The Fair Work Commission announced a 5.75 per cent increase in award wages, arguing that it would not spark a wage-price spiral, but it did send some retail stocks into a minor tailspin.

Look back at how the day's financial news and insights played out on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 5:00pm AEST

By Michael Janda

- ASX 200: +0.5% to 7,145 points (live values below)

- Australian dollar: +0.6% to 66.12 US cents

- Nikkei: +1.2% to 31,524 points

- Hang Seng: +4.3% to 18,993 points

- Shanghai: +0.8% to 3,231 points

- S&P 500: +1% to 4,221 points

- Nasdaq: +1.3% to 13,101 points

- FTSE: +0.6% to 7,490 points

- EuroStoxx: +0.8% to 455 points

- Spot gold: Flat at $US1,978/ounce

- Brent crude: +1.1% to $US75.10/barrel

- Iron ore: +3.1% to $US104.50/tonne

- Bitcoin: +0.8% to $US27,082

Live updates on the major ASX indices:

US employment the key data point tonight

By Michael Janda

The markets overseas will be watching the official US jobs numbers, or non-farm payrolls as they call them, to see how the world's biggest economy is looking and whether the Fed will raise interest rates again in less than two weeks' time.

The market is generally expecting the addition of 190,000 extra jobs in May, down from 253,000 the month before, and unemployment to edge up from 3.4 to 3.5%.

It is also expected that average earnings will grow a slower 0.3% in the month, down from 0.5% in April.

If the numbers are better than expected, bets will increase again on another Federal Reserve rate hike.

Dan Ziffer, Kate Ainsworth and Rachel Pupazzoni will be sharing blogging duties on Monday to bring you the fallout.

I hope you have a great weekend.

'Brutal' reality of today's award wage increase

By Michael Janda

Dan Ziffer takes a look at what today's minimum and award wage increase means for most low paid workers — they're still going backwards, just a little less quickly than before.

Winners and losers

By Michael Janda

The top five gains on the ASX 200:

- Paladin Energy: +10.7% to $0.67

- Syrah Resources: +7.1% to $0.90

- IDP Education: +6.3% to $21.75

- Champion Iron: +5.6% to $6.00

- Sandfire Resources: +5.5% to $5.96

The five biggest losses on the ASX 200:

- Telix Pharmaceuticals: -7.2% to $10.82

- Lovisa Holdings: -3.2% to $19.63

- Brambles Ltd: -2.6% to $13.38

- BrainChip Holdings: -2.3% to $0.435

- IPH Ltd: -2% to $7.72

Companies that employ lots of low-paid people weigh on strong gains elsewhere on ASX

By Michael Janda

Today was a generally positive one on the market — the US debt ceiling deal passed the Senate, so that crisis is averted.

That saw a threat to global growth removed and commodity price climb higher, sending the mining sector on the ASX up 2.2% and energy stocks up 1.1%.

But the news wasn't so good for businesses who sell stuff closer to home.

Retailers were generally hit by the Fair Work Commission's surprise 5.75% award wage increase.

With employers asking for about 3.5-4% and unions asking for 7%, 5.75% is clearly closer to what the workers wanted rather than the bosses.

That showed up in a 1.2% fall for consumer non-cyclicals (basically the big supermarkets), led by a 1.7% drop for Coles and 1.4% for Woolworths.

Other retailers who rely on a lot of low-paid staff to sell things also dropped, with Lovisa down 3.2%, Retail Food Group off 1.8%, Flight Centre down 1.3% and Super Retail Group down 1%.

Home furnishings company Adairs had the double whammy of an earnings downgrade and rising wage costs. It was down nearly 15% to $1.605.

On the other hand, online retailers aren't nearly as affected. Kogan was up 4.6% to $4.53.

Overall, big gains for the big miners (BHP up 2.8% and Rio Tinto up 2.5%) were enough to haul the ASX 200 index 0.5% higher to 7,145 points and the All Ords up 0.6% to 7,331.

More details and reaction to the award and minimum wage decision

By Michael Janda

With the market closing, the blog is soon to shut down.

Sue Lannin spoke to Josh Cullinan, secretary of the Retail and Fast Food Workers Union, about the award increase on ABC News Channel.

If you want to read more detail about the minimum wage decision, my colleagues Gareth Hutchens and Stephanie Chalmers have you covered with their article.

In particular, they look at the very different reactions from employee and employer groups.

Sally McManus, secretary of the Australian Council of Trade Unions (ACTU), warmly welcomed the 5.75% award pay rise.

"This is an absolutely essential increase for all of the people in Australia who are struggling so hard at the moment just to survive, to pay their rent, to pay their groceries, to pay all of the basics," she said.

"They are the people who actually keep the economy going in every way."

While Innes Willox, chief executive of employer body the Australian Industry Group (AiGroup) said it was a blow to his members.

"This decision will add significantly and immediately to the costs facing the large number of businesses that employ under award conditions," he said.

"For some business, these pressures will be particularly intense due to the realignment of the national minimum wage to a higher base level, effectively increasing the NMW [national minimum wage] by 8.6 per cent."

Aged care workers

By Michael Janda

So in your answer i read into that i get 15% plus 5.75% also is that correct??

- John

That is certainly my understanding.

The 15% boost comes in on June 30, then the 5.75% across the board award increase takes effect on July 1.

It makes sense too, because otherwise the Fair Work decision to boost the pay of aged care workers, which it found to be underpaid, would be partially offset if they didn't get the general pay rise all award workers were receiving.

If you're paid under a federal modern award, then you get this pay rise

By Michael Janda

I'm assuming everyone is covered by this increase? Including those of us covered by the Hospitality Industry (General) Award [MA000009]? Could find much info!

- Darcy

This has been a recurring question.

All workers currently employed and paid under a modern award will receive this 5.75% pay rise. That's about one-in-five workers.

There's also a few per cent more whose wage rates are directly linked to the award rates.

All in all, Fair Work said the decision today affects about a quarter of employees directly.

If you are on an enterprise agreement and your base rate of pay would drop below the new award rate after this decision, then your employer must raise your base pay to at least match the base rate in the relevant award.

We're already seeing notes about some of the big retailers that are going to have to top up their workers' pay because otherwise their EBAs would be lower than the new award rates after July 1.

I hope this helps clarify?

Are public sector employees included?

By Michael Janda

Will this increase include Public Sector employees?

- Sian

Generally, no.

Most state government employees are still covered by their own industrial relations systems, while those under the federal system are pretty much all on enterprise agreements (and probably paid well above award minimums).

