Viking Therapeutics Inc. (NASDAQ:VKTX) saw its stock collapse by over 42% on Tuesday after data from its Phase 2 obesity pill trial disappointed investors, sparking a fierce debate between Wall Street bulls and critical biotech experts.

Check out VKTX’s stock price over here.

Bulls See A Generational Buying Opportunity

While the stock’s plunge erased billions in market value, some analysts are calling it a massive overreaction and a prime buying opportunity, while others argue the data reveal a drug that is uncompetitive against market leaders like Eli Lilly And Co. (NYSE:LLY) and Novo Nordisk A/S (NYSE:NVO).

On one side of the divide, Wall Street firms are doubling down. Raymond James issued a “Strong Buy” rating with a staggering $129 price target, citing impressive placebo-adjusted weight loss.

Analysts at William Blair echoed this sentiment, calling the dramatic sell-off “extreme and unwarranted.” They argue that investors over-indexed on tolerability concerns and discontinuation rates, which they believe can be managed in future trials, and missed the positive efficacy signals.

Bears Point To Fatal Flaws In Obesity Data

However, medical and biotech experts on the social media platform X painted a starkly different picture. Biotech investor Adam May provided a direct comparison, concluding that Viking’s drug appears “clearly inferior” to Eli Lilly’s tirzepatide based on available data.

He noted that Viking’s pill requires “14x and 28x more API” than Lilly’s drug, creating a “huge headwind for the company.”

This critique was amplified by others, like Hataf Capital, who pointed to a high trial dropout rate of 20% for patients on the drug, compared to just 5.7% for those on placebo, questioning the drug’s real-world viability.

Eli Lilly’s Potential Target Just Got 42% Cheaper?

The data showed that patients achieved up to a 12.2% mean body weight reduction after 13 weeks, but concerns over tolerability and higher-than-expected discontinuation rates overshadowed the results.

This dramatic turn of events comes just days after Chief Market Strategist at Futurum Equities, Shay Boloor, speculated that Eli Lilly’s recent 40-year bond issuance could be a prelude to acquiring Viking, leaving investors to wonder if the now 42% cheaper company is a bargain or a damaged asset.

Price Action

Viking Therapeutics fell 42.12% to $24.36 on Tuesday and rose 0.16% in after-hours trading. It has lost 40.76% on a year-to-date basis and 63.17% over the past year.

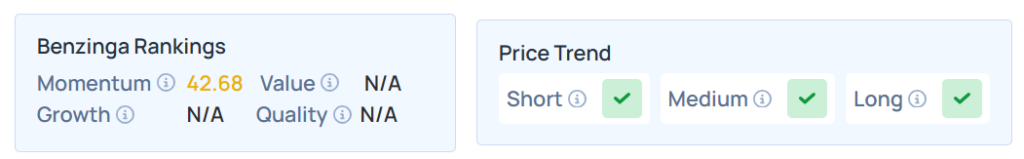

Benzinga's Edge Stock Rankings indicate that VKTX maintains a stronger price trend over the short, medium, and long terms. However, the stock scores moderately on momentum rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower in premarket on Tuesday. The SPY was down 0.54% at $639.81, while the QQQ declined 1.36% to $569.28, according to Benzinga Pro data.

On Wednesday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading lower.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock