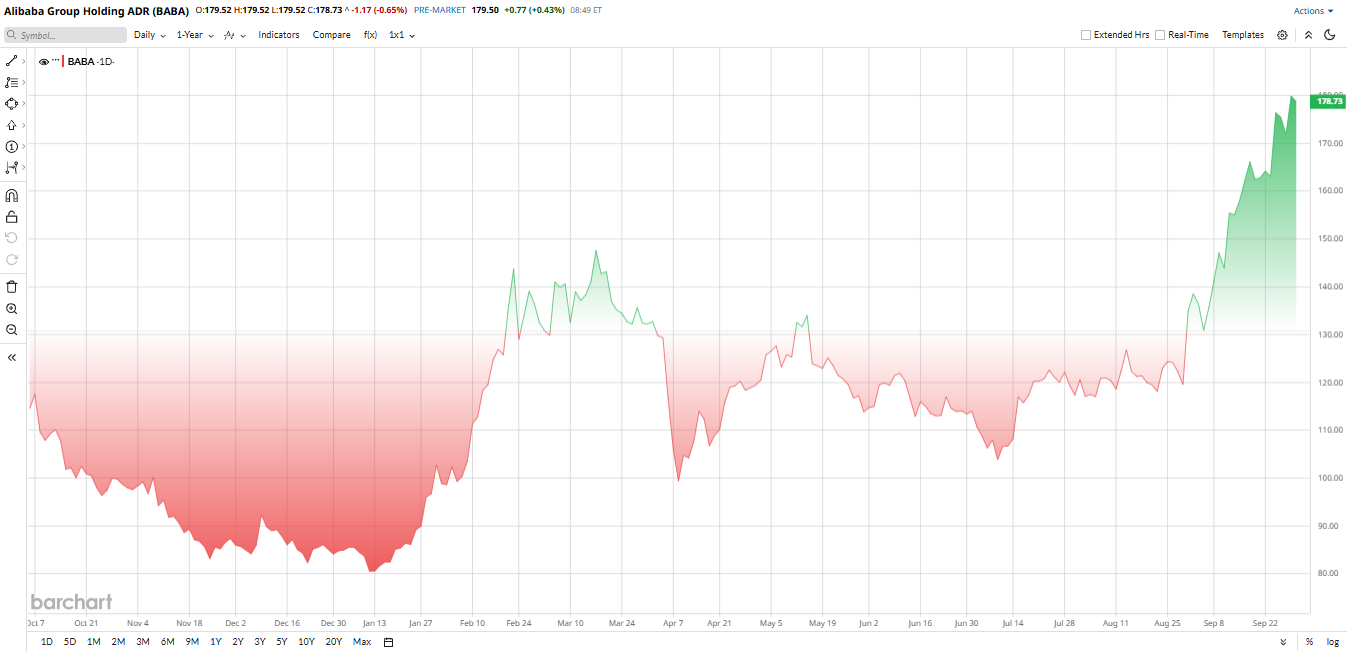

Valued at around $426 billion by market cap, Alibaba’s stock has more than doubled in 2025, making it easily one of the market’s top performers. This rally came on the signs of easing regulatory pressure in China and strong momentum from cloud, international, and AI-driven growth. Optimism around Jack Ma’s return and upbeat Q1 earnings further fueled investor confidence.

BABA presents a mixed valuation landscape. Its price-to-sales (P/S) ratio of 2.86 is significantly higher than the sector median of 0.99, indicating a costly stock compared to peers. However, its P/E ratio of 19.95 is slightly cheaper than the sector median of 20.42, suggesting a more reasonable pricing in this aspect.

Moreover, Alibaba’s current dividend growth rate is -47.5% (TTM) versus the sector median of 5.4%, and its dividend yield sits at only 1.2%, making it a weaker option for income investors.

Alibaba’s AI Push and Global Expansion

Alibaba is betting heavily on AI to reaccelerate growth, and September saw a flurry of announcements. At its annual Apsara Conference held in late September, CEO Eddie Wu unveiled the “Qwen3-Max” large language model (1+ trillion parameters) and a new physical-AI partnership with chipmaker Nvidia (NVDA).

