In a year dominated by artificial intelligence (AI), electric vehicles, and semiconductor headlines, one of the most surprising breakout stories has come from the nuclear energy sector.

Oklo's (OKLO) stock has surged an astonishing 537% year-to-date (YTD), fueled by mounting investor excitement around advanced nuclear energy and a wave of pro-nuclear federal policies. The stock has even climbed an eye-catching 1,170% over the past 52 weeks. The company’s progress on licensing, federal partnerships, and the commercialization of its compact fast reactors has caught the attention of analysts and investors. Furthermore, Oklo's $460 million capital raise and selection by the U.S. Air Force for its first advanced fission project have positioned the company as a frontrunner in the race to deliver clean, scalable, zero-carbon power for the AI and defense sectors.

Let’s see if this rally will propel the company to its high target price of $150 this year.

Right Place, Right Time

The phrase "right place, right time" perfectly describes Oklo's situation. It could not be a better time to work in advanced nuclear energy. The U.S. government is currently taking unprecedented initiatives to accelerate nuclear innovation. The most significant changes are new executive orders, the recently passed "One Big Beautiful Bill," and the Federal AI Action Plan. Oklo stands out as one of the few fast reactor startups poised to benefit from this policy momentum.

Valued at $20.4 billion, Oklo is an advanced nuclear energy business that develops compact, scalable nuclear power facilities. These are referred to as "powerhouses," which are designed to provide clean, reliable, and cost-effective electricity. During the Q2 earnings call, management stated that the One Big Beautiful Bill signed in July extended investment and production tax incentives through 2033, with gradual phaseouts thereafter, giving critical visibility for early-stage deployments such as Oklo's. Furthermore, the Federal AI Action Plan explicitly calls for the development of new, dependable power sources to support America's rapid AI expansion, which is precisely what Oklo's small, distributed reactors are intended to provide.

And Oklo's business model involves selling power under long-term contracts rather than one-time purchases. This structure could generate recurring revenue, provide consistent cash flows, and improve regulatory efficiency. Another milestone in the quarter was the company’s selection by the U.S. Air Force as the intended awardee for the first advanced fission deployment at a U.S. military installation. Under the Notice of Intent to Award (NOITA), Oklo is set to design, construct, own, and operate a powerhouse that will provide both electricity and heat under a long-term purchase agreement for Eielson Air Force Base in Alaska.

As the company is in the pre-commercial stage, it generates no revenue. It reported an operating loss of $28 million. Oklo reaffirmed its full-year cash usage guidance of $65 million to $80 million for 2025, with cash used in operations totaling $30.7 million in the first half of the year. Importantly, management signaled plans to accelerate certain capital expenditures originally slated for 2026 into 2025. Adding to its financial strength, Oklo completed a successful follow-on equity offering on June 12, raising $460 million in gross proceeds. The company ended the quarter with a solid $683 million in cash and marketable securities, giving it plenty of room to execute on its growth plans.

The Bigger Picture: A Scalable Energy Platform

Oklo's momentum is focused on developing a whole advanced nuclear ecosystem that is scalable, cost-effective, and relevant to the real world. Okla has chosen Kiewit, one of the country's most experienced engineering and construction firms, as the prime contractor for the Aurora INL project. Kiewit will manage the design, procurement, and construction of Aurora's first powerhouse under a master services agreement. Oklo estimates that if schedules are met, the Aurora INL powerhouse will start generating sustainable energy by 2028, with regulatory clearances advancing, construction partnerships secured, and early client applications in the works. Management believes this could mark a turning point for the entire advanced nuclear industry.

On the digital front, Oklo is entering the AI and data center energy markets. The company has signed a cooperative development agreement with Vertiv Holdings (VRT), a leader in data center infrastructure, to develop integrated power and cooling solutions.

What Does Wall Street Say About OKLO Stock?

