/W_W_%20Grainger%20Inc_%20supply%20warehouse-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Headquartered in Lake Forest, Illinois, W. W. Grainger, Inc. (GWW) is a Fortune 500 industrial supply company boasting a market capitalization of about $48.5 billion. Grainger offers an extensive range of maintenance, repair, and operating (MRO) products and services via its two main segments: High-Touch Solutions and Endless Assortment.

W. W. Grainger’s 2025 performance has not been smooth, with its shares underperforming the broader market and its sector peers in 2025. On a year-to-date (YTD) basis, the stock declined 3.8%, while the S&P 500 Index ($SPX) climbed around 10.6%. Over the past 52 weeks, W. W. Grainger’s shares have surged 4.8%, trailing behind SPX’s 16.3% gain.

Narrowing the focus, GWW stock fell behind the Industrial Select Sector SPDR Fund’s (XLI) 16.4% YTD gain and XLI’s 18.8% returns over the past 52 weeks.

W.W. Grainger’s subdued stock performance is grounded in a mix of operational strengths and market pressures. On the positive side, Q2 2025 results, released on Aug. 1, showed 5.6% year-over-year (YoY) sales growth amounting to $4.6 billion, and adjusted EPS rose 2.2% annually to $9.97.

However, the company’s performance was tempered by tariff-related pressures, which caused it to trim its full-year adjusted EPS guidance to $38.50 to $40.25 range, down from the previous range of $39 to $41.50 – leading to cautious investor sentiment amid macroeconomic uncertainty.

For the current fiscal year, ending in December 2025, analysts expect W.W. Grainger to report EPS growth of 1.6% YoY to $39.60, on a diluted basis. However, the company has a bleak earnings surprise history. It has missed the Street’s bottom-line estimates in three of the past four quarters, while beating on just one occasion.

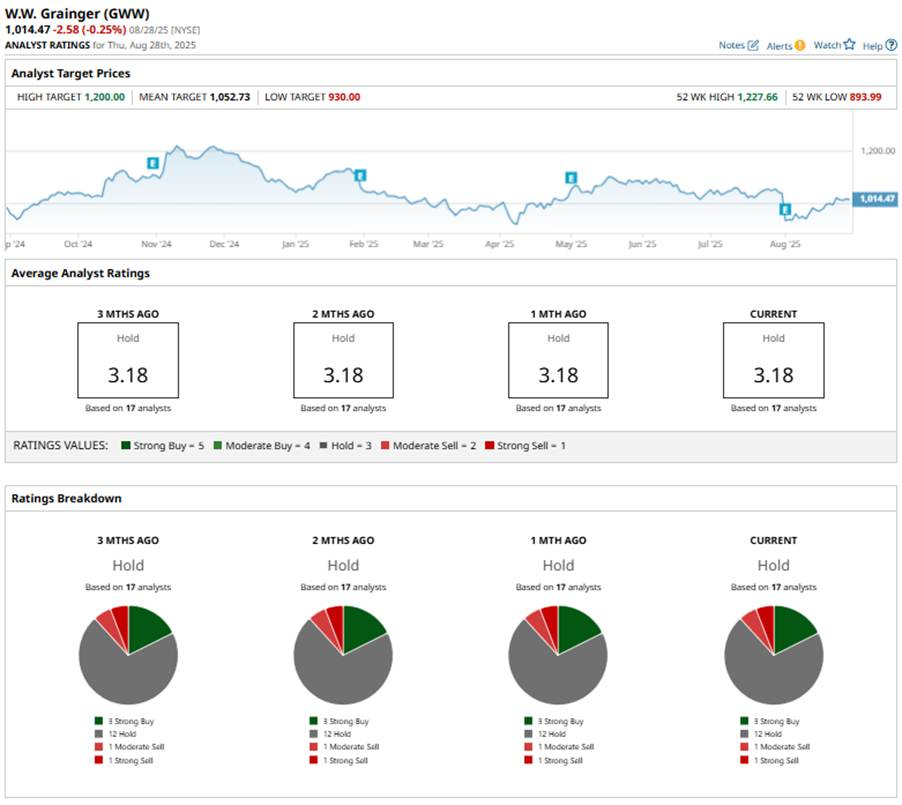

Overall, Wall Street appears cautious about GWW stock, with a consensus “Hold” rating. Of the 17 analysts offering recommendations, three are all in with a “Strong Buy,” 12 maintain a “Hold,” one advises a “Moderate Sell,” and the remaining one has a “Strong Sell” rating.

The current configuration has remained consistent over the past few months.

On Aug. 6, Wells Fargo cut GWW’s price target to $225 from $345, maintaining an “Underweight” rating, amid the macro uncertainties. Also, this month, BofA Securities slashed its price target to $930 from $970, while maintaining an “Underperform” rating, citing margin concerns.

The mean price target of $1,052.73 represents a premium of 3.8% to GWW’s current price. The Street-high price target of $1,200 suggests an upside potential of 18.3%.