He also announced plans for dozens of new data centers worldwide, first in Brazil, France, and the Netherlands, with additional centers slated for Japan, Mexico, Korea, Malaysia, and the UAE over the next year. These moves build on Alibaba’s massive planned spend on AI infrastructure; Wu reiterated the earlier pledge of ¥380 billion ($53 billion) over three years, hinting it might even increase that commitment.

Moreover, analysts note that Alibaba’s AI-related revenue growth has been triple-digit for multiple quarters, with cloud now a bigger driver than ever.

Strong Cloud Growth vs. E‑Commerce Lull

Alibaba’s latest results paint a mixed picture. In late August, the company reported cloud revenue up 26% year-over-year (YoY), ¥33.40 billion, handily beating the 18% growth analysts expected. Management emphasized that AI demand is fueling cloud adoption, noting, for example, that Alibaba invested over ¥100 billion in AI R&D over the past year. This robust cloud performance helped push U.S.-listed shares up about 8% on the day of the earnings release.

However, Alibaba’s core commerce segments grew more slowly. Overall revenue for the June quarter came in at ¥247.7 billion, slightly below the ~¥252.9 billion consensus. On-time e-commerce sales have been pressured by subsidies and competition (as peers Pinduoduo (PDD) and Meituan (MPNGF) pour money into “instant retail” delivery). As a result, operating profit was down 3%, and adjusted EBITDA fell 14% due to heavy investment in new quick-commerce platforms.

Even so, management remains upbeat about its target of 30 trillion yuan of long-term opportunity in instant delivery. It just closed a $350 million buyback of shares in its Cainiao logistics arm, signaling a focus on its core strengths.

Wall Street's Opinion and Final Words

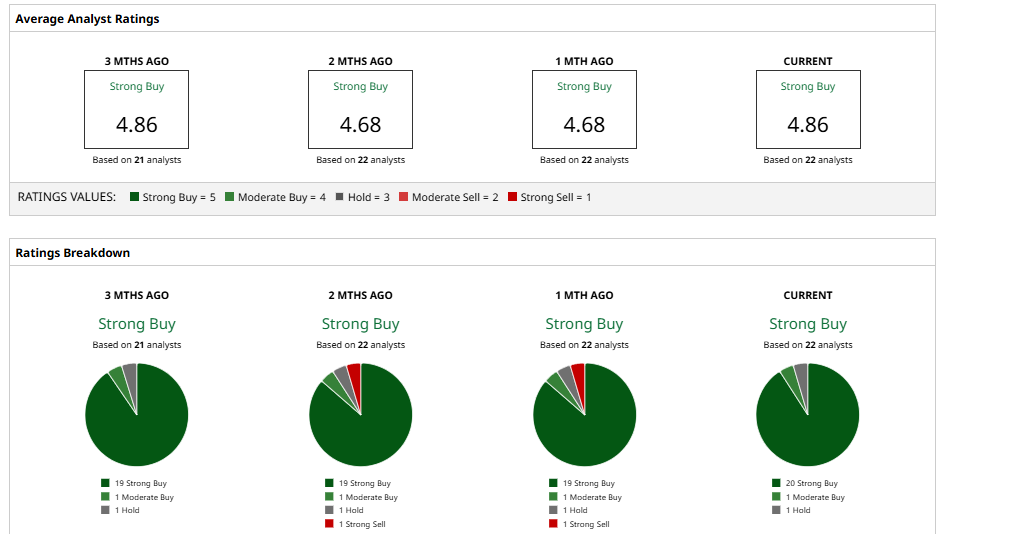

Wall Street analysts are highly optimistic about BABA’s stock growth prospects, with a consensus rating of “Strong Buy.” Of the 22 analysts covering the stock, 20 rate it a “Strong Buy,” one has a “Moderate Buy,” and one maintains a “Hold” rating. Notably, there are no sell ratings on the stock.

Despite this bullish sentiment, the average 12-month price target of $190 is almost exactly in line with the stock’s current trading level. However, the Street-high target of $245 implies a potential upside of about 29% from current levels.

Alibaba has bounced back with stronger e-commerce, fast-growing cloud/AI, and easing regulatory pressure. The stock trades at a fair P/E and still has upside if growth continues, but much good news is already priced in. Investors confident in Alibaba’s cloud and AI momentum may buy now, while cautious ones might wait for clearer profit growth or a pullback.