Valero Energy Corporation (VLO) is a leading American energy company headquartered in San Antonio, Texas. As the largest independent petroleum refiner globally, Valero operates 15 refineries across the U.S., Canada, and the U.K. and is currently trading at a market cap of $50.8 billion.

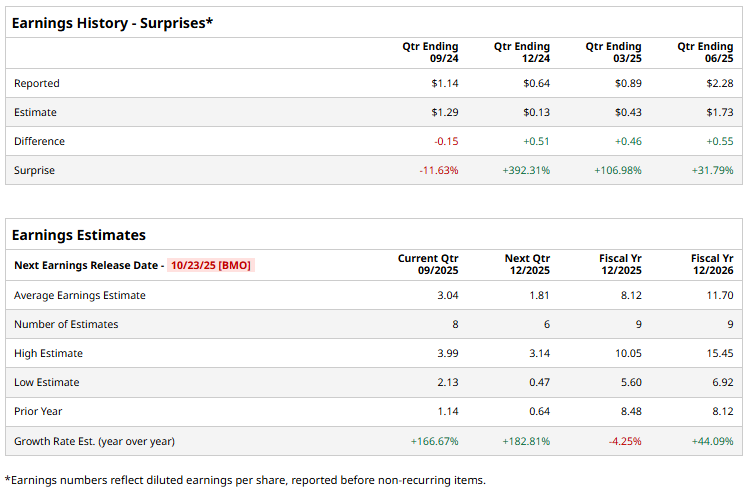

The energy behemoth is set to unveil its third-quarter results on Thursday, Oct. 23, before the market opens. Ahead of the event, analysts expect VLO to report non-GAAP earnings of $3.04 per share, up 166.7% from the profit of $1.14 per share reported in the year-ago quarter. Additionally, the company has surpassed the Street’s bottom-line projections in three of the past four quarters, while missing on one occasion.

For the current year, its earnings are expected to be $8.12 per share, down 4.3% from $8.48 per share reported in the year-ago quarter. However, in fiscal 2026, its earnings are expected to rise 44.1% year-over-year to $11.70 per share.

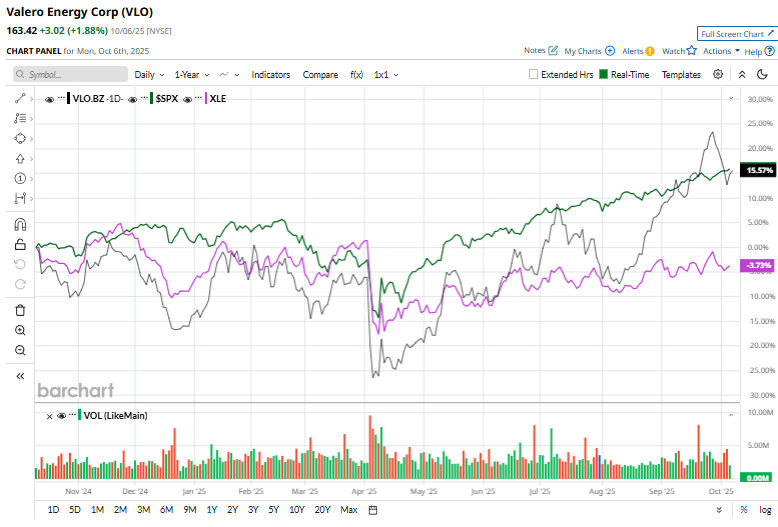

VLO stock has surged 14.8% over the past 52 weeks, outperforming the Energy Select Sector SPDR Fund’s (XLE) 4.1% decline but underperforming the S&P 500 Index’s ($SPX) 17.2% uptick during the same time frame.

On Sept. 30, Valero Energy fell more than 1% as energy producers and service providers retreated following a drop in WTI crude oil to a one-week low.

The consensus opinion on VLO is fairly optimistic, with a “Moderate Buy” rating overall. Of the 19 analysts covering the stock, opinions include 11 “Strong Buys,” one “Moderate Buy,” and seven “Holds.” VLO’s mean price target of $171.12 indicates a potential upswing of 4.7% from the current market price.