The Average Transaction Price (ATP) for new vehicles in the U.S. rose over 2.6% year-over-year in August as 2026 models arrived at dealerships.

Vehicle Prices Increase In August, EV Sales Surge

The new vehicle ATP in August was $49,077 while the MSRP or Manufacturer Suggested Retail Price surged 3.3% YoY to $51,099, data released by Cox Automotive showed on Wednesday.

"Costs are clearly increasing, for automakers, dealers and buyers alike," Erin Keating, Senior Analyst at Cox Automotive, said in the report, adding that the price increase reflected a market that was "adjusting to new production realities and consumer preferences without tipping into volatility."

EV sales also hit a record 146,332 units in August, accounting for a record 9.9% of the total market share. The surge could largely be driven by the end of the IRA $7,500 Federal EV Credit. "Current sales trends suggest Q3 2025 will set a record for EV sales in the U.S," the report suggested.

Tesla Market Share Shrinks

Tesla Inc. (NASDAQ:TSLA) recorded a 2.9% increase in the ATP to $54,468; however, it was still down 5.5% compared to the previous year. Tesla sales contracted in the U.S. as the company's market share fell below 40% for the first time since 2017, as it currently stands at 38%.

Meanwhile, Gary Black, managing director of Future Fund LLC, has questioned the EV giant's future strategy, speculating on a possible affordable model in the Tesla lineup. Interestingly, an unknown compact Tesla was recently spotted at the Gigafactory in Texas.

Optimus Could Be The Biggest Product Ever

Elsewhere, Elon Musk has been pushing for artificial intelligence and robotics since Tesla revealed its Master Plan IV, with the CEO recently saying that Tesla was working on finalizing the Optimus version 3 design and that it could be "the biggest product, ever."

Musk had also said that the robot could represent over 80% of Tesla's future value, illustrating his confidence about Tesla's robotics push. Meanwhile, xAI, Musk's artificial intelligence company, has invested over $40 billion in its Memphis data center.

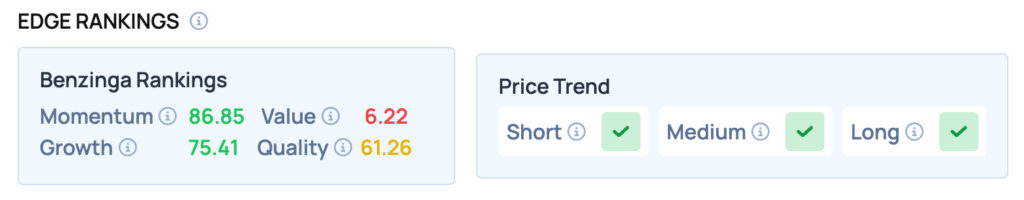

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: VTT Studio / Shutterstock.com