Asset management company, Strive Inc. (NASDAQ:ASST) has been surging since Friday, with the stock up 27.29% during the day and another 40% in overnight trade.

The company was founded by former Republican Presidential hopeful Vivek Ramaswamy as an “anti-woke” and “anti-ESG” asset manager, aimed at countering the growing politicization of corporate America by other large asset managers such as BlackRock Inc. (NYSE:BLK), State Street Corp. (NYSE:STT) and The Vanguard Group.

Merger And Bitcoin Treasury Strategy

Strive recently announced its pivot to becoming a Bitcoin-focused asset manager, which comes after its merger with Asset Entities Inc. (NASDAQ:ASST) last month, with the company continuing to trade on the NASDAQ with the same ticker symbol ASST.

A few weeks later, it announced plans to acquire Semler Scientific Inc. (NASDAQ:SMLR) in an all-stock deal, bringing over 5,000 Bitcoins (CRYPTO: BTC) to its treasury.

This comes in addition to the company’s own efforts to raise $1.5 billion via private placement financing and exercising available warrants to finance its Bitcoin purchases.

Through a combination of mergers, acquisitions and direct purchases, Strive now holds an estimated 10,900 Bitcoins, worth $1.26 billion in its corporate treasury, making it one of the largest Bitcoin Treasuries.

Retail Investor Attention

The stock witnessed a pullback in early October, after it filed to register nearly 1.3 billion new shares, which led to fears of dilution among existing shareholders.

This led the company’s valuation to briefly dip below the value of its Bitcoin holdings, which resulted in growing interest from retail investors.

On Friday, the stock’s initial rally was led by Mike Alfred, a popular independent investor on X, who announced that he had acquired 1 million shares in Strive, while referring to it as “one of the most promising BTC Treasury companies globally,” which was currently trading at an attractive level.

Alfred, a former fintech entrepreneur, has spearheaded several prominent retail-led rallies in recent months and currently serves on the boards of Bakkt Holdings Inc. (NYSE:BKKT) and IREN (NASDAQ:IREN).

Since Alfred’s announcement, Strive has become the second most trending stock on Reddit and fifth on Yahoo Finance, which signals growing retail interest in the company.

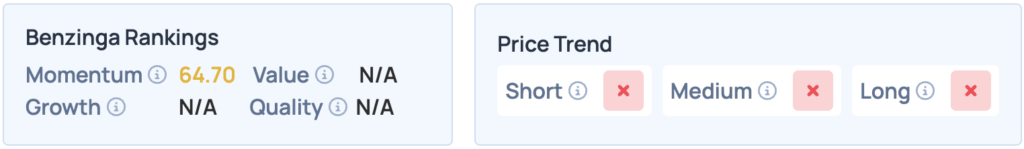

The stock was up 27.29% on Friday, ending the week at $1.10, and is currently surging by another 40% in overnight trade. It scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Photo Courtesy: Maxim Elramsisy on Shutterstock.com

Read More: