By Anirban Mahanti

Upstart UPST missed its guidance for the third quarter 2022 comprehensively. I was extremely disappointed after having a quick look at the results. As I have said time and again, companies should refrain from providing guidance if they are going to miss it or having to revise it downwards at a regular cadence. After all, if Apple can get away with just qualitative guidance, then I am sure Upstart will be fine without guidance. Anyways, that’s a rant.

But as I dug into the results I saw some good progress towards managing through this macroeconomic headwind. This quarter’s results lends further credence to the capital-light underpinnings of the business. David Girourad and team continue to improve their current personal credit offering, while also working towards developing new types of credit. The progress on products and partnerships is real. And the company has got some runway to manage this downturn thanks to their $800 million cash balance.

I think the business is mostly making the right decisions to come out stronger on the other side.

With those high-level comments, let’s dive into some details.

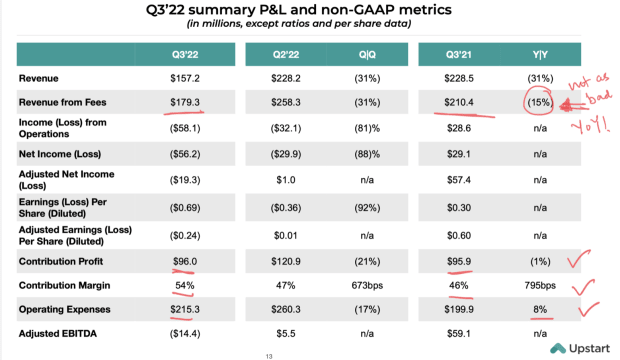

Let’s take the revenue miss. Guidance was for $170 million but revenue landed at $157 million. Looking closely, however, revenue from fees was $179 million, but fair value adjustments and losses on the sale of loans it held on the balance sheet cost Upstart about $22 million. I am not saying these adjustments don’t matter. The loss when a loan held on the balance sheet is sold is real. However, the losses on these loans are hard to predict as they are a function of the macroeconomic conditions and interest rate dynamics.

The Upstart platform is now processing far fewer loans. During Q3 2022, Upstart handled 188,000 loans, down 48% year-over-year. This dramatic reduction is plain and simple because of higher interest rates. CEO and co-founder Girouard nicely summarized the situation in his opening remarks:

“Higher interest rates and significantly elevated risk in the economy means we're approving about 40% fewer applicants than we would have a year ago. And those approved today are seeing offers about 800 basis points higher than they would have a year ago.”

In the current climate, lending partners are cautious. The rise of the interest rate also results in the pool of viable borrowers to decrease significantly. After all, interest rates that are 800 basis points higher than a year ago are no joke.

But while loan volume has been cut in half, the company managed to significantly increase its contribution margin. Contribution margin came in at 54%, which was well behind their guidance of 59%, but it was 800 basis points higher than Q3 2021. Upstart did that by increasing fees per loan, reducing marketing spend on certain channels, and finetuning other operating expenses. Operating expenses were only 8% higher on a year-over-year basis and down 17% on a quarter-over-quarter basis.

Do you want your portfolio to outperform the market? 7investing's lead advisors uncover the top 7 opportunities in the stock market each month for their members. Click here to try 7investing for $1.

In terms of right-sizing cost structures, Upstart eliminated 140 positions (7% of workforce) from their loan operations positions. No further cuts are planned and hiring is limited to a small number of strategic positions.

On the product and partnership side, the company made some solid progress:

- In Q3, 75% of the loans were fully automated. That’s a new record.

- Added 17 new banks/credit unions to the platform, also a record for the quarter. Total number of banks/credit unions on the Upstart platform increased to 83.

- Claims model accuracy has improved by a significant degree in the past four months.

- Small business loans grew from $1 million to $10 million (new product in R&D).

- Small dollar loans grew 4x over prior quarters (new product in R&D).

- Auto lending is live across three dealer groups in four states.

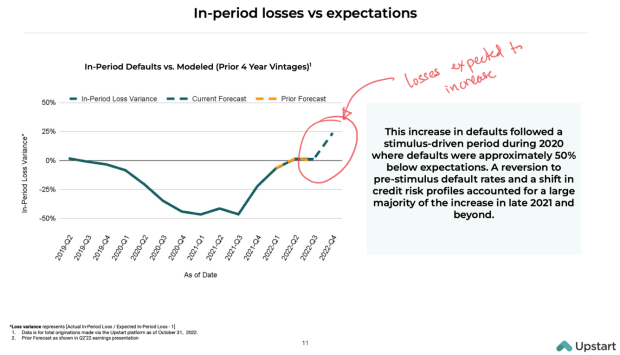

.The company’s Q4 guidance was once again bad. Revenue from fees is expected to further fall, now to $160 million, and there will be headwinds from fair value adjustments and interest expenses. Upstart expects “in period losses” versus “expectations” will increase to around 25%. Note that there’s sort of an upper bound on the losses versus expectations because while the older vintages of loans aren’t going to perform well, the more recent ones (at higher APRs and lower approval rates) will likely overperform. For investors in Upstart’s funding network, the longer-term average return is what should matter.

So, what’s the upshot here?

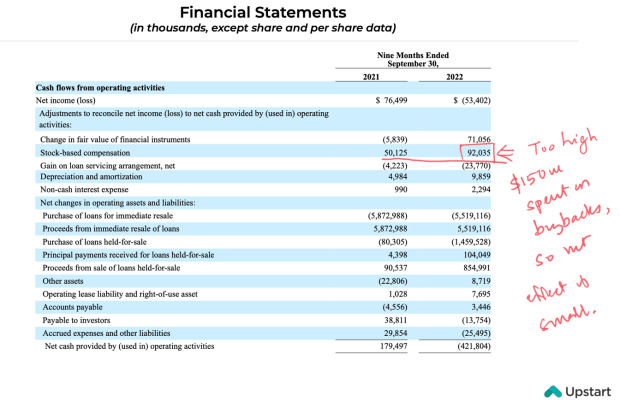

First, I think we are getting a first-hand look at Upstart’s capital-light model. Contributions margins have gone up meaningfully. And operating losses through the first 9-months of fiscal 2022 was $55 million. If you look at that number and then think about other cost savings introduced, we realize the company’s $800 million cash balance buys them plenty of time. There shouldn’t be any immediate need for capital infusion.

Second, the models have calibrated through this downturn and the business has made significant progress on automation and new products. When the tide turns, Upstart will be in a solid footing to turn on the spigot.

Third, the market opportunity remains huge and I think the stock market is seriously misvaluing this company. Yes, I acknowledge that there are plenty of uncertainties right now but the fundamental value of the business is potentially much higher than its $1.5 Billion market capitalization.

Of course, that doesn’t mean the market will realize its mistake soon or that the stock wouldn’t fall further. And there’s nothing stopping someone cash rich coming in with a low ball acquisition offer. Basically, my point is that undervaluation doesn’t necessarily mean our final outcome will definitely be good because markets can stay irrational for a long time and lots can happen in the interim.

Finally, while I didn’t want to end the update on a cautious note, it would be remiss on my part not to mention dilution via stock based compensation (SBC). Upstart has spent $150 million in 9-months buying back shares. In that same timeframe they have issued $90 million SBC. At the company’s current valuation, they really need to dial down SBC. Also, if I was their CFO, I would wait for the “Upstart Macro Index” to start showing a path towards normalization before dialing up stock buybacks

About the author: Anirban Mahanti is a lead advisor for 7investing. Before 7investing, Anirban spent 5-plus years at The Motley Fool’s Australian subsidiary in various roles, including as the Director of Research and the founding lead advisor of the market-beating small-cap ASX stock-picking newsletter Extreme Opportunities. You can follow Anirban on Twitter by clicking this link.