/Verisk%20Analytics%20Inc%20office%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Jersey City, New Jersey-based Verisk Analytics, Inc. (VRSK) provides data analytics and technology solutions to the insurance markets. With a market cap of $34 billion, the company offers data, statistical, and actuarial services, as well as standardized insurance policy programs, underwriting information, and rating-integrity tools. VRSK provides data and software information services to the property and casualty and mortgage industries. The leading strategic data analytics and technology company is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 29.

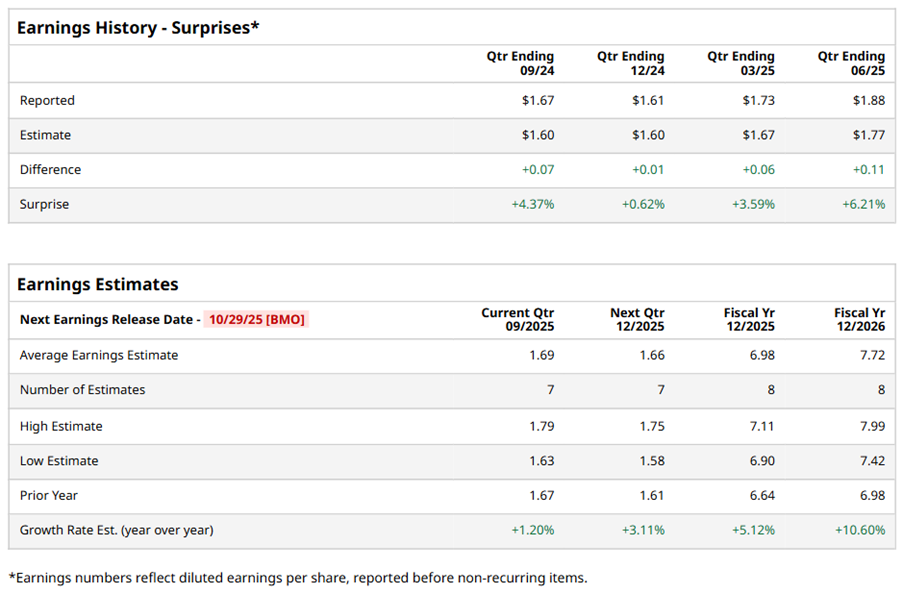

Ahead of the event, analysts expect VRSK to report a profit of $1.69 per share on a diluted basis, up 1.2% from $1.67 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect VRSK to report EPS of $6.98, up 5.1% from $6.64 in fiscal 2024. Its EPS is expected to rise 10.6% year-over-year to $7.72 in fiscal 2026.

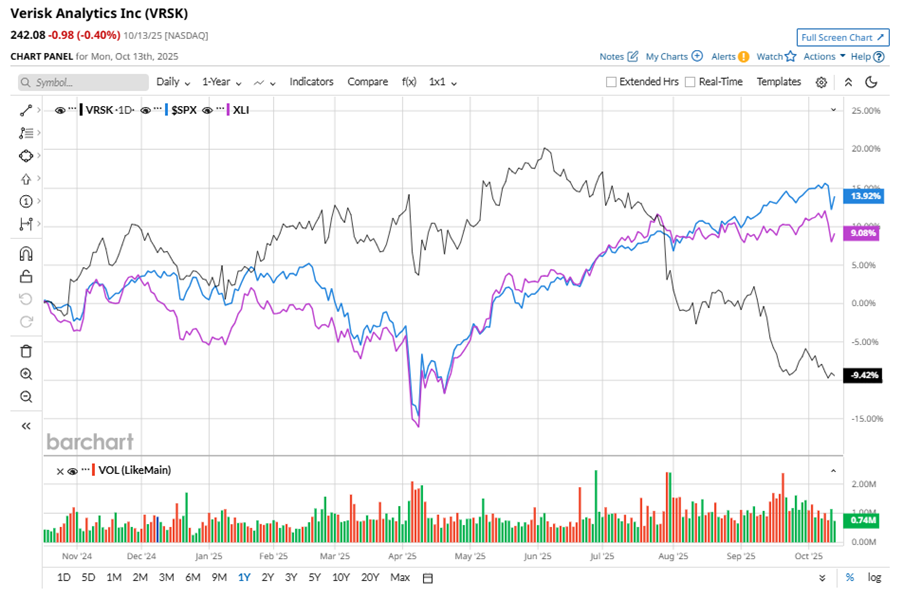

VRSK stock has underperformed the S&P 500 Index’s ($SPX) 14.4% gains over the past 52 weeks, with shares down 9.8% during this period. Similarly, it underperformed the Industrial Select Sector SPDR Fund’s (XLI) 9.4% gains over the same time frame.

VRSK has underperformed due to margin pressures from acquisitions and elevated expenditure.

On Jul. 30, VRSK shares closed down more than 6% after reporting its Q2 results. Its adjusted EPS of $1.88 exceeded Wall Street expectations of $1.77. The company’s revenue was $772.6 million, topping Wall Street forecasts of $768.5 million. Verisk expects full-year adjusted EPS in the range of $6.80 to $7, and expects revenue in the range of $3.09 billion to $3.13 billion.

Analysts’ consensus opinion on VRSK stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 21 analysts covering the stock, eight advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and 11 give a “Hold.” VRSK’s average analyst price target is $308.28, indicating a notable potential upside of 27.3% from the current levels.