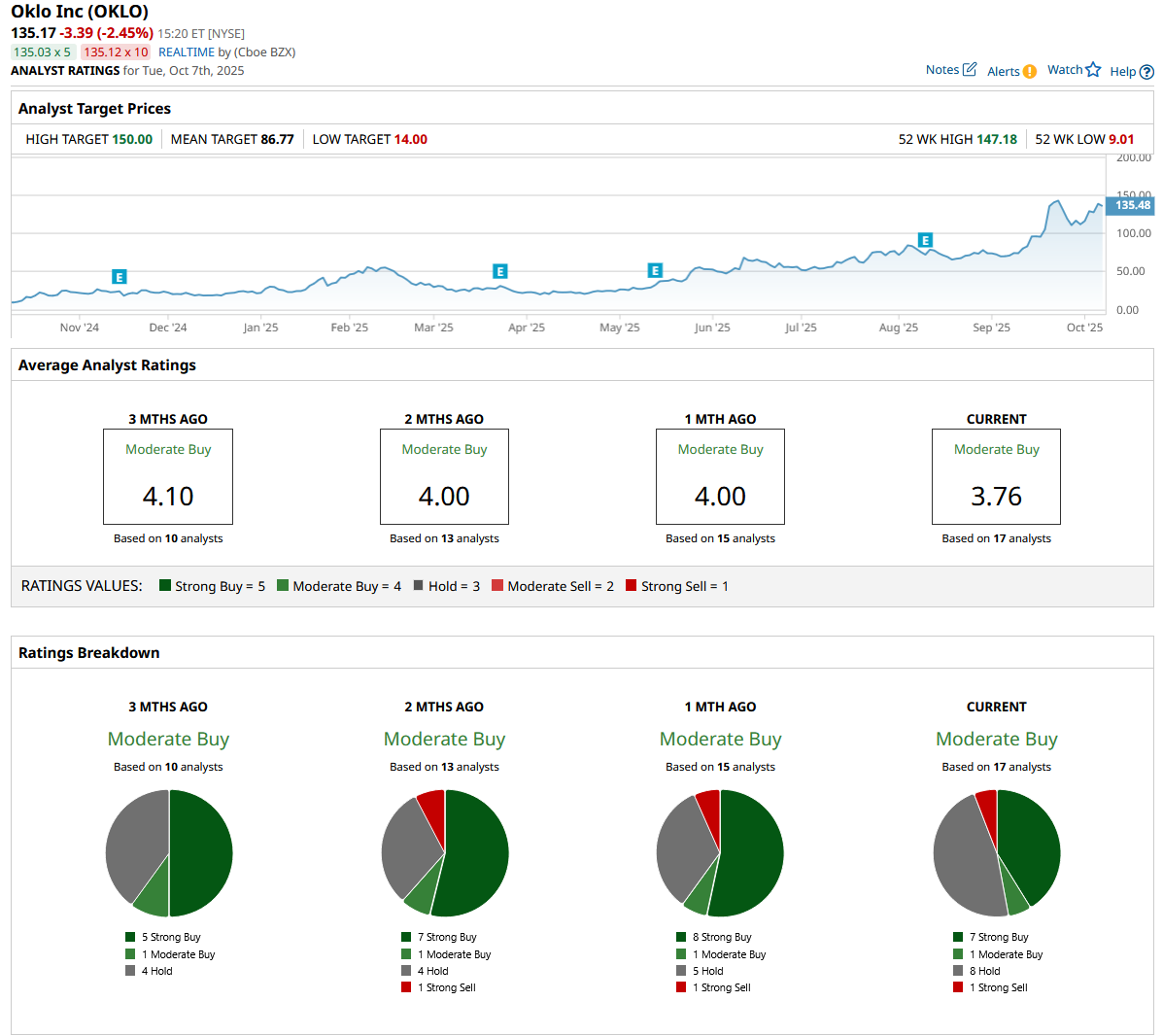

OKLO stock has earned an overall “Moderate Buy” rating on Wall Street. Of the 17 analysts covering the stock, seven rate it a “Strong Buy,” one says it is a “Moderate Buy,” eight say it is a “Hold,” and one rates it a “Strong Sell.”

The rate at which OKLO is climbing this year, it has way surpassed its average target price of $86.77. Although its high price estimate of $150 suggests an upside potential of 11%, there is a high probability that the stock might even cross that mark. Analysts may have to alter their price predictions soon.

Why Oklo Is Built for the Long Term

OKLO stock's spectacular surge may entice investors to cash in now, but it remains an excellent buy-and-hold investment for the long run. The global demand for clean, dependable energy, particularly in energy-intensive industries such as AI, cloud computing, and defense, is rapidly growing. And Oklo’s modular fast reactors could become a backbone of next-generation power infrastructure, making it one of the most transformative energy companies of the next decade.