Retailers to be hit by rising cost of workers

By Michael Janda

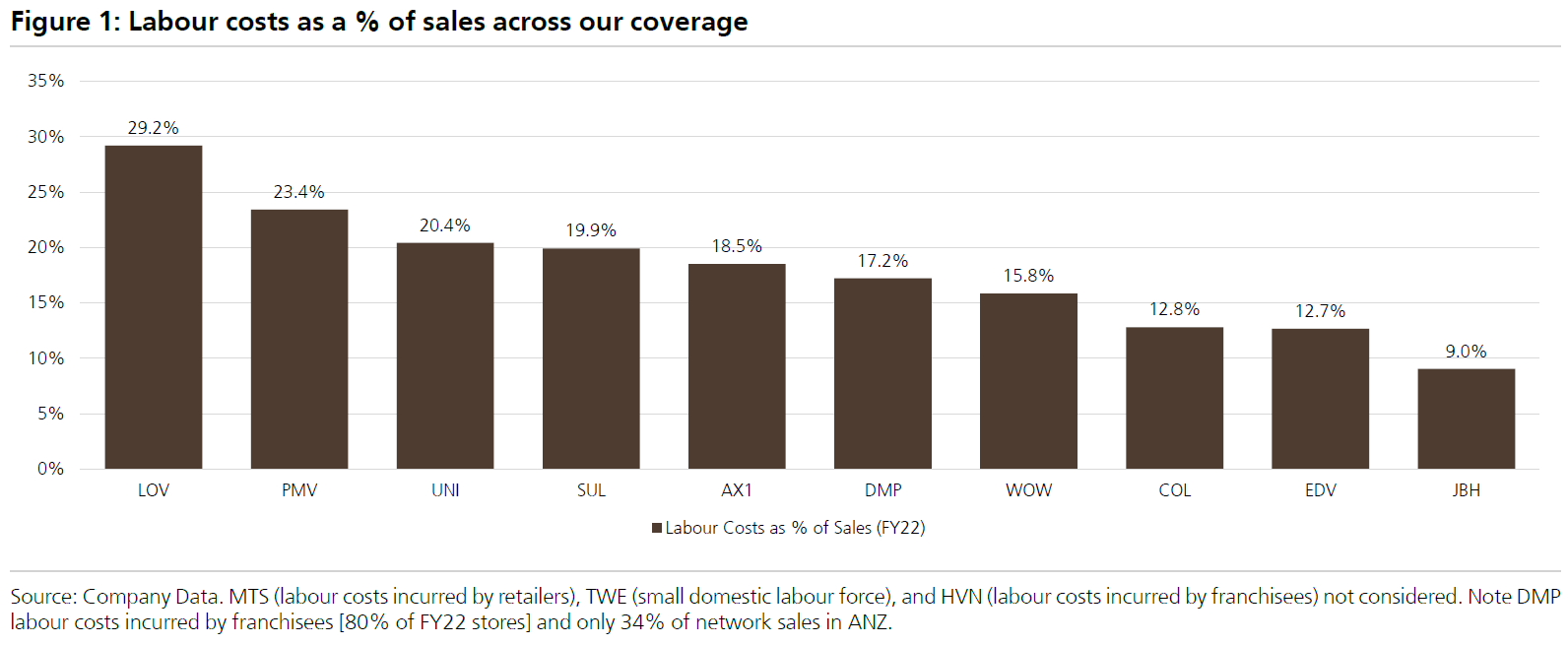

UBS warns Australian retailers are set to take a hit to their profit margins from the Fair Work Commissions 5.75% increase in award wages.

"All retailers in Australia will face an increase in labour costs greater than historical levels and at a scale that we believe many will find it difficult to offset," the investment bank's retail analysts noted.

"Hence the risk to industry EBIT [earnings before interest and tax] margins is skewed to the downside."

The analysts have done a quick assessment of which retailers are likely to be most and least affected.

It thinks Woolworths and Coles will fare reasonably well due to low levels of labour costs relative to sales, cost-saving programs (such as increased automation) and their dominance in selling grocery essentials, which gives them the power to pass on cost increases.

Likewise, UBS believes Wesfarmers — which owns Bunnings, Officeworks, Kmart and Target — will prove resilient.

However, it sees a potential profit hit for Premier Investments (which owns retail brands such as Just Jeans, Portmans, Peter Alexander and Smiggle), fashion and footwear retailers Accent Group and Universal Store Holdings, jewellery and accessories retailer Lovisa, Super Retail Group, Harvey Norman and JB Hi-Fi.

Woolworths says full-time employees will receive at least $51 a week pay rise

By Michael Janda

Woolworths says today's Fair Work Commission decision will raise the wages of more than 145,000 hourly paid workers covered by its Retail Agreement.

"We confirm that we will pass on all of this increase to our hourly paid team members in Supermarkets, Metro, CFCs & BIG W effective Monday, 3 July 2023.

"Team Members will see this in their payslips in their next pay cycle.

"This increase equates to a weekly uplift of at least $51.00 (based on 38 hours per week) for our Supermarkets, Metro, CFCs & BIG W teams."

The company provided no estimate of how much the increase in its wage bill would impact either its product pricing or its profits.

Woolworths (-1.3% to $37.59) and Coles (-1.5% to $17.85) have been two of the biggest losers on the ASX 200 today, with both companies employing a lot of people whose wages will be boosted considerably by today's decision.

Do non-award workers get this pay rise?

By Michael Janda

Does this pay rise get passed on if you are already ona higher rate than set out in your award?

- Nick

I'm afraid Nick that the short answer is no.

Of course, the good news is that if you don't get this pay rise it's because you're on either an Enterprise Agreement or an individual contract that is paying you above the legal minimum rates for your occupation and grade.

The longer answer is that the increase in the legal minimum will feed through to other wages in a number of ways.

Firstly, if today's 5.75% increase takes the base rate of the award above the base rate contained in any enterprise agreement, the workers covered by the agreement will receive a pay rise on July 1 to ensure that they are paid at least the award base rate.

In short, a worker who would be covered by a modern award cannot be paid a base rate less than the award rate.

Anything else in the agreement, such as penalty and overtime provisions that might have been traded off, will remain unaffected until that agreement is renegotiated.

