Velo3D Inc. (NASDAQ:VELO) shares declined 2.7% in pre-market trading despite news of a $6 million U.S. Navy contract and successful uplisting to the NASDAQ Capital Market after completing a $17.5 million public offering.

Check out the current price of VELO stock here.

Navy Awards $6 Million Contract For Ship Component Manufacturing

The Fremont, California-based additive manufacturing company secured a contract to develop and qualify copper-nickel alloy (CuNi) for its Sapphire XC large-format 3D printers. The agreement supports the U.S. Navy Maritime Industrial Base Program’s efforts to accelerate ship repairs through advanced manufacturing.

“Velo3D is proud to be the first U.S.-based OEM with domestically developed Laser Powder-Bed Fusion additive manufacturing solutions to develop CuNi for its systems,” said CEO Arun Jeldi.

CuNi offers exceptional seawater corrosion resistance but presents manufacturing challenges through traditional casting methods. Velo3D’s Rapid Production Solution can produce these critical naval components faster than conventional sourcing while improving supply chain resiliency.

Fresh Nasdaq Listing After Public Offering

The innovative Manufacturing company completed its return to major exchange trading on August 19, raising $17.5 million through the sale of 5.83 million shares at $3.00 each. Trading under ticker “VELO” replaced its previous OTCQX listing under “VLDX.”

Lake Street Capital Markets served as the sole book-running manager for the offering, which included a 30-day option for underwriters to purchase an additional 875,000 shares.

Strategic Defense Partnerships Drive Growth

Velo3D has established itself as a key supplier to major aerospace and defense contractors, including Elon Musk's SpaceX, Lockheed Martin Corp. (NYSE:LMT), and Aerojet Rocketdyne. SpaceX exclusively uses Velo3D’s Sapphire technology as its sole 3D printing platform.

The company’s large-format Sapphire XC printer can produce parts up to 600mm in diameter and 550mm in height, potentially becoming the first printer of its size to qualify CuNi components for naval applications.

Market Performance and Outlook

According to Benzinga Pro data, VELO closed at $3.34 on Thursday, down 81.9% over the past year with a market capitalization of $46.99 million. The stock trades in a 52-week range of $2.81-$4.25 with an average daily volume of 162,090 shares.

The Navy partnership and Nasdaq uplisting position Velo3D to capitalize on the growing demand for domestically produced additive manufacturing solutions in defense applications.

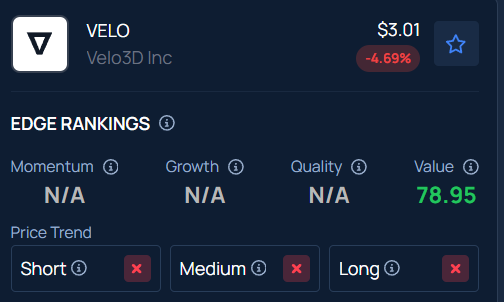

Benzinga’s Edge Stock Rankings indicates Velo3D has a Value score of 78.95. Find out the stock value of skin-care brands.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock