The US Federal Reserve should "resist the temptation to act quickly" as it contemplates the right time to begin interest rate cuts, a senior bank official said Friday.

"The economy is healthy, price stability is within sight, and there is more work to do," San Francisco Fed President Mary Daly told a conference in Washington.

"To finish the job will take fortitude," said Daly, who is a voting member of the Fed's rate-setting committee this year.

"We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves," she added.

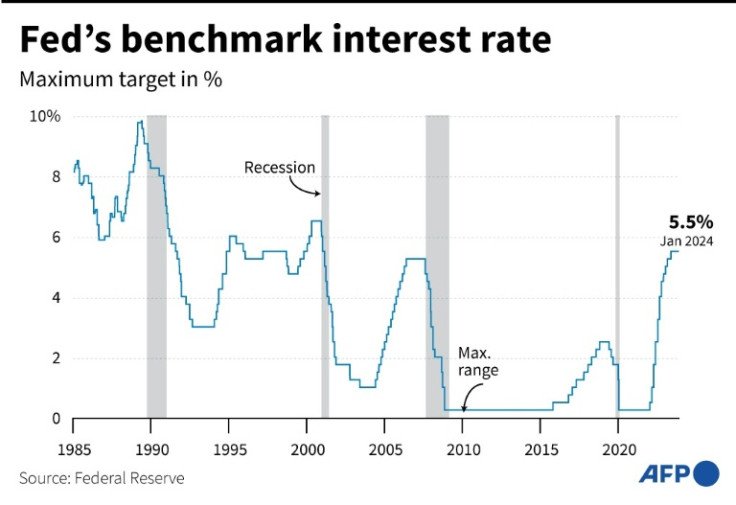

The US central bank is currently in a holding pattern, after hiking rates to a 23-year high to tackle surging prices.

With inflation inching ever closer to the Fed's long-term target of two percent in recent months, officials have indicated they expect to start cutting interest rates this year.

But they remain divided over the best time to do so, with some voicing concern about prematurely declaring victory over inflation.

On Friday, Daly cautioned against being overly optimistic about projections that show the world's largest economy on track to vanquish inflation.

"Projections and expectations are just that: views about what we think will happen," she said.

"We need more time and data to be sure that they will be realized," she continued, adding that the Fed could afford to take a more "gradual approach."

"Gradual doesn't mean slow, it doesn't mean weak," she said. "It simply means not abrupt and urgently when you're facing a lot of uncertainty, and you already have policy in a good place."

Futures traders have also grown more pessimistic about the chances of an early rate cut in recent weeks.

After predicting a March cut as recently as December, they now assign a probability of less than 50 percent that the Fed will cut interest rates at either of its next meetings in March and May, according to data from CME Group.

Instead, they have placed a probability of more than 80 percent that the US central bank will have cut rates by June 12.

.jpg?w=600)