San Antonio, Texas-based Valero Energy Corporation (VLO) is an international manufacturer and marketer of transportation fuels and petrochemical products. Valued at $48.7 billion by market cap, Valero employs nearly 10,000 people and operates 15 petroleum refineries with a combined throughput capacity of approximately 3.2+ million barrels per day.

Companies worth $10 billion or more are generally described as “large-cap stocks.” VLO fits this bill perfectly. Given the company’s extensive operations and dominance in the oil & gas refining & marketing industry, its valuation above this mark is unsurprising.

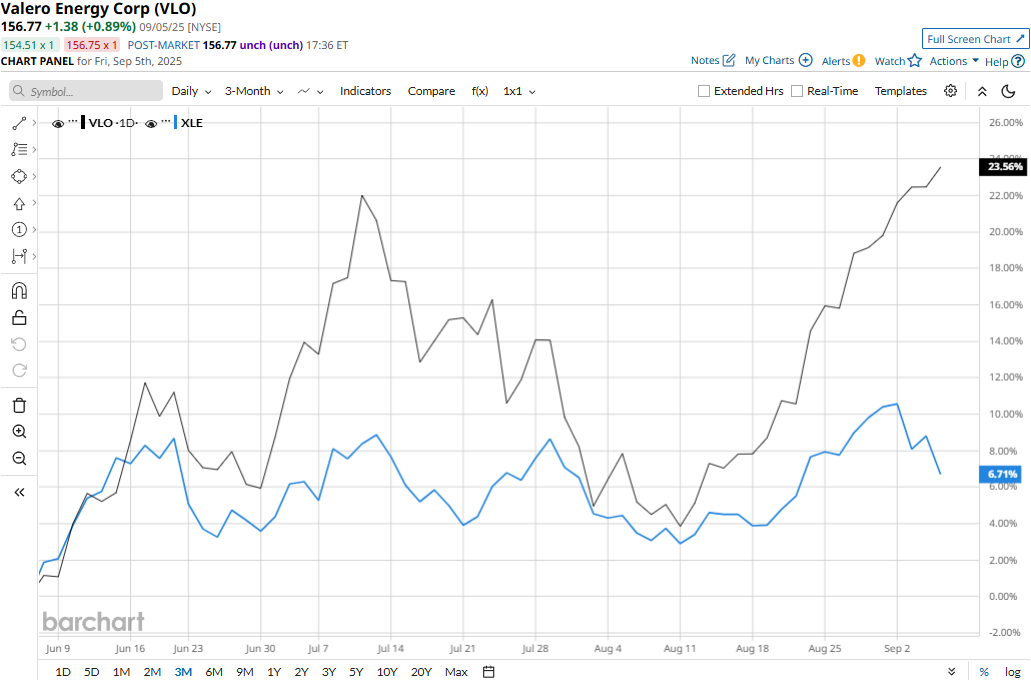

VLO touched its 52-week high of $159.26 on Sept. 3 and is currently trading 1.6% below that peak. Meanwhile, over the past three months, VLO stock has soared 23.6%, notably outperforming the Energy Select Sector SPDR Fund’s (XLE) 6.7% uptick during the same time frame.

Valero has outperformed the broader energy sector over the longer term as well. VLO stock has surged 27.9% on a YTD basis and 15.7% over the past 52 weeks, outperforming XLE’s 2% gains in 2025 and a marginal 30 bps uptick over the past year.

To confirm the recent upsurge, VLO has remained above its 200-day moving average since mid-June and above its 50-day moving average for the past few weeks.

Despite beating Wall Street’s expectations, Valero’s stock prices plunged 4.9% in a single trading session following the release of its Q2 results on Jul. 24. The company’s topline has remained under pressure in recent quarters. Valero’s revenues for the quarter declined 13.3% year-over-year to $29.9 billion, but surpassed the Street’s estimates by 7.4%. Furthermore, its EPS plunged 15.9% year-over-year to $2.28, but exceeded the consensus estimates by 31.8%.

While the company’s throughput volumes decreased from 3 million barrels a day in the year-ago quarter to 2.9 million barrels a day, its refining margin increased from $11.14 per barrel to $12.35 per barrel, which supported Valero’s financials. Following the initial dip, VLO stock prices gained 3.1% over the two subsequent trading sessions.

Meanwhile, Valero has notably outperformed its peer, Phillips 66’s (PSX) 15.5% surge in 2025 and 2.1% uptick over the past 52 weeks.

Among the 20 analysts covering the VLO stock, the consensus rating is a “Moderate Buy.” Its mean price target of $159.28 suggests a modest 1.6% uptick from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.