The markets have delivered their verdict. They want Rachel Reeves, and no one else will do. If the chancellor needed saving, they’ve done the job, boosting her political clout in the process.

The events of the last 24 hours have been quite remarkable, almost on a level with the Truss mini-Budget, when the City’s appalled reaction resulted in the near collapse of several big pension funds, and ultimately led to the end of a premiership before a now-infamous lettuce had rotted.

The tearful expression on the face of a visibly upset Reeves, and a less than ringing endorsement from a prime minister who had previously said she would be in place for the full parliament, triggered a panic, with some of the biggest movements in UK government bond prices recorded since the “Trussterf***” Budget.

They were swiftly relocated to the bargain bin, while the pound was confronted by a sea of red on dealers’ screens. Lower bond prices mean higher yields – or interest rates – making it more expensive for the government to service the national debt. Some estimates put the cost of the moves at close to £2bn annually in the absence of a recovery.

Reeves’ tears might thus be the most expensive in history. Consider that the producers of Gravity paid Sandra Bullock an estimated $70m (£51m) for hers. The chancellor’s were nearly 40 times as costly prior to this morning’s recovery. Doubtless, the Bank of England will have put in a call to ask what on earth was going on.

Threadneedle Street will play a key role in dealing with the fallout. Smile if you’re a borrower: I could be wrong, but I suspect this may make an interest rate cut more likely. That, too, would be just the ticket for Reeves. It would ease some of the pressure she faces by making borrowing cheaper and giving the economy a much-needed boost.

Why are markets riding to the chancellor’s rescue? They know that Reeves is the most fiscally hawkish – and thus the most market-friendly – figure at the top of the Labour Party. She continues to insist that she will stick to her fiscal rules, governing tax, spending and borrowing, and hinted that the welfare climbdown will be felt in the forthcoming budget as a result.

We should really add the word “relatively” to the phrase “fiscally hawkish”. The chancellor changed the way the national debt was calculated to make it easier to balance the books after she took office. And she made room to pump more than £100bn of debt-funded investment spending into the economy (which I would endorse if the right projects are chosen). The government needs to get the economy moving. We all need it to get moving. There will be no money for public services if it remains stuck in the middle of a muddy field, and there will be more tax to pay.

But even with all that, the City has looked at the possible alternatives and baulked. It trusts Reeves to (more or less) hold the line from hereon out, to be the voice of fiscal responsibility in government, to resist demands for more spending/further concessions from the left of the party. It does not trust anyone else to be so tough. Replacing Reeves could thus prove appallingly expensive: Britain’s IOUs would once again find themselves on the sales rail.

If Reeves’ expression and Starmer’s cack-handed comments could have cost the country £2bn based purely on speculation, just imagine how high the price might be if she departed. This explains why No 10 rushed into damage control mode and Starmer took to the nation’s TV screens, computer monitors and mobile phones to insist that he and Reeves are in “lockstep”. “She will be chancellor for a very long time to come,” he told the BBC. Starmer urgently needs to take some lessons in politics. Much of this is on him, although Reeves deserves criticism too.

The markets have nonetheless given her a big boost: the morning after saw UK bonds recovering some of their losses, while the pound gained some poise. Credibility like that matters to chancellors and governments, particularly when the national debt as a proportion of GDP is running at its highest level in half a century.

The more conspiratorial, less rational parts of the left, and even parts of the right these days, too – read some of Truss’s supporters if you don’t believe me – think they can and should be taken on. The lesson of the past couple of days is that they can’t. Doing so would be suicidal.

Fortunately for Reeves and Starmer, the economy could yet join forces with the City to cement her position. The forward-looking PMI (Purchasing Managers Index) for the crucial services sector turned in a number of 52.8 – anything above 50 indicates growth – in June. That is its best result since August 2024. At the same time, indications of slowing service price inflation could also encourage the fence-sitters on the Bank of England’s Monetary Policy Committee to believe that a rate cut is justified despite inflation running above target.

If the economy does pick up a little steam and if lower interest rates provide a further boost, then Reeves could yet have the last laugh. The chancellor, whose evident unhappiness in the Commons was blamed on a personal matter, will still need a little luck to get there. She has precious little room for manoeuvre and almost no fiscal headroom left. But she might just have found some auspicious fortune cookies.

For crying out loud: are you ready for the ‘politics of pain’ about to hit us?

Badenoch’s lack of empathy over Reeves’s tears will come back to haunt her

Watching Rachel Reeves crying in the Commons was quietly devastating

It’s hard to see how Rachel Reeves can survive

The BBC claims impartiality over Gaza but there’s a conflict of interest at its heart

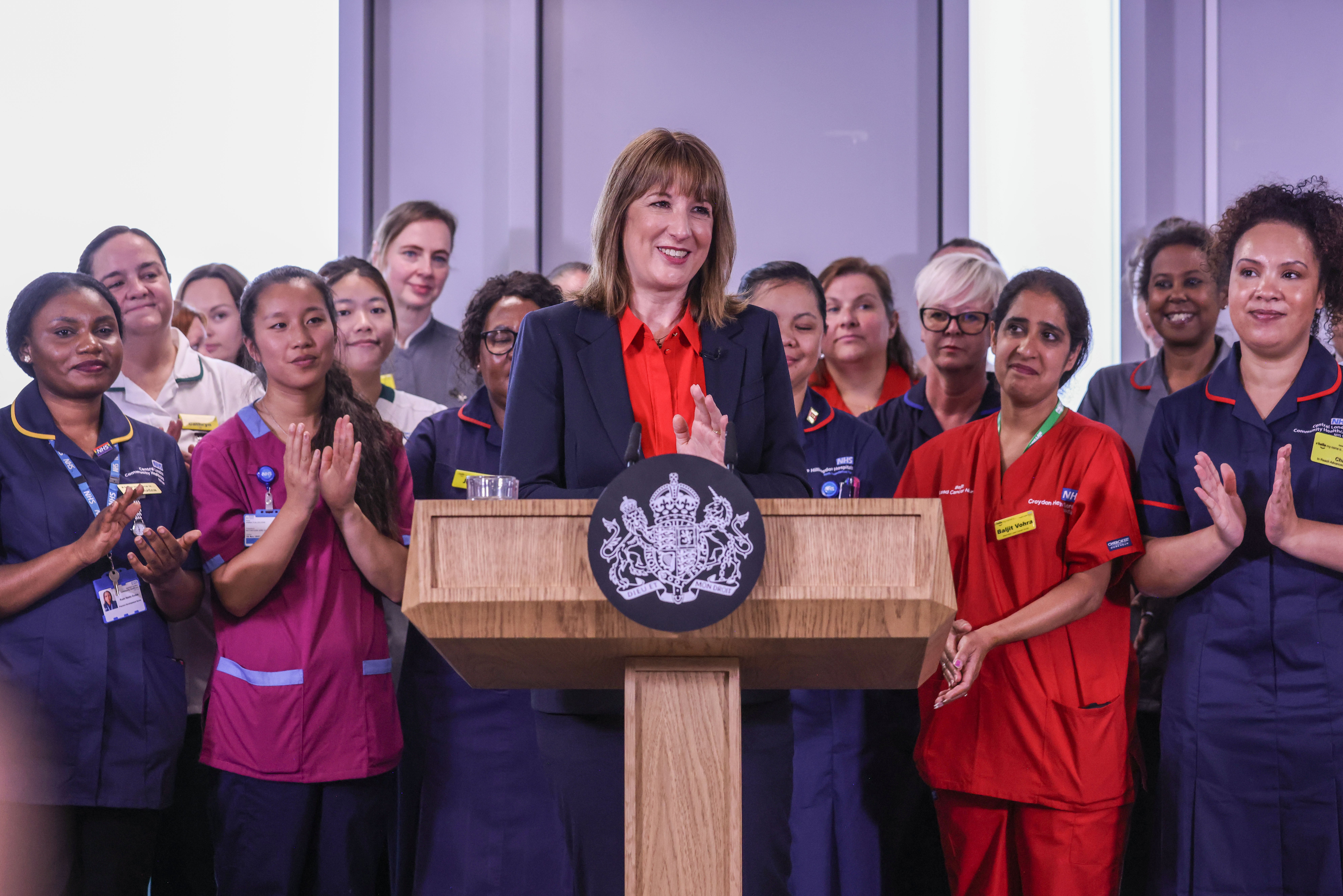

Have your say: Can Labour’s 10-year plan finally fix the NHS?