(Thankyou to Professor Andrew Stewart from the University of Adelaide who helped with this query).

When enterprise agreements are renegotiated and presented to Fair Work for approval, they must pass a Better Off Overall Test (BOOT). Today's decision sets the pay benchmarks underpinning that test for new agreements.

Secondly, non-award employees will look at today's decision as something of a benchmark for a 'fair' wage claim.

In industries where workers have more bargaining power, such as through labour shortages or high trade union membership, they are more likely to get something closer to what they demand.

Thirdly, with unemployment still at low levels, under 4 per cent, employers may struggle to fill vacancies unless they offer competitive pay rises. The award rates set a benchmark for the minimum.

Fall in new mortgages being taken out in April, ABS data shows

By Kate Ainsworth

There is no shortage for business and financial related news this Friday, let me tell you!

While we were busy digesting the Fair Work Commission's minimum wage decision, the Bureau of Statistics released some new lending indicators data — aka the number and value of new housing loans.

In April, there was a 2.9% fall in the rate of new loans being taken out, after a rise of 5.3% in March (which was the first rise in 14 months).

The ABS figures also show there were fewer first home buyers who purchased a home, with the value of first home buyer loans down by 2.1% in April, and 16.4% over the year.

There was also a drop in the rate of people refinancing to a new lender.

That dropped by 9.2% since March —making it the largest monthly decrease since November 2020.

Award pay rises across the board

By Michael Janda

Award rate increase: does the 5.75% apply to each level of an award? For example, the Professional Employees award 2020. Will the level 1 at each of the pay points receive it? Thanks!

- Justin

Good question Justin.

The answer is yes, all award wage rates will rise by 5.75%, except those on the absolute minimum wage, who are seeing an 8.6% increase (which Kate Ainsworth explained well in this post).

This pay rise is to try and maintain the real value of wages — that is, to cancel out some of the effects of the high inflation we've seen.

It doesn't quite do that in full, but it goes quite a long way to compensating workers on award wages for their rising cost of living.

If the pay rise didn't apply to all levels of an award, it would in effect narrow pay gaps between more junior or less qualified staff on lower levels and those at higher pay grades, which is not the point of the Fair Work Commission's annual wage review.

BREAKING: US debt ceiling bill passes Senate

By Kate Ainsworth

The US Senate has passed a bill to suspend the $US 31.4 trillion debt ceiling, averting the risk of a default.

The Senate voted 63-36 to approve the bill that was passed yesterday by the House of Representatives, as lawmakers raced against the clock following months of partisan bickering between Democrats and Republicans.

The Treasury Department had warned it would be unable to pay all its bills on June 5 if Congress failed to act by then.

The debt ceiling will be suspended until January 1, 2025.

The bill now goes to US President Joe Biden to sign into law.

Market snapshot at 1:00pm AEST

By Michael Janda

-

ASX 200: +0.3% to 7,130 points (live values below)

- Australian dollar: +0.6% to 66.06 US cents

- S&P 500: +1% to 4,221 points

- Nasdaq: +1.3% to 13,101 points

- FTSE: +0.6% to 7,490 points

- EuroStoxx: +0.8% to 455 points

- Spot gold: +0.1% to $US1,980/ounce

- Brent crude: +0.4% to $US74.55/barrel

- Iron ore: +3.1% to $US104.50/tonne

- Bitcoin: +0.3% to $US26,954

Live updates on the major ASX indices:

ASX clings to gains mid-session

By Michael Janda

For those of you desperate to keep up with the latest market news, apologies for the wages distraction.

But the Fair Work Commission (FWC) award wages decision does seem to have had some influence on the ASX.

From an early high of 7,166 around 10:12am AEST, around the time the FWC handed down its wages determination, the ASX 200 index has steadily pared back its gains to 7,131 points.

That is still up 0.3% on yesterday's close, but well off the S&P 500's 1% gain on Wall Street overnight.

There are two reasons why a higher than expected award wage increase may have had this effect:

- 1.It will push up costs for businesses who pay their employees award rates or whose enterprise agreements are benchmarked off the award.

- 2.Some economists believe it will raise pressure on the Reserve Bank to raise interest rates again, possibly as soon as next week.

That seems to be reflected in the sectors gaining and losing ground.

Mining, utilities and energy are up — they are much more affected by global pricing forces, with wages a smaller share of costs and most of their workforces above award rates anyway.

Consumer non-cyclicals (dominated by the big supermarkets), financials and healthcare are down.

These are labour intensive sectors, with many employees either on award rates or on enterprise agreements that are not a huge amount above award rates, so many of these firms are likely to see their costs rise substantially as a result of today's decision.

How have businesses responded to the minimum wage decision?

By Kate Ainsworth

Business groups had been arguing for a far more modest rise to the minimum wage in the next financial year.

The Australian Chamber of Commerce and Industry had been pushing for a wage increase of just 3.5%.

Its chief executive, Andrew McKellar, says the decision will hurt small businesses.

"They [small businesses] have to make a decision, they have to make a decision about whether they can pay themselves, the ongoing wages, meet their superannuation expenses for themselves, can they pay their suppliers in a timely fashion, can they take on the employees that they need to hire?" he said.

AiGroup, Australia's peak industry association, had been lobbying for a 3.8% increase.

Its chief executive, Innes Willox, described the Fair Work Commission's ruling as "disappointing".

"While today's decision in the Annual Wage Review to raise award wages by 5.75 per cent is disappointing, employers recognise the competing tensions involved between addressing cost of living pressures and the difficulties of a large increase in a weakening economy including for the many small and medium-sized businesses who are also doing it tough," he said.

"Nevertheless, at a time when the economy and the labour market are clearly under growing pressures and when productivity growth has flatlined, it is a decision that adds to the risks of an inflation blowout; is likely to see interest rates rise further than they would have otherwise; and raises the likelihood that households will face further cost of living pressures. "

Business NSW (formerly the NSW Business Chamber) has also criticised the increase for putting further pressure on businesses.

"This large wage increase comes at a time when a growing proportion of businesses (about one in four employers) have indicated to us that they will shed staff in the next three months,” its CEO, Daniel Hunter said.

“Businesses are already tackling interest rate hikes, inflation, labour supply problems, energy price spikes, insurance cost spirals and other pressures.

“Business confidence also remains low, according to the Business Conditions Survey. This, combined with falling productivity levels, make now a bad time to be increasing wages by such a significant amount.”

How much will tax erode Fair Work's pay rises?

By Michael Janda

Why is the tax affect on such pay rises never mentioned? The case argued for the minimum wage to be increased at least to match inflation, but that approach fails to address the cost of living expenses properly given that any rise matched to inflation is eroded by the prevailing tax.

- Mike

This is a good question Mike.

For the first time in recent memory, someone working fulltime on the minimum wage with no tax deductions will slip above the 19 per cent tax bracket and into the 32.5 per cent one.

The threshold for that is $45,001 and the new full-time minimum wage on a 38-hour week will be $45,906 across the year.

The higher tax rate means they will pay about $122 extra from their pay rise in tax than if their extra income was taxed at the 19 per cent rate.

The easy solution to this "bracket creep"? Indexing the income tax brackets to some measure of inflation (like the Consumer Price Index) or wage rises (the Wage Price Index).

Conveniently, ABC News has just published my video explainer on how the stage three tax cuts work, why they don't really fix bracket creep (especially for lower paid workers), and why governments really don't want to end bracket creep.

Why is the minimum wage going up by 8.6% for some?

By Kate Ainsworth

We initially heard from the Fair Work Commission that both the minimum wage and award wage would increase by 5.75% from July 1 — but there is a technicality that means 184,000 people are actually going to get a pay bump of 8.6%.

Let me explain.

The FWC spent a good chunk of its decision talking about the C14 classification. For the last 25 years, that classification has been aligned with the national minimum wage.

In today's decision, the FWC is ending that alignment between C14 classification and the national minimum wage.

Instead, the national minimum wage will be aligned with a slightly higher classification of C13 — and that classification's wage rate will jump by 5.75%.

For those workers who were once on the C14 rate, it means they will be getting a total pay increase of 8.6%.

That's why the minimum wage in dollar values is now $23.23 an hour, or $882.80 a week.

If it were only a 5.75% increase, the hourly rate for those minimum wage workers would have been $22.60.

But the FWC has framed the increase in the minimum wage as only being a 5.75% increase, because that's the size of the increase in the C13 classification rate that the minimum wage will now be aligned with.