Chicago, Illinois-based Ventas, Inc. (VTR) is a leading real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. With a market cap of $35.2 billion, Ventas operates numerous senior housing communities, providing valuable services to residents.

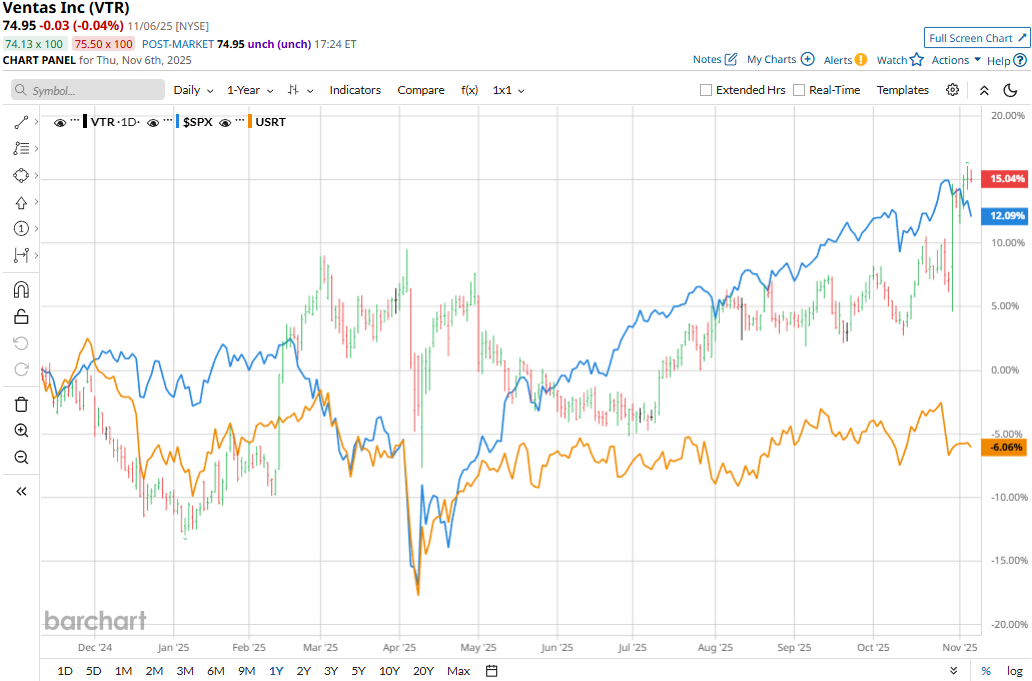

The senior housing giant has significantly outpaced the broader market over the past year. VTR stock prices have soared 18.6% over the past 52 weeks and 27.3% on a YTD basis, outpacing the S&P 500 Index’s ($SPX) 13.4% gains over the past year and 14.3% returns in 2025.

Narrowing the focus, Ventas has also outpaced the industry-focused iShares Core U.S. REIT ETF’s (USRT) marginal 35 bps uptick in 2025 and 3.7% decline over the past 52 weeks.

Ventas' stock prices soared 6.6% in the trading session following the release of its robust Q3 results on Oct. 29. The company has continued to observe broad-based demand growth across its senior housing operating portfolio (SHOP). This has encouraged the company to invest $2.2 billion in senior housing acquisitions in the first three quarters of 2025, which is expected to significantly boost revenues in the coming quarters. In Q3, the company’s same-store SHOP cash operating revenues grew 8% year-over-year, leading to a solid 20.4% surge in total revenues to $1.5 billion, beating the consensus estimates by 3.9%.

Moreover, Ventas delivered solid growth in same-store net operating income (NOI) and aggregate NOI. Meanwhile, its normalized funds from operations (NFFO) per share grew by a solid 10% year-over-year to $0.88, beating the Street’s expectations by 1.2%.

For the full fiscal 2025, ending in December, analysts expect VTR to deliver an NFFO of $3.46 per share, up 8.5% year-over-year. On a more positive note, the company has a solid FFO surprise history. It has surpassed the Street’s cash flow estimates in each of the past four quarters.

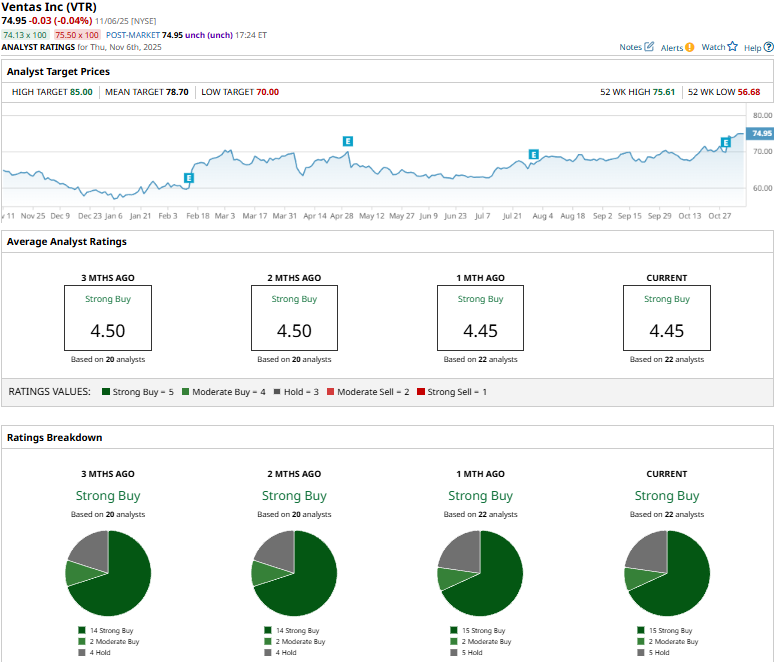

Among the 22 analysts covering the VTR stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buys,” two “Moderate Buys,” and five “Holds.”

This configuration is slightly better than two months ago, when 14 analysts gave “Strong Buy” recommendations.

On Oct. 31, Cantor Fitzgerald analyst Richard Anderson reiterated an “Overweight” rating on VTR and raised the price target from $77 to $85, suggesting a 13.4% upside potential.

As of writing, VTR’s mean price target of $78.70 represents a modest 5% premium to current price levels.