/GE%20Aerospace%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

GE Aerospace (GE) will release its third quarter 2025 financials on Tuesday, Oct. 21. Shares of this jet engine manufacturer have been on a strong upward trajectory in 2025, rising 77% year-to-date. This rally reflects rising orders, a swelling backlog, and steady gains in operating profit and earnings per share (EPS).

The company’s performance in the first half of 2025 had been solid. Adjusted revenue climbed 18% during the period, while operating margins expanded by 230 basis points. Adjusted EPS also soared nearly 47%, reflecting GE Aerospace’s ability to convert top-line growth into higher profitability. The company ended the second quarter with a substantial $175 billion backlog, which indicates solid growth potential in the quarter ahead.

GE’s fundamentals look solid heading into Q3 earnings. Further, the stock’s 14-day Relative Strength Index (RSI) stands at 52.21, which is comfortably below the 70 overbought threshold. That suggests GE Aerospace stock has room to run if the upcoming earnings report and guidance exceed market expectations.

GE Aerospace Could Deliver Solid Q3 Results

GE Aerospace is well-positioned to extend its strong momentum into the third quarter, supported by robust demand across both its commercial and defense businesses. The company has been benefitting from a recovery in air travel and sustained growth in maintenance and service activity, which continue to boost its top line.

In its Commercial Engines & Services (CES) division, GE Aerospace is capitalizing on its large installed bases of commercial aircraft engines. This has translated into strong financial performance, with service orders climbing 28% and equipment orders rising 26%. The strength reflects both higher spare parts volume and a favorable mix of pricing and services. Service revenue jumped 29%, with spare parts sales rising more than 25%. This momentum will push GE Aerospace’s top line higher in Q3.

The company’s defense operations are also likely to contribute meaningfully to its growth. Orders in the segment climbed 24% year-over-year in Q2, resulting in a healthy book-to-bill ratio of 1.2x. Revenue in the defense business grew 7%, led by a 6% increase in the Defense & Systems unit and a 9% rise in Propulsion & Additive Technologies.

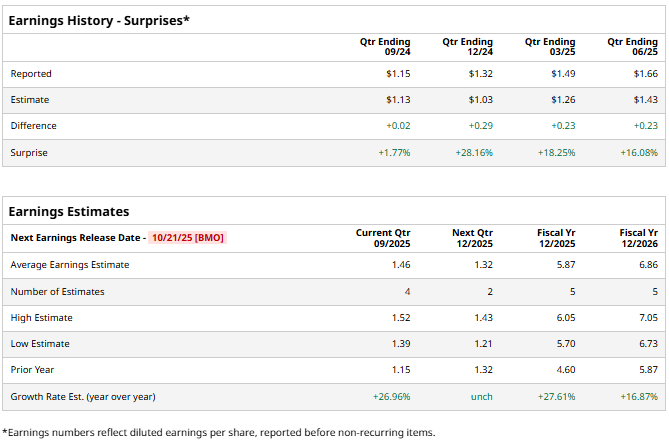

While GE Aerospace is delivering solid revenue growth, it has consistently outperformed earnings expectations, thanks to the increased mix of high-margin services revenue and operating leverage. Notably, the company has beaten Wall Street’s earnings estimates for four consecutive quarters, including a notable 16.1% earnings surprise in the second quarter.

Looking ahead to the third quarter, analysts anticipate GE Aerospace will post earnings of about $1.46 per share, representing a 27% year-over-year increase. With both commercial and defense segments firing on all cylinders, the company is well-positioned to deliver another solid set of results that could support its share price.

Is GE Stock a Buy Now?

GE Aerospace has been performing well, generating higher revenue and margins. However, the rally has also driven valuations higher. Currently, GE trades at a forward price-earnings (P/E) ratio of about 51x, which is high considering analysts’ projections of 16.9% earnings growth in 2026. Such a multiple suggests that the market has already priced in much of the near-term optimism. Yet, the premium valuation also reflects confidence in GE Aerospace’s long-term earnings power, which continues to strengthen thanks to its high-quality service-driven business model.

GE Aerospace’s services division contributes roughly 70% of total revenue. This segment provides recurring, high-margin income streams related to the maintenance and support of GE’s massive installed base of commercial aircraft engines. As the installed base expands, which management projects will grow at a CAGR of low- to mid-single-digit rate through the end of the decade, the services business will likely grow in tandem, driving the company’s profitability and cash flow.

Moreover, the services operation gives GE a strategic edge. By maintaining ongoing relationships with customers, GE gains valuable insights that influence product innovation and ensure that its future products are designed to meet evolving market needs.

The macro environment also favors GE Aerospace’s long-term trajectory. Air travel demand is expected to rise, driving GE’s installed engine base and service revenue potential.

On the defense side, GE Aerospace is benefiting from the modernization programs and increased defense spending worldwide amid rising geopolitical tensions. Management expects the defense propulsion market to grow at a mid-single-digit annual rate through 2028, supporting sustained earnings growth.

Despite its rich valuation, GE Aerospace’s fundamentals remain strong, supported by commercial and defense tailwinds. Wall Street analysts maintain a “Strong Buy” rating on the stock.

In short, while GE’s valuation is high, its durable earnings base, expanding services business, and exposure to structural growth in global aviation suggest that it is a solid long-term investment.