Valued at a market cap of $33 billion, VICI Properties Inc. (VICI) is a top experiential real estate investment trust. Headquartered in New York, it owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas. The company is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Thursday, Oct. 30.

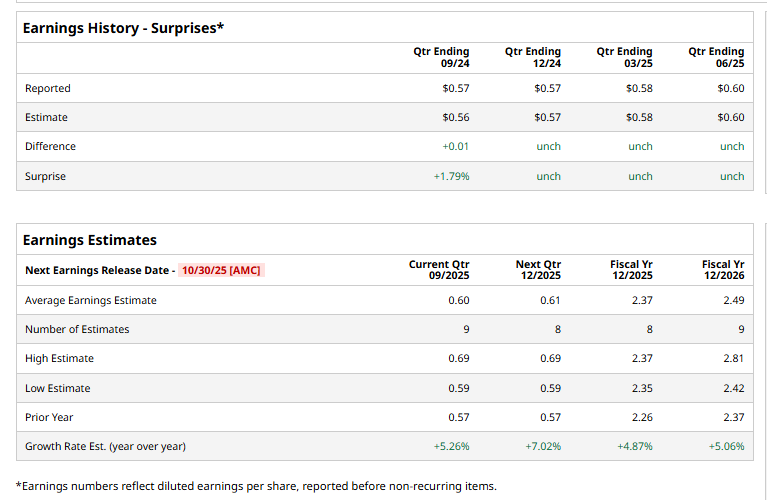

Ahead of this event, analysts expect this experiential REIT to report an FFO of $0.60 per share, up 5.3% from $0.57 per share in the year-ago quarter. The company has met or exceeded Wall Street’s FFO estimates in each of the last four quarters.

For fiscal 2025, analysts expect VICI to report FFO of $2.37 per share, up 4.9% from $2.26 per share in fiscal 2024. Furthermore, its FFO per share is expected to grow 5.1% year-over-year to $2.49 in fiscal 2026.

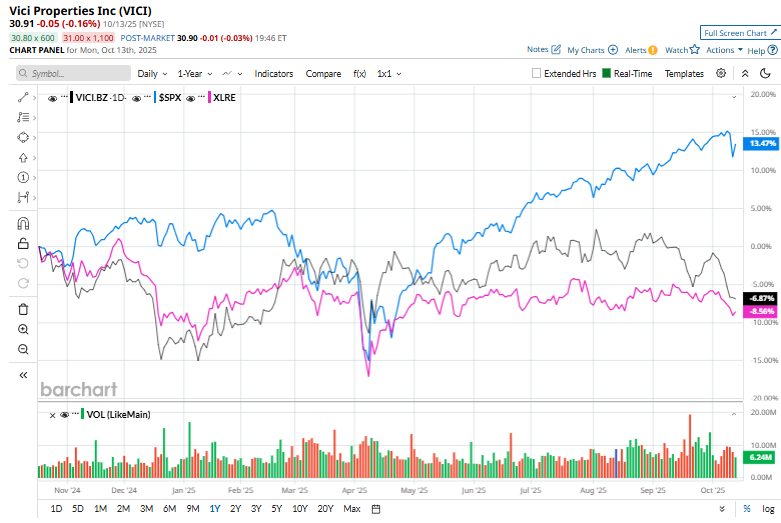

Shares of VICI have dropped 5% over the past 52 weeks, trailing the S&P 500 Index's ($SPX) 14.4% uptick but surpassing the Real Estate Select Sector SPDR Fund’s (XLRE) 5.8% fall over the same time frame.

VICI delivered its Q2 results on Jul. 30, and its shares rose marginally in the following trading session. The company reported quarterly revenue of $1 billion, up 4.6% year over year and marginally above consensus estimates. Higher income from sales-type leases, along with growth in income from lease financing receivables, loans and securities, supported its top-line performance.

Additionally, its AFFO of $0.60 per share improved 5.3% from the same period last year, meeting analyst estimates. Looking ahead, VICI raised its fiscal 2025 AFFO per share guidance to $2.35 to $2.37, further bolstering investor confidence.

Wall Street analysts are highly optimistic about VICI’s stock, with a "Strong Buy" rating overall. Among 23 analysts covering the stock, 18 recommend "Strong Buy," one indicates a "Moderate Buy," and four suggest "Hold.” The mean price target for VICI is $36.86, which indicates a 19.2% potential upside from the current levels.