Robinhood Markets Inc. (NASDAQ:HOOD) CEO Vlad Tenev shared his perspective on the potential role of cryptocurrency in the company’s future revenue in a podcast aired Tuesday.

HOOD is showing strength near its 52-week high. See real-time price here.

Crypto To Drive Robinhood’s Growth?

During the Thinking Crypto podcast with Tony Edward, Tenev was asked if he envisioned cryptocurrency as the biggest component of Robinhood’s business by 2030.

“I think it depends on how you measure crypto. So if crypto includes tokenization of real-world assets, like stocks, I think that could grow rather large,” Tenev responded.

See Also: Robinhood Markets Director Sold $157.86M In Company Stock

Tokenization Very Much Like Stablecoin, Says Tenev

Tenev believed that the majority of investments would remain in assets with fundamental utility, including real estate, private credit, private equity, public stocks and art or collectibles. However, if these assets are tokenized, they could be categorized as cryptocurrency revenue.

He likened the idea of tokenization to stablecoin, stating that tokenization puts U.S. stocks on the blockchain in the same way that stablecoin puts the U.S. dollar on the blockchain.

“In the U.S., it’s really about 24/7 trading, it’s about lower settlement times and the DeFi interoperability,” he added.

Positive Outlook For Equity Tokenization

Tenev’s comments come in the context of Robinhood’s ongoing efforts to work with U.S. regulators to unlock opportunities in tokenized stocks. The company has expressed a positive outlook towards the future of equity tokenization in the U.S, despite potential regulatory hurdles.

Robinhood unveiled a suite of products during its event in France for its European customers, the highlight of which was blockchain-powered tokenized equities of companies like OpenAI and SpaceX. The offerings ran into controversy after OpenAI denied it was involved with them.

The company reported its second-quarter financials last week, with crypto revenue nearly doubling year-over-year and accounting for 30% of its overall transaction-based revenue.

Price Action: Shares of Robinhood dipped 0.28% in after-hours trading after closing 0.18% higher at $105.64 during Wednesday’s regular trading session, according to data from Benzinga Pro. The stock has gained 13% over the last month.

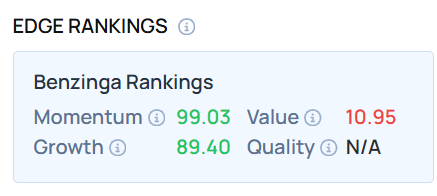

HOOD exhibited very high Momentum and Growth scores as of this writing. Wondering how it compares to the highest-weighted stock in your portfolio? Go to Benzinga Edge Stock Rankings.

Photo Courtesy: mundissima on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.