Shares of UWM Holdings Corp (NYSE:UWMC) are trading higher Friday morning, as a surprisingly weak August jobs report sent waves across Wall Street, fueling expectations of imminent Federal Reserve interest rate cuts.

What To Know: The U.S. economy added just 22,000 jobs last month, falling drastically short of the 75,000 economists had anticipated. This sharp slowdown in the labor market is seen as a potential signal that the Fed could be forced to cut rates to stimulate the economy, perhaps as early as its September 17 meeting.

For a mortgage giant like UWMC, the prospect of lower interest rates is a significant tailwind. Cheaper borrowing costs are expected to drive a surge in mortgage refinancing activity and boost demand for new home loans.

This increase in loan volume would directly bolster the company's revenue and profitability. The news also sent Treasury yields tumbling, further paving the way for lower mortgage rates for consumers.

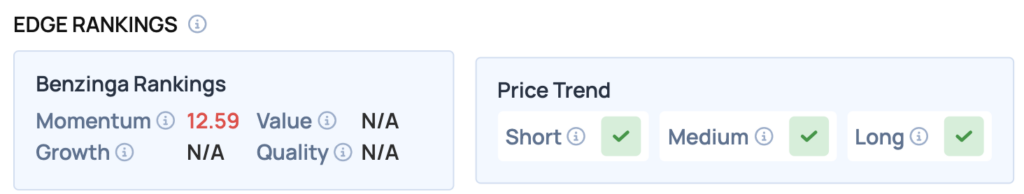

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, UWMC shows a positive price trend across short, medium and long-term outlooks.

Price Action: According to data from Benzinga Pro, UWMC shares are trading higher by 3.81% to $6.12 Friday morning. The stock has a 52-week high of $9.25 and a 52-week low of $3.80.

How To Buy UWMC Stock

By now you're likely curious about how to participate in the market for UWM Holdings – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of UWM Holdings, which is trading at $5.9 as of publishing time, $100 would buy you 16.95 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock