/Verisign%20Inc_%20sign%20on%20HQ%20building-by%20DCStockPhotography%20via%20Shutterstock.jpg)

VeriSign, Inc. (VRSN), headquartered in Reston, Virginia, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names. Valued at $26.7 billion by market cap, the company enables the security, stability, and resiliency of key internet infrastructure and services, as well as provides root zone maintainer services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and VRSN perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the software infrastructure industry. VeriSign dominates the domain name registry market, managing .com and .net domains. Its robust infrastructure, trusted brand, and operation of two root servers solidify its pivotal role in the internet ecosystem.

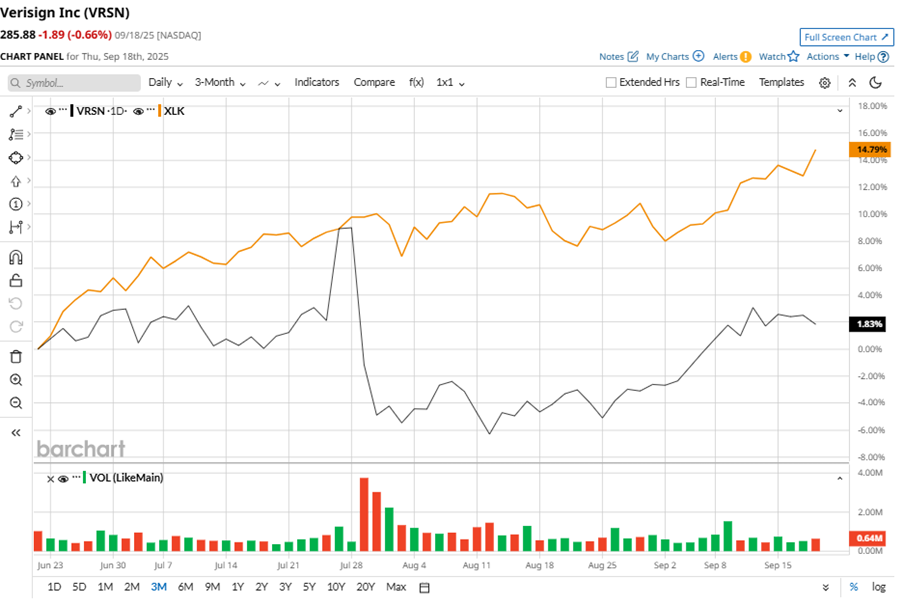

Despite its notable strength, VRSN shares slipped 8% from their 52-week high of $310.60, achieved on Jul. 28. Over the past three months, VRSN stock has gained 1.7%, underperforming the Technology Select Sector SPDR Fund’s (XLK) 14.3% gains during the same time frame.

In the longer term, shares of VRSN rose 38.1% on a YTD basis and climbed 59.5% over the past 52 weeks, outperforming XLK’s YTD gains of 18.8% and 27.1% returns over the last year.

To confirm the bullish trend, VRSN has been trading above its 50-day and 200-day moving averages over the past year, with some fluctuations.

On Jul. 24, VRSN reported its Q2 results, and its shares closed up by 6.7% in the following trading session. Its revenue stood at $409.9 million, up 5.9% year-over-year. The company’s EPS increased 10% from the year-ago quarter to $2.21.

In the competitive arena of software infrastructure, GoDaddy Inc. (GDDY) has lagged behind VRSN, falling 25.8% on a YTD basis and 5.1% over the past 52 weeks.

Wall Street analysts are bullish on VRSN’s prospects. The stock has a consensus “Strong Buy” rating from the two analysts covering it, and the mean price target of $338.50 suggests a potential upside of 18.4% from current price levels.