Voya Financial (VOYA) just picked up a significant stake in Wolfspeed (WOLF), the struggling silicon carbide chipmaker that emerged from bankruptcy last month. The asset manager now owns 18.3% of Wolfspeed, or about 5.3 million shares, according to a regulatory filing. Wolfspeed shares briefly jumped over 2% on the news, though the filing indicates Voya's position is passive, meaning it won't push for board seats or operational changes. And WOLF stock dropped 4.4% on Friday and another 2.2% today.

Wolfspeed's recent bankruptcy restructuring dramatically reduced its share count and slashed debt levels. The company also moved its headquarters from North Carolina to Delaware and brought in five new board members. These changes were designed to give the silicon carbide maker a fresh start after financial struggles.

Is Wolfspeed Stock a Good Buy Right Now?

Wolfspeed operates in the silicon carbide semiconductor space, which is critical for electric vehicles (EVs) and renewable energy applications. Wolfspeed recently emerged from Chapter 11 bankruptcy protection last month with a dramatically improved balance sheet, slashing total debt by roughly 70% and cutting annual cash interest expenses by about 60%.

The silicon carbide chipmaker's restructuring pushed debt maturities out to 2030 and wiped out existing shareholders, who received just 3% to 5% of the new equity. Convertible noteholders and lender Renesas Electronics now control 95% of the company after exchanging $5.2 billion in debt for new notes and equity.

CEO Robert Feurle expressed confidence that the financial reset positions Wolfspeed to capitalize on growing demand in artificial intelligence, electric vehicles, industrial applications, and energy markets.

Moreover, a vertically integrated 200mm manufacturing footprint in the U.S. represents a competitive advantage, especially as silicon carbide semiconductors become critical for power electronics and EV charging infrastructure.

Fourth quarter (ended in June) revenue came in at $197 million, below prior-year sales of $201 million. It posted a GAAP gross margin of negative 13% and a non-GAAP gross margin of negative 1%. For the full fiscal year, revenue declined to $758 million from $807 million. The Mohawk Valley facility contributed $94.1 million in quarterly revenue, up from $41 million previously, but underutilization costs of $23.6 million continue weighing on margins.

Wolfspeed lost $4.30 per share on a GAAP basis in the quarter, compared to a $1.39 loss the prior year. Non-GAAP losses improved slightly to $0.77 per share from $0.89. For the full year, the GAAP loss per share ballooned to $11.39 from $4.56, while non-GAAP losses widened to $3.32 from $2.59.

The company maintains it has sufficient liquidity and plans to become free cash flow positive, supporting a self-funded business plan. Five new directors joined the board as part of the emergence.

While Wolfspeed operates in a promising sector with strong secular tailwinds, investors should recognize that this remains a turnaround story with execution risks. The company needs to ramp up production at its new facilities while simultaneously improving margins and achieving profitability.

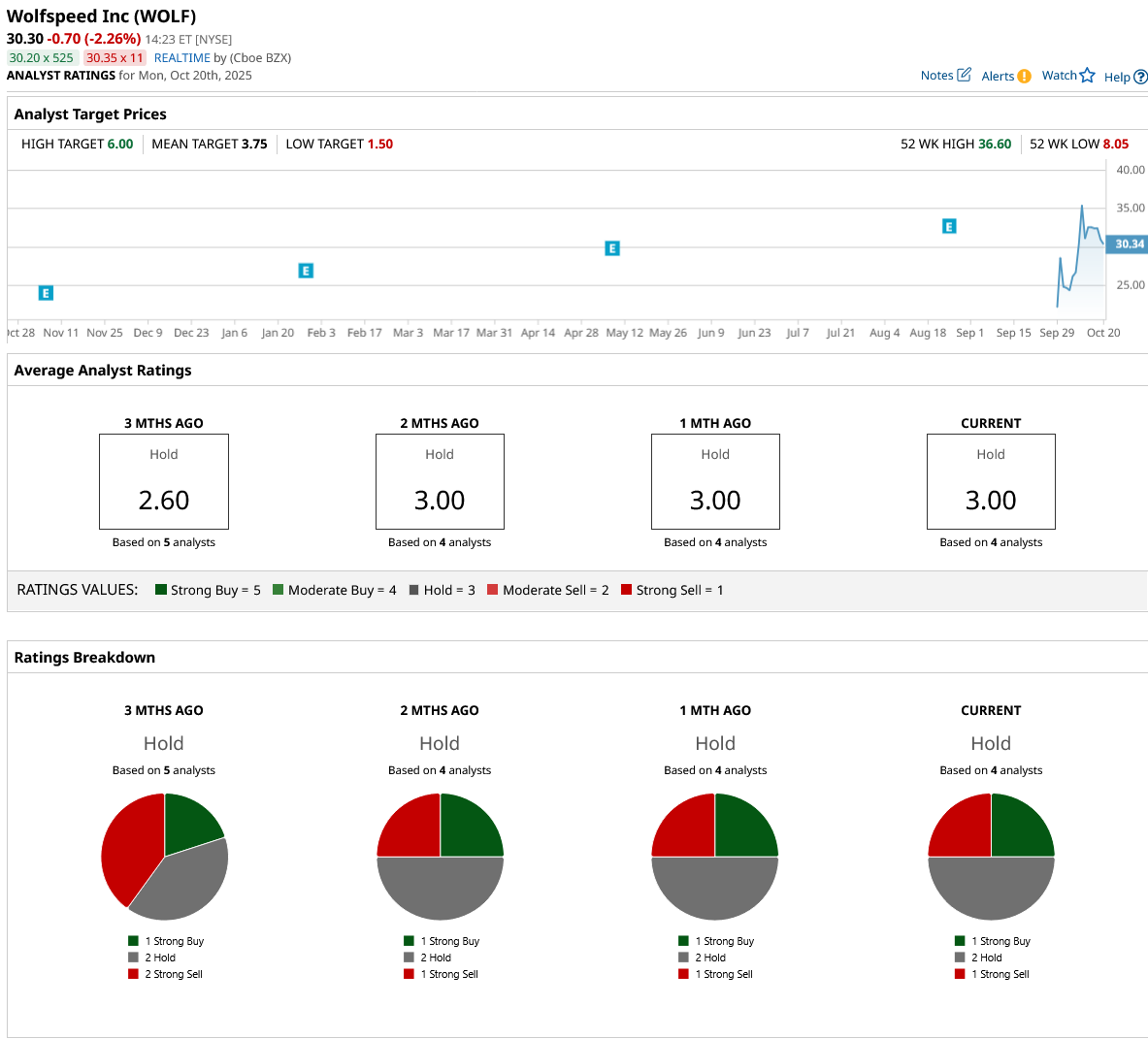

What Is the WOLF Stock Price Target?

Analysts tracking WOLF stock forecast revenue to increase from $757.6 million in fiscal 2025 to $997.5 million in fiscal 2027. Compared to a free cash outflow of $2 billion in 2025, analysts forecast free cash flow to improve to $224 million in 2026 and $62 million in 2027.

Out of the four analysts covering WOLF stock, one recommends “Strong Buy,” two recommend “Hold,” and one recommends “Strong Sell.” The average WOLF stock price target is $3.75, well below the current price of $30.